Get the free Installment Request for Individual Income - revenue louisiana

Show details

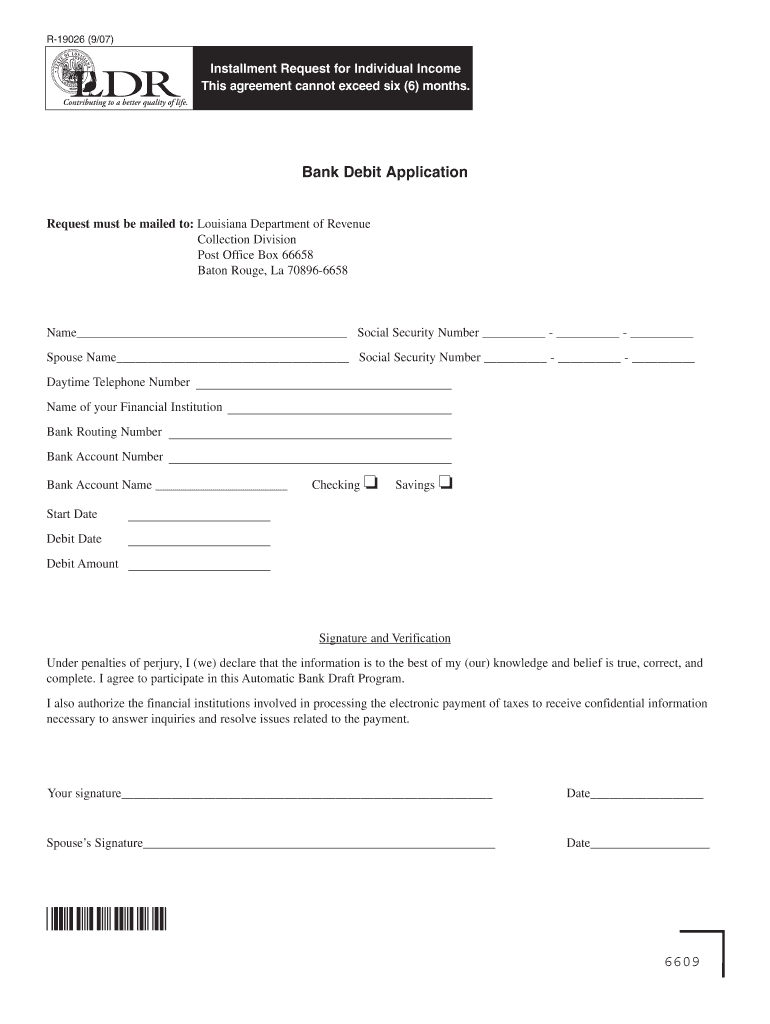

This document serves as an application for setting up an automatic bank draft for individual income tax payments with the Louisiana Department of Revenue.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign installment request for individual

Edit your installment request for individual form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your installment request for individual form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit installment request for individual online

Follow the steps below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit installment request for individual. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out installment request for individual

How to fill out Installment Request for Individual Income

01

Obtain the Installment Request form for Individual Income from the relevant tax authority or their website.

02

Fill out your personal information, including your name, address, and Social Security number.

03

Provide details about your income for the current tax year.

04

Specify the amount you wish to pay and the desired installment plan duration.

05

Review the form for accuracy and completeness.

06

Sign and date the form to certify the information is correct.

07

Submit the completed form according to the instructions provided, either online or via mail.

Who needs Installment Request for Individual Income?

01

Individuals who owe taxes but are unable to pay the full amount at once.

02

Taxpayers facing financial hardship and seeking to manage their tax liabilities over time.

03

Individuals who have received a notice from the tax authority indicating the need to pay taxes owed.

Fill

form

: Try Risk Free

People Also Ask about

How long can you pay an installment agreement with the IRS?

Long-term payment plan (also called an installment agreement) – For taxpayers who have a total balance less than $50,000 in combined tax, penalties and interest. They can make monthly payments for up to 72 months.

How much does an IRS installment agreement cost?

Fees for IRS installment plans If you can pay off your balance within 180 days, it won't cost you anything to set up an installment plan. If you can't pay off your balance within 180 days, setting up a direct debit payment plan online will cost $22, or $107 if the plan is set up by phone or mail.

How much is the user fee for the direct debit installment agreement?

If you apply for the DDIA online through the IRS Online Payment Agreement tool, the user fee is $31. The user fee for a regular pay by check installment agreement is $225 or $149 if requested through the online tool.

How much is the 9465 installment agreement fee?

The user fee for requesting an installment agreement using Form 9465 is $225 with payment by check and $107 with payment by direct debit from your checking account.

How much interest does the IRS charge for a payment plan?

Individuals: The interest rate on overpayments and underpayments is 8% per year, compounded daily. This is for taxpayers looking for reasonable payment amounts through the IRS term payment plan options. Corporations: Overpayments are subject to 7% interest, while underpayments are subject to 8% interest.

How long does it take IRS to process Form 9465?

If you don't qualify for an IA through OPA, you may also request an IA by submitting Form 9465, Installment Agreement Request, with the IRS. When you request an IA using the form, generally, you'll receive a response from the IRS within 30 days notifying you of whether the IA request was approved or rejected.

Is the IRS installment plan worth it?

You could pay less in interest and fees: With IRS payment plan interest rates at 8% and the lower penalty rate of 0.25% per month, it's possible that you'll have lower ongoing costs by repaying this way than if you borrowed the money with a personal loan.

What is the PPIA program for taxes?

A PPIA[CW1] is designed for taxpayers who cannot pay their full tax debt within the statutory collection period (generally ten years). Under a PPIA, the taxpayer makes monthly payments based on their ability to pay, which may be less than the total debt owed.

Why would the IRS reject an installment agreement?

The IRS considers extravagant expenses as those that include charitable contributions, private school funding and hefty credit card payments. In addition, if you fail to provide accurate information on Form 433-A, Collection Information Statement, you can expect your agreement to be rejected.

Does the IRS charge a processing fee?

The IRS does not charge a fee but convenience fees apply and vary by the payment processor.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Installment Request for Individual Income?

An Installment Request for Individual Income is a form submitted by individuals to request permission to pay their income taxes in installments rather than in a single payment.

Who is required to file Installment Request for Individual Income?

Individuals who are unable to pay their entire tax liability by the due date and wish to pay in installments must file the Installment Request for Individual Income.

How to fill out Installment Request for Individual Income?

To fill out the Installment Request for Individual Income, provide personal identification information, detail the amount owed, specify the proposed installment payment schedule, and include any necessary financial information to support the request.

What is the purpose of Installment Request for Individual Income?

The purpose of the Installment Request for Individual Income is to allow taxpayers who are facing financial difficulties to pay their income taxes over time rather than in a lump sum.

What information must be reported on Installment Request for Individual Income?

The information that must be reported includes the individual's name, Social Security number, tax year, the total amount due, proposed payment amounts, and any additional financial details relevant to the request.

Fill out your installment request for individual online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Installment Request For Individual is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.