LA R-9015i Instructions 2012 free printable template

Get, Create, Make and Sign LA R-9015i Instructions

Editing LA R-9015i Instructions online

Uncompromising security for your PDF editing and eSignature needs

LA R-9015i Instructions Form Versions

How to fill out LA R-9015i Instructions

How to fill out LA R-9015i Instructions

Who needs LA R-9015i Instructions?

Instructions and Help about LA R-9015i Instructions

Hi guys welcome back again to my channel cooking with Lisa I have a perfect recipe for you guys today as you know I'm in New York, so I'm trying to get as much Guyanese recipes like as I can for you guys and the person to do this is my mother, so I have to thank her very much for making all these Guyanese snacks for me, so I can share my culture with you guys, so today we're going to make something another guy a snack named Saul sail but in Guyana it is known as Chicken foot it does not look like a chicken foot at all, and I'm not sure why they call it that, but that's what it's called, and it is also eaten with spicy mango sauce also known as mango sour so the ingredients you'll need for this recipe are flour some garlic yellow food color you will need ground DAL also known as split pea powder, and you will need some salt and a little of pepper we're going to make this recipe today and uh make sure here, but you can also mix it by hand so into the mixer pour the flour in there along with some garlic and this 50 powder you're going to add a little of salt to taste and yellow food coloring I will list the amount of ingredients we're using to make this recipe in the description box down below this video and some hot pepper after you finish mixing to though let it need for about five minutes and then transfer it to your work surface this is what it should look like as you can see we're dividing it into smaller balls, so it will be easier to handle after you're finished making smaller balls with the dough take one and roll it out you're going to roll out each one just put some flour if it's too sticky, and you're going to roll it out tillage Music then place each one on a flat pan to cook for about 15 seconds on each side then set them aside and continue to do this for all the doubles you have so here we have the sausage sheets that are precooked next fold it in half like this then fold it back into quarters cut it in half and then cut like this into very fine strips and this is what it looks like after finished cutting them you'll need a lot of vegetable oil to fry the salty oh here they are when the oil is hot put them in there not too much and allow them to fry until they're golden brown and here you have it guys the final product Sal sale also known as chicken foot it's really crispy, and you eat it with spicy mango sauce or mango sour, so that's all for today's video guys I hope you enjoy watching this video if you did give it a like and I will see you guys later bye

People Also Ask about

How do I transfer a joint tenant property after death in NSW?

How do you change from joint tenants to tenants in common in NSW?

Why would you sever a joint tenancy?

How do you end a joint tenancy in NSW?

How do I change my joint tenancy to tenants in common NSW?

What does tenants in common mean UK?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send LA R-9015i Instructions for eSignature?

How do I complete LA R-9015i Instructions online?

How do I fill out the LA R-9015i Instructions form on my smartphone?

