Get the free Department Request for Payroll Deduction Vendor, SED-3 - doa louisiana

Show details

This memorandum serves as a reminder for agencies to submit the Department Request for Payroll Deduction Vendor, SED-3 forms, which require certification by department heads for payroll deduction

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign department request for payroll

Edit your department request for payroll form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your department request for payroll form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing department request for payroll online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit department request for payroll. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out department request for payroll

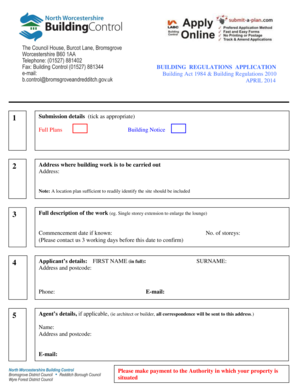

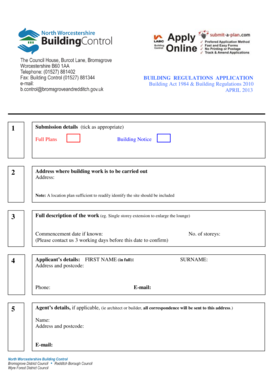

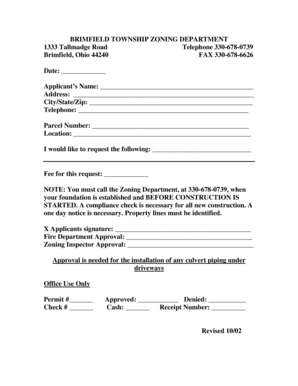

How to fill out Department Request for Payroll Deduction Vendor, SED-3

01

Obtain the Department Request for Payroll Deduction Vendor, SED-3 form from the appropriate administrative office.

02

Fill in the department name and contact information at the top of the form.

03

Clearly list the vendor's name and address in the designated section.

04

Specify the type of deduction and any relevant details related to the payroll deduction.

05

Indicate the start date for the payroll deductions.

06

Provide any additional information required by your department or institution's policies.

07

Sign and date the form to validate the submission.

08

Submit the completed form to the relevant payroll or human resources department for processing.

Who needs Department Request for Payroll Deduction Vendor, SED-3?

01

Department heads or administrators responsible for payroll management.

02

Employees wishing to set up or modify payroll deductions for specified vendors.

03

Human resources personnel managing payroll deductions and vendor relationships.

Fill

form

: Try Risk Free

People Also Ask about

Which of the following is a required deduction?

Expert-Verified. The required deduction from an employee's paycheck is A. FICA, which funds Social Security and Medicare. Health insurance, Medicaid, and disability insurance are not required deductions for all employees.

What is considered a required deduction?

Deductions that are required of the employer by federal or state law, such as income taxes or garnishments. Deductions expressly authorized in writing by the employee to cover insurance premiums, hospital or medical dues or other deductions not amounting to a rebate or deduction from the wage paid to the employee.

What is payroll deduction authorization?

A payroll deduction plan is voluntary when an employee authorizes an employer in writing to withhold money for certain benefits or services, such as a retirement savings plan, healthcare, or life insurance premiums, among others.

What is a payroll deduction?

Payroll deductions are wages withheld from an employee's total earnings for the purpose of paying taxes, garnishments and benefits, like health insurance. These withholdings constitute the difference between gross pay and net pay and may include: Income tax. Social security tax. 401(k) contributions.

What is employer deduction?

Understanding paycheck deductions. What you earn (based on your wages or salary) is called your gross income. Employers withhold (or deduct) some of their employees' pay in order to cover payroll taxes and income tax. Money may also be deducted, or subtracted, from a paycheck to pay for retirement or health benefits.

Which is an example of a required employer deduction?

The most common mandatory withholdings include federal and state income taxes, Social Security and Medicare contributions, and, where applicable, court-ordered wage garnishments. Employers are obligated to follow these non-negotiable withholdings and may face fines or penalties if they fail to do so.

What is an example of a required deduction?

Mandatory Deductions: Employers are legally required to make these from every paycheck, regardless of employee consent. Examples include federal and state taxes, Social Security contributions, and in some cases, wage garnishments and union dues.

Do payroll deductions have to be approved by the employee in writing?

Any deductions other than income taxes and court-ordered payments require your written authorization. If you agreed in writing about the payment amount, that agreement is binding on both you and your employer, ing to the state laws which govern written contracts.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Department Request for Payroll Deduction Vendor, SED-3?

The Department Request for Payroll Deduction Vendor, SED-3 is a form used by departments to request the approval of a vendor from which payroll deductions can be made for employees.

Who is required to file Department Request for Payroll Deduction Vendor, SED-3?

Departments that wish to establish or modify payroll deductions for their employees are required to file the Department Request for Payroll Deduction Vendor, SED-3.

How to fill out Department Request for Payroll Deduction Vendor, SED-3?

To fill out Department Request for Payroll Deduction Vendor, SED-3, a department must provide details such as the vendor's name, contact information, type of service offered, and any specific instructions pertaining to the payroll deductions.

What is the purpose of Department Request for Payroll Deduction Vendor, SED-3?

The purpose of the Department Request for Payroll Deduction Vendor, SED-3 is to facilitate the proper authorization and setup of payroll deductions for services or programs that benefit employees.

What information must be reported on Department Request for Payroll Deduction Vendor, SED-3?

The information that must be reported includes the vendor's name and address, the type of deduction, the reason for the deduction, and any terms and conditions related to the payroll deduction.

Fill out your department request for payroll online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Department Request For Payroll is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.