LA BHSF form 2G 2007-2026 free printable template

Show details

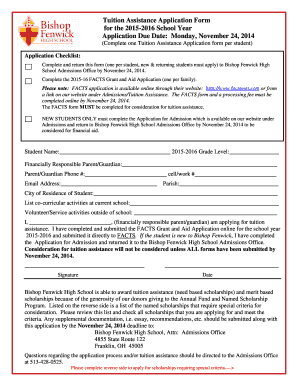

BHF Form 2(G) Rev. 01/07 Prior Issue Obsolete LOUISIANA MEDICAID PROGRAM Renewal Month: COLD/WAR: Renewal Form Return by: Use this form to renew Medicaid coverage. If you do not renew, Medicaid services

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign LA BHSF form 2G

Edit your LA BHSF form 2G form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your LA BHSF form 2G form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit LA BHSF form 2G online

Follow the guidelines below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit LA BHSF form 2G. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out LA BHSF form 2G

How to fill out LA BHSF form 2G

01

Obtain the LA BHSF form 2G from the appropriate agency or website.

02

Read the instructions carefully to ensure you understand the form's purpose.

03

Fill in your personal details in the designated sections, including your name, address, and contact information.

04

Provide any required identification numbers, such as Social Security or tax identification numbers.

05

Answer all relevant questions truthfully and accurately, providing additional information if requested.

06

Review the form for completeness and correctness before submitting it.

07

Submit the form as per the specified guidelines, either in-person or online.

Who needs LA BHSF form 2G?

01

Individuals applying for certain health services or benefits under the LA BHSF program.

02

Healthcare providers seeking to assist patients in accessing benefits.

03

Organizations and agencies involved in community health programs.

Fill

form

: Try Risk Free

People Also Ask about

How do I get my Louisiana state tax forms?

Most Requested Louisiana Tax Forms Please contact the Dept. of Revenue at 1-888-829-3071 to receive a form by mail or click here to request a form. Please note that if you choose to download and print a form at the State Library or at your library, you may be charged for the cost of printing.

Can I get my w2g online?

You can get a wage and income transcript, containing the Federal tax information your employer reported to the Social Security Administration (SSA), by visiting our Get Your Tax Record page. Refer to Transcript Types and Ways to Order Them and About Tax Transcripts for more information.

Do online s send W2G?

You don't necessarily receive a W-2G for all gambling winnings but you still need to report all of your winnings. A gaming facility is required to report your winnings on a W-2G when: Horse race winnings of $600 or more (if the win pays at least 300 times the wager amount)

Can you report gambling winnings without W2G?

You must report all gambling winnings on Form 1040 or Form 1040-SR (use Schedule 1 (Form 1040)PDF), including winnings that aren't reported on a Form W-2GPDF. When you have gambling winnings, you may be required to pay an estimated tax on that additional income.

How much are gambling winnings taxed in Louisiana?

Every person or business that pays gaming winnings won in Louisiana is required to withhold individual income taxes at a rate of six percent if income taxes are required to be withheld for the Internal Revenue Service under 26 USC 3402 on the same winnings.

How do I get a sales tax exemption certificate in Louisiana?

All locations located in the state must apply for and receive an exemption, even if the business headquarters are located out of the state. The application is Form R-1370, Purchase of Lease or Rental Vehicles Tax Exemption Application, and may be found on the Department's website.

How do I get my w2g online?

Answer: You can get a wage and income transcript, containing the Federal tax information your employer reported to the Social Security Administration (SSA), by visiting our Get Your Tax Record page. You can also use Form 4506-T, Request for Transcript of Tax Return.

How do I get a sales tax certificate in Louisiana?

You can easily acquire your Louisiana Sales Tax License online using the LaTAP website. If you have quetions about the online permit application process, you can contact the Department of Revenue via the sales tax permit hotline (225) 219-7318 or by checking the permit info website .

How do I get sales tax exemption in Louisiana?

All locations located in the state must apply for and receive an exemption, even if the business headquarters are located out of the state. The application is Form R-1370, Purchase of Lease or Rental Vehicles Tax Exemption Application, and may be found on the Department's website.

What is an L-3 Louisiana?

Form L-3 is the Employer's Annual Reconcilation of. Louisiana Income Tax Withheld used to reconcile the. total amount of income tax withheld that was reported. with Form L-1 filings during the calendar year to the. total amount of income tax withheld that was listed.

Do s report w2g to IRS?

Generally, if you receive $600 or more in gambling winnings, the payer is required to issue you a Form W-2G. If you have won more than $5,000, the payer may be required to withhold 28% of the proceeds for Federal income tax.

How do I apply for exemption from collection of Louisiana state sales tax?

You can apply to obtain Louisiana sales tax exemption by filing form R-1048, the Application for Exemption from Collection of Louisiana State Sales Tax with the Louisiana Department of Revenue.

How much state tax should be withheld in Louisiana?

The state income tax rates for the 2021 tax year range from 2.0% to 6.0%, and the sales tax rate is 4.45%.

Do you have to attach w2g to tax return?

If you receive multiple W-2G forms, you'll need to enter the winnings for each of them when preparing your tax return. You are required to also report winnings even if the payer doesn't send you a Form W-2G.

Do I have to claim w2g on my taxes?

If you receive a Form W-2G for gambling winnings, you must report the full amount of income shown on the W-2G on your tax return. The W-2G will also show any federal and state income tax withheld from your winnings. You cannot report your actual net winnings (winnings less buy in).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send LA BHSF form 2G to be eSigned by others?

When your LA BHSF form 2G is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I execute LA BHSF form 2G online?

Easy online LA BHSF form 2G completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I fill out LA BHSF form 2G using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign LA BHSF form 2G and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

What is LA BHSF form 2G?

LA BHSF form 2G is a specific form utilized in Los Angeles for reporting financial and operational information pertaining to certain businesses.

Who is required to file LA BHSF form 2G?

Entities or individuals engaged in business activities that fall under the relevant jurisdiction of the Los Angeles Business Health Services Fund are required to file LA BHSF form 2G.

How to fill out LA BHSF form 2G?

To fill out LA BHSF form 2G, candidates must accurately provide requested information concerning business operations, financial data, and ensure all relevant sections are completed as per the guidelines provided.

What is the purpose of LA BHSF form 2G?

The purpose of LA BHSF form 2G is to collect essential data to facilitate the assessment and oversight of business compliance with health and safety regulations within Los Angeles.

What information must be reported on LA BHSF form 2G?

Information required on LA BHSF form 2G includes business identification details, financial statements, employee information, and any health and safety compliance records.

Fill out your LA BHSF form 2G online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

LA BHSF Form 2g is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.