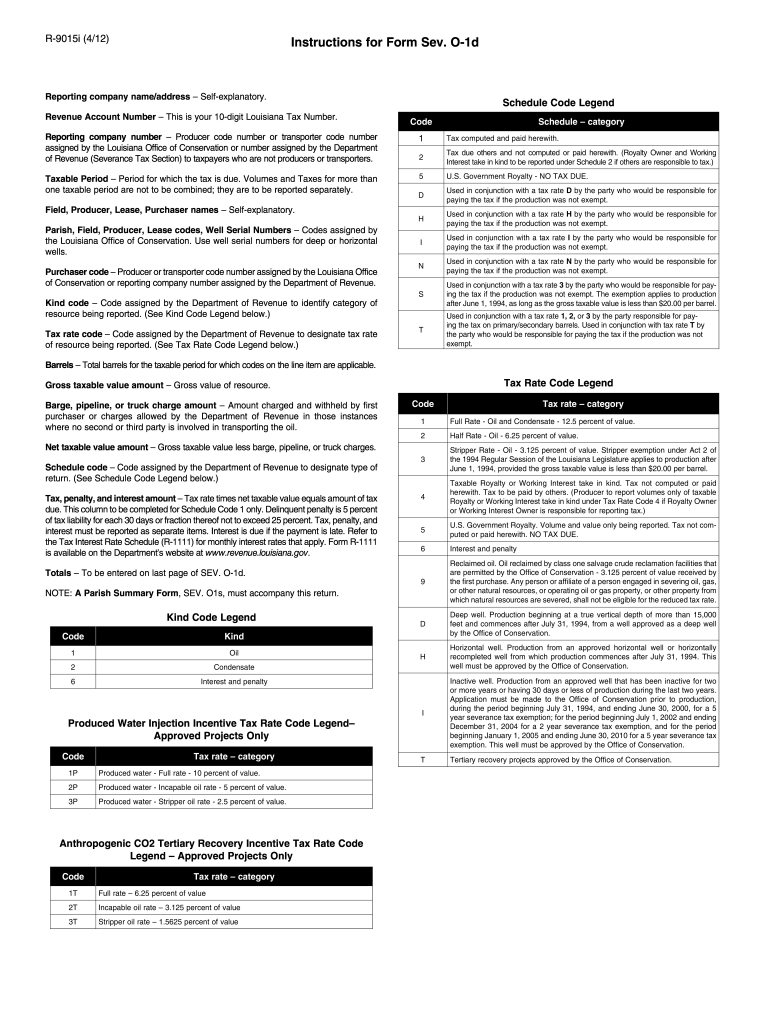

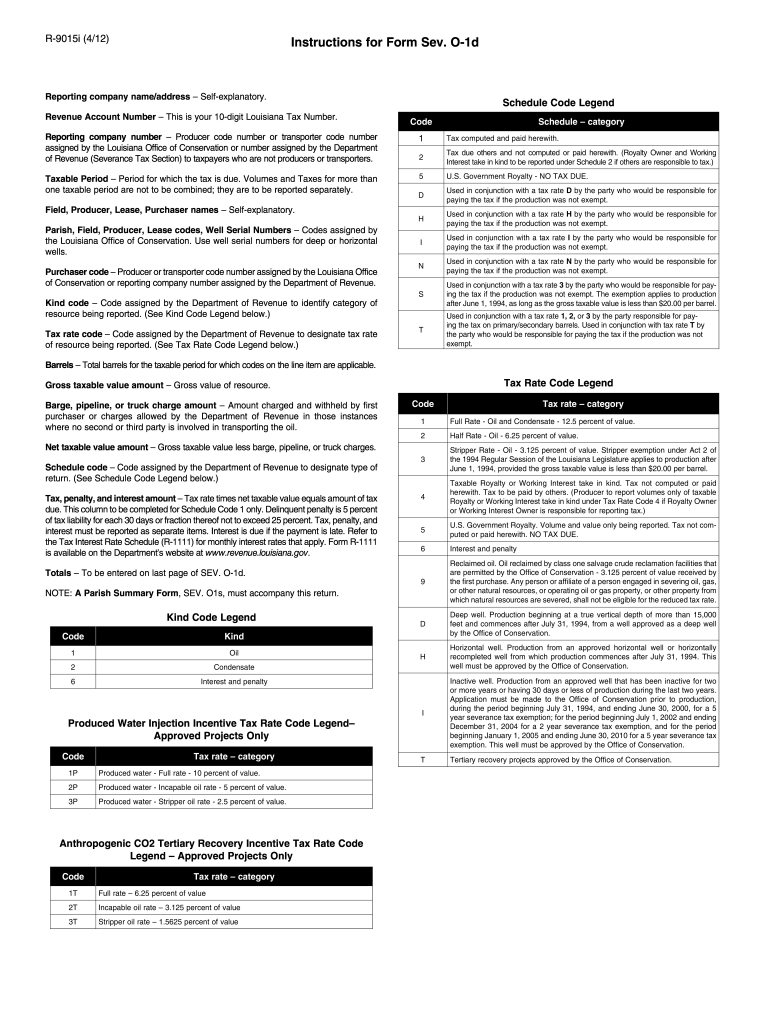

What is LA R-9015i Instructions?

Who is required to file LA R-9015i Instructions?

How to fill out LA R-9015i Instructions?

What is the purpose of LA R-9015i Instructions?

What information must be reported on LA R-9015i Instructions?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.