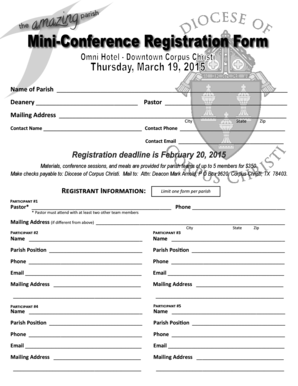

Get the free Worksheet for Maine Form 1120ME Schedule B, Line 20 Modification for Alternative Min...

Show details

This document serves to outline the specific modifications for alternative minimum tax calculations in Maine, particularly for corporate income. It details various income additions and subtractions

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign worksheet for maine form

Edit your worksheet for maine form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your worksheet for maine form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit worksheet for maine form online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit worksheet for maine form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out worksheet for maine form

How to fill out Worksheet for Maine Form 1120ME Schedule B, Line 20 Modification for Alternative Minimum Tax

01

Gather your financial documents and previous year's tax return.

02

Obtain a copy of the Maine Form 1120ME and the corresponding Schedule B.

03

Identify Line 20 where you will report modifications for the Alternative Minimum Tax.

04

Review the instructions for the Worksheet for any updates or specific requirements.

05

Fill out the Worksheet by entering your taxable income, adjustments, and any credits that apply.

06

Follow the calculations on the Worksheet carefully to determine your final adjustments.

07

Transfer the final amounts from the Worksheet to Line 20 on Schedule B.

08

Double-check for accuracy before filing your Maine Form 1120ME.

Who needs Worksheet for Maine Form 1120ME Schedule B, Line 20 Modification for Alternative Minimum Tax?

01

Any corporation filing Maine Form 1120ME that is subject to Alternative Minimum Tax.

02

Businesses with certain tax adjustments or modifications that affect their taxable income.

03

Tax professionals preparing forms for clients who need to calculate Alternative Minimum Tax.

Fill

form

: Try Risk Free

People Also Ask about

Which IRS form does a taxpayer calculate Alternative Minimum Tax?

To figure out whether you owe any additional tax under the Alternative Minimum Tax system, you need to fill out Form 6251. If the tax calculated on Form 6251 is higher than that calculated on your regular tax return, you have to pay the difference as AMT in addition to the regularly calculated income tax.

What form do I fill out to amend my tax return?

To amend a return, file Form 1040-X, Amended U.S. Individual Income Tax Return. You can use tax software to electronically file your 1040-X online. Submit all the same forms and schedules as you did when you filed your original Form 1040 even if you don't have adjustments on them.

How do I calculate my Alternative Minimum Tax?

How to calculate the AMT Determine your regular taxable income. Make required adjustments. Subtract your AMT exemption. Calculate your AMT income. Multiply your AMTI by the AMT rates. Compare the TMT to your regular tax liability. Complete AMT form 6251.

What is a 1041 amendment form?

If you need to make changes to your return after it has been filed, you may need to file an amended return. The amended Form 1041 U.S. Income Tax Return for Estates and Trusts return is one of the few that the IRS will accept electronically, so you have the option to either mail or e-file.

What is the 183 day rule in Maine?

ing to the Maine Instructions: A Resident of Maine is an individual that was domiciled in Maine for the entire taxable year or maintained a permanent place of abode in Maine for the tax year and spent more than 183 days there.

What form do I use to calculate alternative minimum tax?

Use Form 6251 to figure the amount, if any, of your alternative minimum tax (AMT). The AMT applies to taxpayers who have certain types of income that receive favorable treatment, or who qualify for certain deductions, under the tax law.

Does Maine tax pensions for seniors?

Social Security is exempt from taxation in Maine, but other forms of retirement income are not. Seniors who receive retirement income from a 401(k), IRA or pension will pay tax rates as high as 7.15%, though a small deduction is available.

What is a 1040ME form?

Individual Income Tax (1040ME) Maine generally imposes an income tax on all individuals that have Maine-source income.

Do I have to pay Maine income tax if I work in another state?

Maine taxes income earned for personal services performed while in Maine (even if you're a nonresident). This includes remote work for an employer or clients based outside Maine if you were physically in the state while doing the work.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Worksheet for Maine Form 1120ME Schedule B, Line 20 Modification for Alternative Minimum Tax?

The Worksheet for Maine Form 1120ME Schedule B, Line 20 Modification for Alternative Minimum Tax is a calculation tool used to determine adjustments to income for Maine corporations to comply with the Alternative Minimum Tax (AMT) requirements.

Who is required to file Worksheet for Maine Form 1120ME Schedule B, Line 20 Modification for Alternative Minimum Tax?

Corporations that are subject to the Alternative Minimum Tax in Maine and are filing Form 1120ME are required to complete and file the Worksheet for Schedule B, Line 20.

How to fill out Worksheet for Maine Form 1120ME Schedule B, Line 20 Modification for Alternative Minimum Tax?

To fill out the worksheet, corporations need to gather their financial data, compute adjustments that affect AMT, and enter the appropriate figures in accordance with the instructions provided for the worksheet.

What is the purpose of Worksheet for Maine Form 1120ME Schedule B, Line 20 Modification for Alternative Minimum Tax?

The purpose of the worksheet is to assist Maine corporations in calculating any modifications necessary to determine their taxable income in relation to the Alternative Minimum Tax, ensuring compliance with state tax regulations.

What information must be reported on Worksheet for Maine Form 1120ME Schedule B, Line 20 Modification for Alternative Minimum Tax?

Information that must be reported includes adjustments related to depreciation, tax preference items, and any other modifications that impact the calculation of the corporation's Alternative Minimum Tax.

Fill out your worksheet for maine form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Worksheet For Maine Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.