Get the free Employer-Assisted Day Care Tax Credit Worksheet for Tax Year 2006

Show details

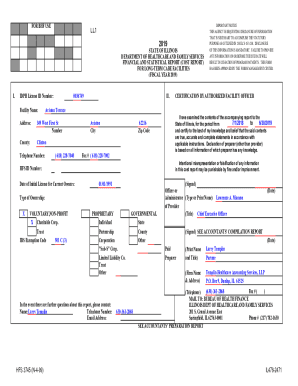

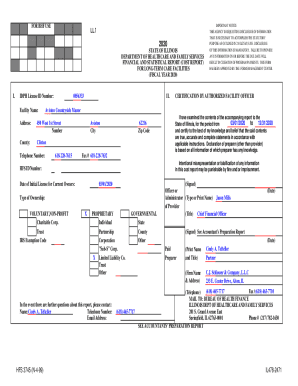

This worksheet is used for tax credits available to employers providing or paying for day-care services for their employees' children, detailing various cost calculations and eligibility for quality

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign employer-assisted day care tax

Edit your employer-assisted day care tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your employer-assisted day care tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit employer-assisted day care tax online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit employer-assisted day care tax. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out employer-assisted day care tax

How to fill out Employer-Assisted Day Care Tax Credit Worksheet for Tax Year 2006

01

Gather necessary documents including your business information, employee information, and records of day care expenses.

02

Download the Employer-Assisted Day Care Tax Credit Worksheet for Tax Year 2006 from the IRS website.

03

Fill in your business name, address, and employer identification number (EIN) at the top of the worksheet.

04

List the names and Social Security numbers of employees who received dependent care assistance.

05

Enter the total amount of dependent care assistance provided to each employee during the tax year.

06

Determine and input the total number of employees who received the assistance.

07

Calculate the applicable percentage of the credit based on the total assistance provided.

08

Complete any additional required sections of the worksheet as indicated in the instructions.

09

Review all entries for accuracy before submitting with your tax return.

Who needs Employer-Assisted Day Care Tax Credit Worksheet for Tax Year 2006?

01

Employers who provide dependent care assistance to their employees and wish to claim the Employer-Assisted Day Care Tax Credit for their employees on their tax returns.

Fill

form

: Try Risk Free

People Also Ask about

Where do I get the IRS form 2441?

Form 2441 is a two-page form divided into three sections. Each section details a separate area of qualifying factors and calculations. The first two sections appear on the first page. All pages of Form 2441 are available on the IRS website.

Who fills out form 2441?

Form 2441 is used to claim the Child and Dependent Care Credit, which is available to those who pay someone to care for dependent children under 13, disabled spouses, or other dependents who cannot mentally or physically care for themselves.

Where do I get a 2441 form?

Form 2441 is a two-page form divided into three sections. Each section details a separate area of qualifying factors and calculations. The first two sections appear on the first page. All pages of Form 2441 are available on the IRS website.

Do you get a tax form from daycare?

Daycare centers are required to provide parents with an annual daycare tax statement. This statement shows the total amount parents spent on child care costs during the past year. These annual receipts should cover January 1st through December 31st of the previous year.

How do I claim child dependent care credit?

Reporting on your tax return If you qualify for the credit, complete Form 2441, Child and Dependent Care Expenses and attach to Form 1040, U.S Individual Income Tax Return, Form 1040-SR, U.S. Tax Return for Seniors or Form 1040-NR, U.S. Nonresident Alien Income Tax Return.

Why can't I claim daycare expenses on my taxes?

Child care expenses are only eligible if the costs were incurred because the parent was working or attending school, and must be claimed by the lower income parent. Your child care costs are not eligible for tax deduction.

What is the tax credit form for daycare?

To claim the credit, taxpayers must complete Form 2441, a two-page document that reports child and dependent care expenses as part of a federal income tax return and is used to determine the amount of child and dependent care expenses the taxpayer can claim.

What is the employer childcare contribution tax credit?

The Employer-Provided Childcare Credit offers employers a tax credit up to $150,000 per year to offset 25% of qualified childcare facility expenditures and 10% of qualified childcare resource and referral expenditures. Find details in Internal Revenue Code (IRC) Section 45F.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Employer-Assisted Day Care Tax Credit Worksheet for Tax Year 2006?

The Employer-Assisted Day Care Tax Credit Worksheet for Tax Year 2006 is a tax form used by employers to calculate the tax credit they can claim for providing child care assistance to employees. This worksheet helps in determining the amount of credit allowed based on eligible expenses incurred.

Who is required to file Employer-Assisted Day Care Tax Credit Worksheet for Tax Year 2006?

Employers who provide child care assistance or facilities to their employees and wish to claim the Employer-Assisted Day Care Tax Credit are required to file the worksheet for Tax Year 2006.

How to fill out Employer-Assisted Day Care Tax Credit Worksheet for Tax Year 2006?

To fill out the Employer-Assisted Day Care Tax Credit Worksheet for Tax Year 2006, employers need to gather details regarding the total expenses incurred for employee child care assistance, complete the necessary calculations as outlined in the worksheet, and provide supporting documentation as required.

What is the purpose of Employer-Assisted Day Care Tax Credit Worksheet for Tax Year 2006?

The purpose of the Employer-Assisted Day Care Tax Credit Worksheet for Tax Year 2006 is to enable employers to formally calculate and claim tax credits associated with benefits provided to employees for child care, encouraging companies to support working parents and improve workforce stability.

What information must be reported on Employer-Assisted Day Care Tax Credit Worksheet for Tax Year 2006?

The information that must be reported on the Employer-Assisted Day Care Tax Credit Worksheet for Tax Year 2006 includes total qualified expenses for child care, the number of employees receiving benefits, and any other relevant details regarding child care facilities used or support offered by the employer.

Fill out your employer-assisted day care tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Employer-Assisted Day Care Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.