Get the free HSA Payroll Deduction Contribution Authorization Form

Show details

Este formulario debe completarse si va a contribuir a su Cuenta de Ahorros para la Salud (HSA) a través de deducción de nómina. La contribución total anual no debe exceder el límite permitido

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign hsa payroll deduction contribution

Edit your hsa payroll deduction contribution form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your hsa payroll deduction contribution form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit hsa payroll deduction contribution online

To use the professional PDF editor, follow these steps:

1

Sign into your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit hsa payroll deduction contribution. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out hsa payroll deduction contribution

How to fill out HSA Payroll Deduction Contribution Authorization Form

01

Obtain the HSA Payroll Deduction Contribution Authorization Form from your employer or benefits portal.

02

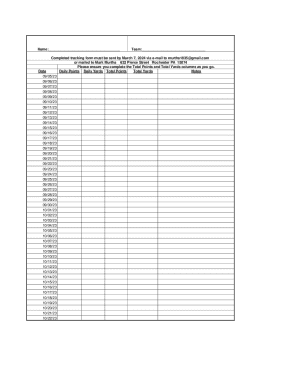

Fill in your personal information at the top of the form, including your name, employee ID, and contact information.

03

Specify the amount you wish to contribute to your HSA, indicating whether it's a per-pay-period contribution or an annual total.

04

Select the start date for the deductions to commence.

05

Review the employer's matching or contribution policies, if applicable, and indicate any preferences.

06

Sign and date the form to authorize the contributions.

07

Submit the completed form to your HR or payroll department for processing.

Who needs HSA Payroll Deduction Contribution Authorization Form?

01

Employees who wish to contribute to a Health Savings Account (HSA) through payroll deductions.

02

Individuals who have a high-deductible health plan (HDHP) and want to take advantage of tax savings by contributing pre-tax dollars to an HSA.

03

New employees enrolling in an HSA for the first time or current employees making changes to their contribution amounts.

Fill

form

: Try Risk Free

People Also Ask about

What is a payroll deduction authorization form?

Contribute Through Payroll Deduction The funds are deducted pre-tax through your employer's Section 125 Plan. You may change or stop your contribution amount at any time through your employer. Employees should contact their Human Resources department to start payroll deductions.

How do I contribute to HSA through payroll?

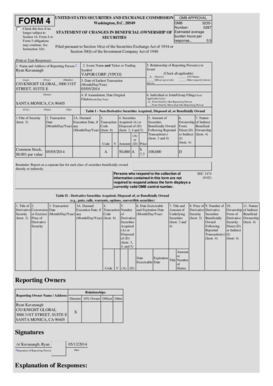

File Form 8889 to: Report health savings account (HSA) contributions (including those made on your behalf and employer contributions). Figure your HSA deduction. Report distributions from HSAs.

What is a payroll authorization form?

Labor Code Section 224 clearly prohibits any deduction from an employee's wages which is not either authorized by the employee in writing or permitted by law, and any employer who resorts to self-help does so at its own risk as an objective test is applied to determine whether the loss was due to dishonesty,

What is payroll deduction authorization?

Payroll Deduction Authorization means the written authorization made by a Participant to permit the Employer to deduct amounts from the Participant's Compensation and contribute such amounts to the Personal Retirement Annuity on the Participant's behalf. Sample 1Sample 2Sample 3 AI Clause Builder.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is HSA Payroll Deduction Contribution Authorization Form?

The HSA Payroll Deduction Contribution Authorization Form is a document that allows employees to authorize their employer to deduct specified amounts from their paychecks to contribute to their Health Savings Account (HSA).

Who is required to file HSA Payroll Deduction Contribution Authorization Form?

Employees who wish to set up payroll deductions for their Health Savings Account (HSA) are required to file the HSA Payroll Deduction Contribution Authorization Form.

How to fill out HSA Payroll Deduction Contribution Authorization Form?

To fill out the HSA Payroll Deduction Contribution Authorization Form, employees should provide their personal information, specify the amount they want to contribute from each paycheck, and sign the form to authorize the deductions.

What is the purpose of HSA Payroll Deduction Contribution Authorization Form?

The purpose of the HSA Payroll Deduction Contribution Authorization Form is to facilitate automatic contributions to an employee's Health Savings Account, enabling employees to save for qualified medical expenses tax-efficiently.

What information must be reported on HSA Payroll Deduction Contribution Authorization Form?

The information that must be reported on the HSA Payroll Deduction Contribution Authorization Form includes the employee's name, address, Social Security number, the amount to be deducted, and the frequency of deductions.

Fill out your hsa payroll deduction contribution online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Hsa Payroll Deduction Contribution is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.