Get the free Direct Deposit (EFT) Bank Reversal Procedures - doa louisiana

Show details

This document outlines the procedures for agencies to follow when submitting bank reversal requests for direct deposit overpayments, detailing the acceptable reasons, required information, and processes

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign direct deposit eft bank

Edit your direct deposit eft bank form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your direct deposit eft bank form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit direct deposit eft bank online

Follow the steps below to use a professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit direct deposit eft bank. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

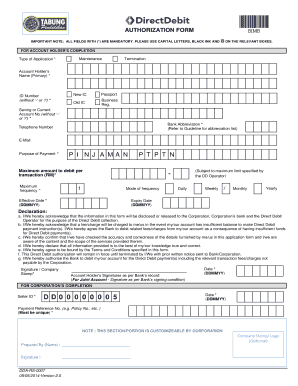

How to fill out direct deposit eft bank

How to fill out Direct Deposit (EFT) Bank Reversal Procedures

01

Obtain the Direct Deposit (EFT) Bank Reversal Procedures form from your payroll or HR department.

02

Carefully read the instructions provided on the form to understand the requirements.

03

Fill in your personal details, including your name, employee ID, and contact information.

04

Specify the reason for the reversal, ensuring it complies with the policy's criteria.

05

Enter the date of the original direct deposit and the amount to be reversed.

06

Sign and date the form to authorize the reversal action.

07

Submit the completed form to your payroll or finance department via the specified method (email, in-person, etc.).

08

Follow up after submission to confirm the processing of your request.

Who needs Direct Deposit (EFT) Bank Reversal Procedures?

01

Employees who have received incorrect direct deposits.

02

Individuals who need to reverse a payment mistakenly deposited into their account.

03

Finance or payroll departments responsible for handling direct deposit transactions.

Fill

form

: Try Risk Free

People Also Ask about

Can a bank reverse a direct deposit?

To have your funds reversed, you will have to request an EFT payment recall. The process can take up to 10 working days.

Can a bank reverse an EFT payment?

An EFT payment is final and irrevocable. This means that once you have made an EFT payment you cannot reverse it. For further assistance you can request the bank to reverse the erroneous payment however the bank must first obtain the authorisation from the recipient.

Can you do a reversal in EFT?

Authorisation reversal If either a consumer or a vendor notices something is wrong with the payment, they can contact the bank to stop the transaction going through. This is typically the payment reversal type which involves the least hassle for both customers and businesses.

Can a direct deposit be taken back?

A direct deposit payment may be returned automatically by the payee's receiving depository financial institution (RDFI) if the payment cannot be posted because the account is closed, the payee is deceased, or other reasons. See Returned Money Items.

How long does it take for a bank to reverse a direct deposit?

However, the ACH system usually requires the reversal to be submitted within five banking days of the original transaction. After submission, it can take another 1-3 business days for the reversal to be processed by the employee's bank. Keep in mind that some banks might have additional processing times.

Can a direct bank deposit be reversed?

The National Automated Clearing House Association (NACHA) establishes the rules, deadlines and criteria for a reversal: The reversal request must be processed no later than four banking days from the settlement date of the payment. The reasons for a reversal are limited to: Incorrect payee.

Can my bank reverse a direct debit?

In the rare event that an error is made in the payment of your Direct Debit, contact your bank or building society straightaway. It's the bank that is responsible for refunding you in the event of a mistake, even if the original error was made by the organisation collecting the payment.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Direct Deposit (EFT) Bank Reversal Procedures?

Direct Deposit (EFT) Bank Reversal Procedures are the guidelines established for reversing an Electronic Funds Transfer (EFT) made through direct deposit. This may involve returning funds mistakenly deposited into an account or resolving transactions that need correction.

Who is required to file Direct Deposit (EFT) Bank Reversal Procedures?

Financial institutions, payroll departments, and businesses that conduct direct deposit transactions are required to file Direct Deposit (EFT) Bank Reversal Procedures if any errors or issues arise in the processing of electronic payments.

How to fill out Direct Deposit (EFT) Bank Reversal Procedures?

To fill out the Direct Deposit (EFT) Bank Reversal Procedures, you typically need to provide details of the original transaction, including the amount, date, and account numbers involved. Follow your institution's specific forms and include all requested information accurately.

What is the purpose of Direct Deposit (EFT) Bank Reversal Procedures?

The purpose of Direct Deposit (EFT) Bank Reversal Procedures is to ensure that funds can be returned to the originating account or correct errors promptly, maintaining financial accuracy and integrity in electronic transactions.

What information must be reported on Direct Deposit (EFT) Bank Reversal Procedures?

The information that must be reported includes the original transaction details (amount, date, account numbers), the reason for the reversal, and any relevant identifiers such as transaction reference numbers or employee IDs.

Fill out your direct deposit eft bank online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Direct Deposit Eft Bank is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.