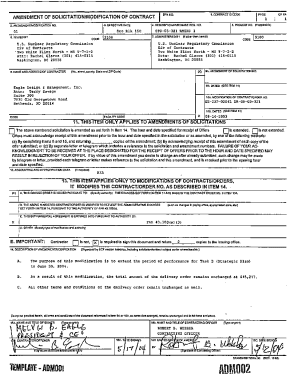

Get the free Tax Credit for Pollution-Reducing Boilers Worksheet for Tax Year 2007

Show details

This worksheet allows businesses to claim a tax credit for using pollution-reducing boiler or furnace systems, detailing the process for calculating eligible kilowatt-hours produced and required documentation.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax credit for pollution-reducing

Edit your tax credit for pollution-reducing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax credit for pollution-reducing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tax credit for pollution-reducing online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tax credit for pollution-reducing. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax credit for pollution-reducing

How to fill out Tax Credit for Pollution-Reducing Boilers Worksheet for Tax Year 2007

01

Gather all necessary documentation, including proof of purchase and installation of the pollution-reducing boiler.

02

Obtain Form 5695 from the IRS website or your local tax office.

03

Fill out the taxpayer information section at the top of Form 5695.

04

In Part I, enter the total cost of the qualifying boiler in Line 1.

05

Calculate the credit percentage applicable for the boiler and apply it in Line 2.

06

Total the credits in Line 3 and carry this amount to your main tax return.

07

Complete any additional sections on Form 5695 as required based on your specific situation.

08

Review the form for accuracy and completeness before submitting with your tax return.

Who needs Tax Credit for Pollution-Reducing Boilers Worksheet for Tax Year 2007?

01

Homeowners who installed pollution-reducing boilers during the tax year 2007.

02

Taxpayers seeking to claim credits for energy-efficient improvements made to their residence.

03

Individuals who want to reduce their tax liability through environmentally friendly investments.

Fill

form

: Try Risk Free

People Also Ask about

How do I get energy credit on my taxes?

If you make qualified energy-efficient improvements to your home after Jan. 1, 2023, you may qualify for a tax credit up to $3,200. You can claim the credit for improvements made through 2032. For improvements installed in 2022 or earlier: Use previous versions of Form 5695.

What IRS form do I use to claim energy tax credit?

File Form 5695, Residential Energy Credits with your tax return to claim the credit. You must claim the credit for the tax year when the property is installed, not merely purchased.

What is nontaxable use of fuels Form 8849?

Schedule 1 (Form 8849) is a supplementary form used to claim refunds or credits for certain fuels used in non-taxable situations. It primarily addresses the nontaxable use of specific types of fuels, including gasoline, diesel fuel, kerosene, aviation gasoline, and aviation-grade kerosene.

What documentation is needed for energy tax credits?

A: Fill out IRS Form 5695, following IRS instructions, and include it when filing your tax return. Include any relevant product receipts. Q: Are there limits to what consumers can claim?

Where does residential energy credit go on 1040?

The value you filled on line 15 is the amount the IRS will credit on your taxes this year. Enter this number on line 5 of Schedule 3 on Form 1040. If you make additional energy-efficient home improvements in the fiscal year, you may qualify for other tax credits.

What is the tax form for residential energy credit?

Form 5695 is used to claim residential energy credits, including the 30% solar tax credit, which helps offset the cost of your solar installation. Filling it out correctly ensures you receive the maximum savings available.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Tax Credit for Pollution-Reducing Boilers Worksheet for Tax Year 2007?

The Tax Credit for Pollution-Reducing Boilers Worksheet for Tax Year 2007 is a form that taxpayers can use to claim a tax credit for the installation of boilers that improve energy efficiency and reduce pollution.

Who is required to file Tax Credit for Pollution-Reducing Boilers Worksheet for Tax Year 2007?

Taxpayers who installed qualified pollution-reducing boilers during the tax year 2007 and wish to claim the associated tax credit are required to file this worksheet.

How to fill out Tax Credit for Pollution-Reducing Boilers Worksheet for Tax Year 2007?

To fill out the worksheet, taxpayers must provide information regarding the installation details of the pollution-reducing boilers, including dates, costs, and specific qualifying criteria as outlined in the IRS instructions for the form.

What is the purpose of Tax Credit for Pollution-Reducing Boilers Worksheet for Tax Year 2007?

The purpose of the worksheet is to calculate and substantiate the tax credit that taxpayers can claim for investments made in environmentally beneficial boiler technologies, thereby incentivizing energy efficiency and reduction of pollution.

What information must be reported on Tax Credit for Pollution-Reducing Boilers Worksheet for Tax Year 2007?

The worksheet requires reporting of details such as the taxpayer's identification information, cost of the boiler installed, installation dates, and confirmation that the boiler meets the specified pollution-reduction criteria.

Fill out your tax credit for pollution-reducing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Credit For Pollution-Reducing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.