Get the free IT-540B - revenue louisiana

Show details

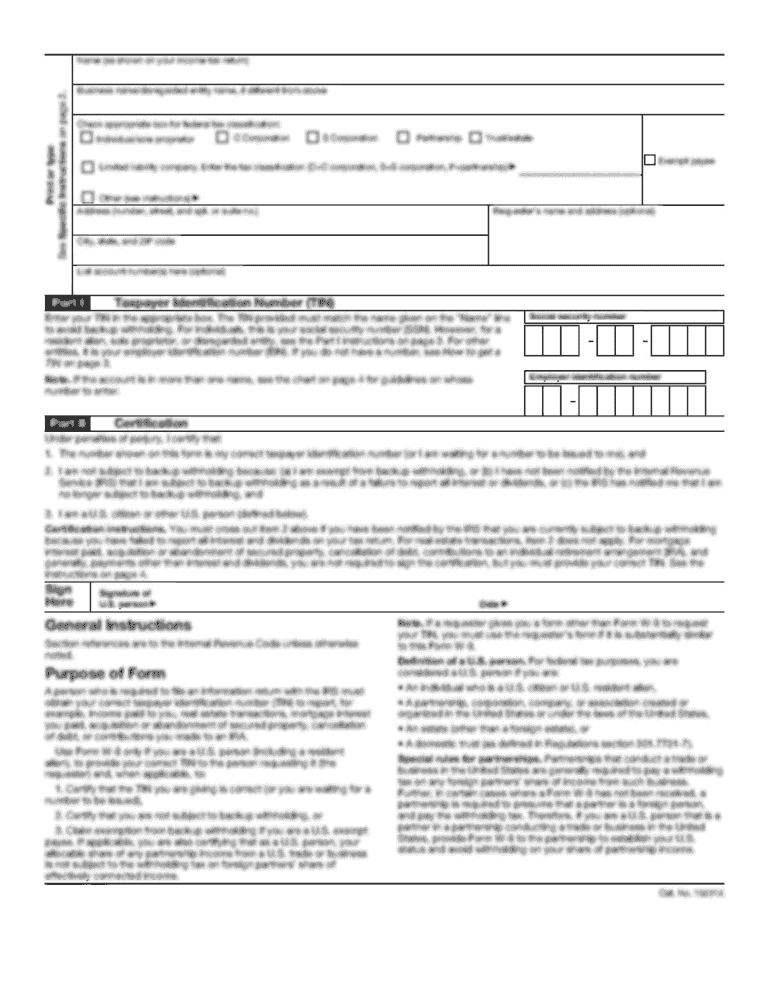

This document is a tax return form for non-residents and part-year residents of Louisiana to report their income and determine their tax liability for the year 2002.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign it-540b - revenue louisiana

Edit your it-540b - revenue louisiana form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your it-540b - revenue louisiana form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing it-540b - revenue louisiana online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit it-540b - revenue louisiana. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out it-540b - revenue louisiana

How to fill out IT-540B

01

Gather your personal information such as name, address, and Social Security number.

02

Collect your income documents including W-2s and 1099s.

03

Fill out the identification section with your personal details.

04

Report your total income in the appropriate sections.

05

Deduct any allowable expenses and credits as applicable.

06

Calculate your tax liability using the tax tables provided.

07

Complete the signature section and date your form.

08

Send the completed IT-540B form to the designated tax office.

Who needs IT-540B?

01

Residents of Louisiana who are filing an individual income tax return.

02

Individuals earning income from Louisiana sources.

03

Taxpayers looking to claim specific credits or deductions applicable to Louisiana.

Fill

form

: Try Risk Free

People Also Ask about

Am I required to file a Louisiana tax return?

Who must file. Louisiana residents, part-year residents of Louisiana, and nonresidents with income from Louisiana sources who are required to file a federal income tax return must file a Louisiana Individual Income Tax Return.

What is the English translation of the IRS?

abbreviation for Internal Revenue Service: the US government department that is responsible for calculating and collecting taxes: The IRS grants tax exemptions for charities and community organizations.

What earned income is not taxable?

Inheritances, gifts, cash rebates, alimony payments (for divorce decrees finalized after 2018), child support payments, most healthcare benefits, welfare payments, and money that is reimbursed from qualifying adoptions are deemed nontaxable by the IRS.

What is the personal exemption for Louisiana state income tax?

The annual exemption calculation for personal exemptions has been replaced by a standard deduction. The annual exemption calculation for dependent exemptions has been removed. The standard deduction for single filers is $12,500. The standard deduction for Married and Head of Household filers is $25,000.

What income doesn't pay taxes?

Disability and worker's compensation payments are generally nontaxable. Supplemental Security Income payments are also tax-exempt. Disability compensation or pension payments from the Department of Veterans Affairs to U.S. military Veterans are tax-free as well.

What income is not taxable in Louisiana?

Louisiana exempts interest and dividends earned on federal obligations and obligations from the State of Louisiana and its political subdivisions and municipalities. Interest and dividends from all state and local government obligations are exempt from federal income tax.

What income can be non taxable?

Examples of Non-Taxable Income Type of IncomeTax-Free Reason Gifts Transfers of money or property not in exchange for services. Employer-Provided Health Insurance Exempt under IRS fringe benefit rules. Disability Pay Tax-free if premiums were paid with after-tax dollars.9 more rows • 6 days ago

Is Social Security income taxable in Louisiana?

Is Social Security taxable in Louisiana? The state of Louisiana does not tax Social Security income. Social Security retirement benefits earned by Louisiana residents may still be subject to federal income taxes, however.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is IT-540B?

IT-540B is a Louisiana income tax return form used by residents to report their income, calculate their tax liability, and claim any applicable credits and deductions.

Who is required to file IT-540B?

Residents of Louisiana who have a certain level of income and wish to report their earnings, pay state taxes, or claim refunds are required to file IT-540B.

How to fill out IT-540B?

To fill out IT-540B, taxpayers need to provide personal information, report their income, claim deductions and credits, calculate their tax due, and sign the form before submitting it to the Louisiana Department of Revenue.

What is the purpose of IT-540B?

The purpose of IT-540B is to ensure that Louisiana residents accurately report their income and pay their state income taxes while also allowing them to claim credits and deductions that may reduce their tax liability.

What information must be reported on IT-540B?

Taxpayers must report personal identifying information, total income, adjustments, deductions, credits, tax liability, payments made, and any balance due or refund amount on IT-540B.

Fill out your it-540b - revenue louisiana online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

It-540b - Revenue Louisiana is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.