Get the free Contractor/Subcontractor Surety Bond - revenue louisiana

Show details

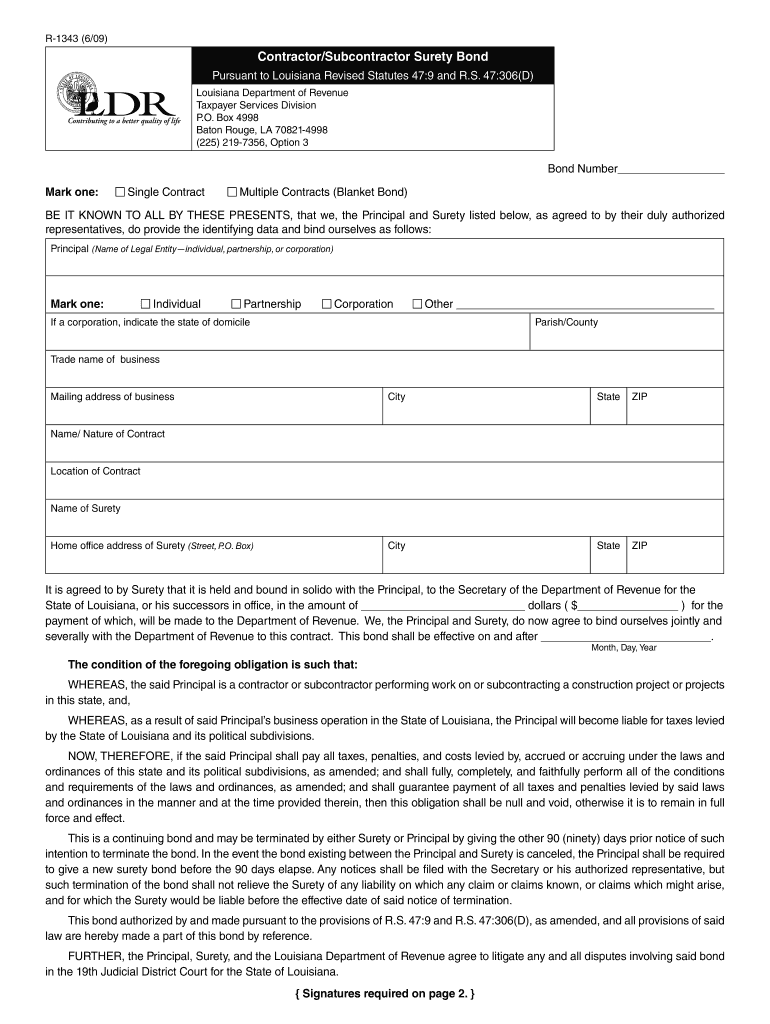

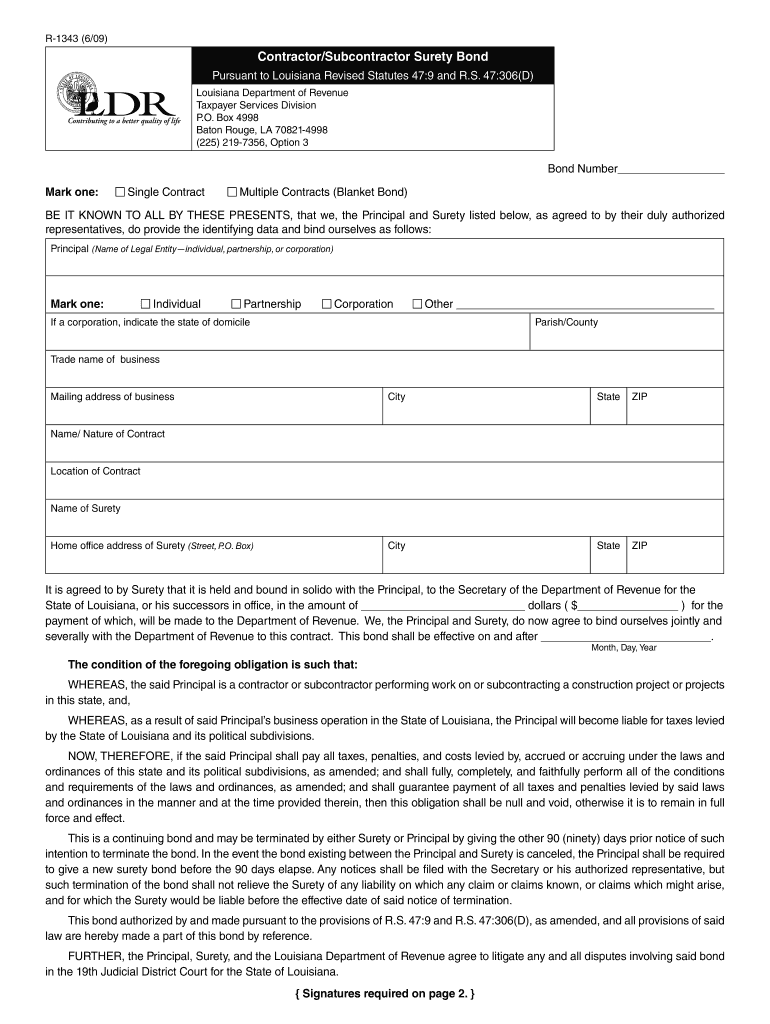

This document serves as a surety bond required under Louisiana law for contractors or subcontractors to guarantee payment of taxes and compliance with state laws.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign contractorsubcontractor surety bond

Edit your contractorsubcontractor surety bond form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your contractorsubcontractor surety bond form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing contractorsubcontractor surety bond online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit contractorsubcontractor surety bond. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out contractorsubcontractor surety bond

How to fill out Contractor/Subcontractor Surety Bond

01

Obtain the bond form from your surety company or bonding agent.

02

Fill out the contractor's details including name, address, and license number.

03

Provide project specifics, such as the project name and location.

04

Indicate the bond amount required for the project.

05

Include subcontractor details if applicable.

06

Review the terms and conditions outlined in the bond.

07

Sign the bond as required by the surety company.

08

Submit the completed bond form along with any necessary documentation to the surety company for approval.

Who needs Contractor/Subcontractor Surety Bond?

01

Contractors who are seeking to bid on public works projects.

02

Subcontractors working on projects that require bonding.

03

Construction companies looking to secure payment and performance guarantees.

Fill

form

: Try Risk Free

People Also Ask about

What is a subcontractor surety bond?

Surety bonds provide project financial security by ensuring that contractors fulfill their obligations. If a contractor defaults, the surety will either complete the work, hire a new contractor, or compensate the project owner, safeguarding their financial interests.

What is a bond for a contractor?

There are many types of surety bonds, and each state has its own bonding requirements for different industries. However, there are four major types of surety bonds that you should know: license and permit bonds, contract bonds, court bonds, and fidelity bonds.

How do you write a surety bond?

How to Fill Out a Surety Bond Form Bond Number. The bond number is the unique identification number assigned to your bond. Bond Premium. This is the cost of your bond, typically calculated as a percentage of your bond coverage. Principal Name. Surety Name. State of Incorporation. Obligee Name. Bond Amount. Bond Obligation.

