Get the free Requirements for Substitute Forms - revenue louisiana

Show details

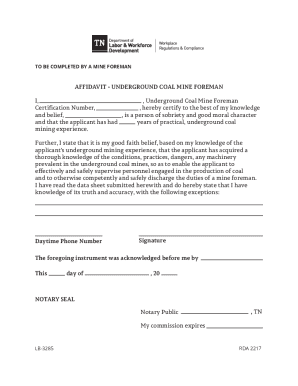

This document outlines the testing and approval requirements for various substitute tax forms that must be submitted to the Louisiana Department of Revenue prior to distribution.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign requirements for substitute forms

Edit your requirements for substitute forms form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your requirements for substitute forms form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit requirements for substitute forms online

To use the professional PDF editor, follow these steps below:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit requirements for substitute forms. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out requirements for substitute forms

How to fill out Requirements for Substitute Forms

01

Begin by gathering all necessary information related to the substitute.

02

Provide the full name and contact details of the substitute.

03

Specify the type of substitutes required for your particular needs.

04

Include any relevant dates, such as start date and end date for the substitute role.

05

List the qualifications or certifications needed for the substitute.

06

Review the form for completeness and accuracy before submission.

Who needs Requirements for Substitute Forms?

01

Educators and administrators who require temporary staff replacements in schools and educational institutions.

02

Human resources personnel managing staffing requirements during employee absences.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Requirements for Substitute Forms?

Requirements for Substitute Forms outline the specific guidelines and regulations that must be followed for submitting alternative formats of official tax forms, allowing taxpayers to use substitutes instead of the standard forms provided by the IRS.

Who is required to file Requirements for Substitute Forms?

Any taxpayer or entity that wishes to use substitute forms instead of the official IRS forms must follow the Requirements for Substitute Forms, including tax preparers, financial institutions, and businesses handling tax-related documents.

How to fill out Requirements for Substitute Forms?

To fill out Requirements for Substitute Forms, one must follow the prescribed format, ensure all required fields are completed, and adhere to the specific instructions provided by the IRS for each form being substituted, ensuring compliance with all relevant regulations.

What is the purpose of Requirements for Substitute Forms?

The purpose of Requirements for Substitute Forms is to ensure that substitute forms are acceptable for filing with the IRS, providing taxpayers with flexibility in filing options while maintaining the integrity and accuracy of tax reporting.

What information must be reported on Requirements for Substitute Forms?

Requirements for Substitute Forms must report essential information typically required on the corresponding official forms, such as taxpayer identification numbers, financial data, and any relevant details necessary for accurate tax processing.

Fill out your requirements for substitute forms online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Requirements For Substitute Forms is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.