LA R-540X 2012-2025 free printable template

Show details

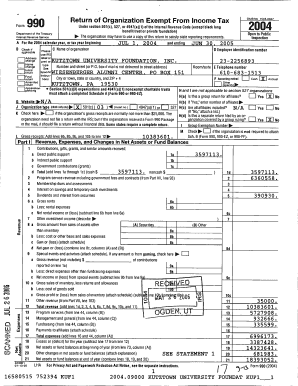

R-540X 1/12 TAXPAYER COPY 2011 Louisiana Resident Amended Return Information Sheet DO NOT MAIL. Your first name and initial Last name Your Social Security Number If joint return spouse s first name and initial Spouse s Social Security Number Present home address City Town or APO State ZIP Filing Status On original return Single Married filing jointly Head of household Qualifying widow er On this return Single A Number of Exemptions Yourself a...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign louisiana r 540x

Edit your louisiana r 540x form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your louisiana r 540x form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing louisiana r 540x online

Follow the steps down below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit louisiana r 540x. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out louisiana r 540x

How to fill out LA R-540X

01

Obtain the LA R-540X form from the appropriate tax authority website or office.

02

Read the instructions carefully before starting to fill out the form.

03

Provide your personal information, including your name, address, and Social Security number.

04

Fill out the income sections accurately, listing all sources of income.

05

Deduct any applicable expenses and credits carefully as per the guidelines.

06

Review all entries for accuracy to avoid mistakes.

07

Sign and date the form where required.

08

Submit the completed form either electronically or by mail to the designated address.

Who needs LA R-540X?

01

Individuals or entities who need to amend a previously filed tax return.

02

Taxpayers who have identified errors or omissions in their filed returns.

03

Anyone seeking to correct tax information for compliance and accurate records.

Fill

form

: Try Risk Free

People Also Ask about

Are you required to file a Louisiana resident tax return?

Individuals who are domiciled, reside, or have a permanent residence in Louisiana are required to file a Louisiana individual income tax return and report all of their income and pay Louisiana income tax on that income, if applicable.

How do I get a sales tax exemption certificate in Louisiana?

All locations located in the state must apply for and receive an exemption, even if the business headquarters are located out of the state. The application is Form R-1370, Purchase of Lease or Rental Vehicles Tax Exemption Application, and may be found on the Department's website.

How do I get a sales tax certificate in Louisiana?

You can easily acquire your Louisiana Sales Tax License online using the LaTAP website. If you have quetions about the online permit application process, you can contact the Department of Revenue via the sales tax permit hotline (225) 219-7318 or by checking the permit info website .

How do I get sales tax exemption in Louisiana?

All locations located in the state must apply for and receive an exemption, even if the business headquarters are located out of the state. The application is Form R-1370, Purchase of Lease or Rental Vehicles Tax Exemption Application, and may be found on the Department's website.

Does an LLC in Louisiana have to file a tax return?

An LLC is treated and taxed in the same manner for Louisiana income tax purposes as it is treated and taxed for federal income tax purposes. If the LLC is taxed as a corporation for federal income tax purposes, the LLC will be taxed as a corporation for Louisiana income tax purposes.

What is a form 540 Louisiana?

If you need to change or amend an accepted Louisiana State Income Tax Return for the current or previous Tax Year, you need to complete Form IT-540 (residents) or Form IT-540B (nonresidents and part-year residents). Forms IT-540 and IT-540B are Forms used for the Tax Amendment.

How to fill out Louisiana state tax form?

0:13 2:17 Form IT 540 Individual Income Return Resident - YouTube YouTube Start of suggested clip End of suggested clip Step 6 enter your federal itemized deductions on line 8a. Your federal standard deductions on lineMoreStep 6 enter your federal itemized deductions on line 8a. Your federal standard deductions on line 8b. Then subtract the ladder from the former enter the difference on line 8c.

How much state tax should be withheld in Louisiana?

The state income tax rates for the 2021 tax year range from 2.0% to 6.0%, and the sales tax rate is 4.45%.

How is Louisiana state income tax calculated?

Like the federal income tax, the Louisiana state income tax is based on income brackets, with marginal rates increasing as incomes increase. In total, there are three income brackets.Income Tax Brackets. Single FilersLouisiana Taxable IncomeRate$0 - $12,5001.85%$12,500 - $50,0003.50%$50,000+4.25% Jan 1, 2023

Who must file a Louisiana tax return?

Who must file. Louisiana residents, part-year residents of Louisiana, and nonresidents with income from Louisiana sources who are required to file a federal income tax return must file a Louisiana Individual Income Tax Return.

How to get a $10,000 tax refund?

Individuals who are eligible for the Earned Income Tax Credit (EITC) and the California Earned Income Tax Credit (CalEITC) may be able to receive a refund of more than $10,000. “If you are low-to-moderate income and worked, you may be eligible for the Federal and State of California Earned Income Tax Credits (EITC).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my louisiana r 540x in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your louisiana r 540x and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I edit louisiana r 540x from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your louisiana r 540x into a dynamic fillable form that can be managed and signed using any internet-connected device.

How can I send louisiana r 540x for eSignature?

When your louisiana r 540x is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

What is LA R-540X?

LA R-540X is a form used by taxpayers in Louisiana to amend their previously filed individual income tax returns.

Who is required to file LA R-540X?

Taxpayers who need to correct errors or make changes to their previously submitted LA R-540 or federal income tax returns must file LA R-540X.

How to fill out LA R-540X?

To fill out LA R-540X, taxpayers should provide their basic information, specify the tax year being amended, explain the reasons for the changes, and report the corrected figures on the form.

What is the purpose of LA R-540X?

The purpose of LA R-540X is to allow taxpayers to amend their tax returns to correct mistakes, report additional income, or claim deductions or credits that were not included in their original filing.

What information must be reported on LA R-540X?

LA R-540X requires taxpayers to report their Social Security number, the tax year being amended, the specific adjustments being made, and the correct amounts for income, deductions, and credits.

Fill out your louisiana r 540x online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Louisiana R 540x is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.