What are the three types of bonds that can form?

There are three primary types of bonding: ionic, covalent, and metallic.

How much does a $1,000,000 surety bond cost?

$1,000,000 Surety Bond Cost by Credit Score Surety Bond AmountOver 675 (0.5-3%)600-675 (3-5%) $1,000,000 $5,000–$30,000 $30,000–$50,000 *This table provides general estimates. Bond pricing fluctuates due to various factors.

What are the three main types of construction bonds?

Bid, performance and payment bonds are by far the most common of these. Let's take a closer look at each of these bond type and explore how it's typically used in large construction projects.

What are the three types of bonds that can be required from a contractor?

Usually, a project requires a trio of bid, performance, and payment bonds. Bid Bonds. Bid bonds guarantee that if chosen as the winning bidder, the contractor will accept the job. Performance Bonds. Payment Bonds. Contractor License Bonds.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Contractor/Subcontractor Surety Bond?

A Contractor/Subcontractor Surety Bond is a three-party agreement that ensures a contractor or subcontractor fulfills their contractual obligations to complete a project according to the terms of the contract.

Who is required to file Contractor/Subcontractor Surety Bond?

Typically, contractors or subcontractors working on public construction projects or projects that require bonding as specified by law or contract are required to file a Contractor/Subcontractor Surety Bond.

How to fill out Contractor/Subcontractor Surety Bond?

To fill out a Contractor/Subcontractor Surety Bond, parties must provide necessary information including their names, the amount of the bond, project details, and signatures from the contractor, surety company, and possibly other parties involved.

What is the purpose of Contractor/Subcontractor Surety Bond?

The purpose of a Contractor/Subcontractor Surety Bond is to protect the project owner from financial loss due to a contractor's failure to complete the project or meet contractual obligations.

What information must be reported on Contractor/Subcontractor Surety Bond?

Information that must be reported on a Contractor/Subcontractor Surety Bond includes the bond amount, project description, names of the involved parties, dates, and any pertinent contractual stipulations.

Fill out your contractorsubcontractor surety bond online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Contractorsubcontractor Surety Bond is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.