Get the free JOBS AND INVESTMENT TAX CREDIT WORKSHEET FOR TAX YEAR 2008

Show details

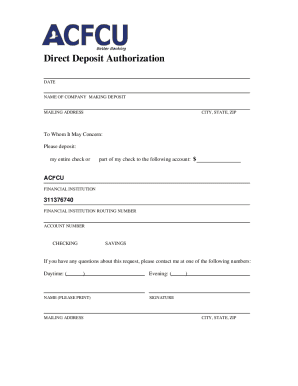

This worksheet is used by taxpayers to calculate the Jobs and Investment Tax Credit for the tax year 2008, based on qualified investments made in Maine. It includes sections for investment amounts,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign jobs and investment tax

Edit your jobs and investment tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your jobs and investment tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit jobs and investment tax online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit jobs and investment tax. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out jobs and investment tax

How to fill out JOBS AND INVESTMENT TAX CREDIT WORKSHEET FOR TAX YEAR 2008

01

Gather all necessary documentation related to your investments and job creation for the tax year 2008.

02

Obtain the JOBS AND INVESTMENT TAX CREDIT WORKSHEET for the relevant tax year from the official tax authority website or a tax professional.

03

Start with Section 1, where you will enter your name, address, and tax identification number.

04

Proceed to Section 2: document the amount of eligible investments made during the year.

05

In Section 3, detail the number of new jobs created as a result of the investments.

06

Calculate the credit amount based on the guidelines provided in the worksheet, ensuring that you reference the specific tax regulations applicable for 2008.

07

Review all entries for accuracy, and make sure to sign and date the worksheet before submission.

Who needs JOBS AND INVESTMENT TAX CREDIT WORKSHEET FOR TAX YEAR 2008?

01

Businesses that made qualifying investments and created new jobs during the tax year 2008.

02

Taxpayers seeking to benefit from tax credits related to job creation and investments.

03

Financial and tax professionals assisting clients with their tax filings for 2008.

Fill

form

: Try Risk Free

People Also Ask about

What are 3 examples of tax credits?

An investment credit is a type of medium or long-term loan (i.e. with a term of two to 20 years). You can use it for purchasing fixed assets such as property for your business, company cars and equipment. It can be used to fund the start-up of your business or for new investments to further grow your business.

Do you actually get money back from solar tax credit?

Personal Credits California Earned Income Tax Credit. Child Adoption Costs Credit. Child and Dependent Care Expenses Credit. College Access Tax Credit. Dependent Parent Credit. Foster Youth Tax Credit. Joint Custody Head Of Household. Nonrefundable Renter's Credit.

How does an investment tax credit work?

When you purchase solar equipment for your home and have tax liability, you generally can claim a solar tax credit to lower your tax bill. The Residential Clean Energy Credit is non-refundable meaning that it can offset your income tax liability dollar-for-dollar, but any excess credit won't be refunded.

How much is the investment tax credit?

Quick facts. The ITC is a 30 percent tax credit for individuals installing solar systems on residential property (under Section 25D of the tax code).

How much was the child tax credit in 2008?

Tables Year Enacted & LawMaximum CreditPhaseout Rate 2001 P.L. 107-16 (EGTRRA) $600 per child 0-16 (2001-2004) $700 per child 0-16 (2005-2008) $800 per child 0-16 (2009) $1,000 per child 0-16 (2010) not adjusted for inflation ⸺ 2003 P.L. 108-27 (JGTRRA) $1,000 per child 0-16 (2003-2004) not adjusted for inflation ⸺5 more rows • Dec 23, 2021

What is the 45V investment tax credit?

Section 45V provides annual PTCs up to $3/kg of qualified clean hydrogen produced by a taxpayer at a qualified facility during the 10-year period after the facility is first placed in service.

Why am I only getting $2500 Child Tax Credit for 2 kids?

Why am I only getting child tax credit for one child when I have two?? You've entered something wrong. Your child may be too old (over 16). Your income is too high. Your income is too low. You are the custodial parent and the non-custodial parent is claiming the dependent this year.

What is investment tax credit example?

The Investment Tax Credit applies to any technologies that result in less greenhouse gas emissions than traditional ones available at that time – such as solar panels, wind turbines, and geothermal pumps.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is JOBS AND INVESTMENT TAX CREDIT WORKSHEET FOR TAX YEAR 2008?

The JOBS AND INVESTMENT TAX CREDIT WORKSHEET for tax year 2008 is a form used to calculate tax credits available for businesses that create jobs and make qualified investments during that tax year.

Who is required to file JOBS AND INVESTMENT TAX CREDIT WORKSHEET FOR TAX YEAR 2008?

Businesses that meet the specific criteria for job creation and investment as outlined by the tax regulations for the tax year 2008 are required to file the worksheet.

How to fill out JOBS AND INVESTMENT TAX CREDIT WORKSHEET FOR TAX YEAR 2008?

To fill out the JOBS AND INVESTMENT TAX CREDIT WORKSHEET, gather necessary financial documentation, calculate eligible job creation and investment amounts, and enter the relevant figures according to the instructions provided on the form.

What is the purpose of JOBS AND INVESTMENT TAX CREDIT WORKSHEET FOR TAX YEAR 2008?

The purpose of the JOBS AND INVESTMENT TAX CREDIT WORKSHEET is to provide a structured way for businesses to claim tax credits that encourage job creation and stimulate economic investment.

What information must be reported on JOBS AND INVESTMENT TAX CREDIT WORKSHEET FOR TAX YEAR 2008?

The worksheet requires reporting of information such as the number of jobs created, total investment amounts, details of the types of investments made, and any other relevant financial data as outlined in the form instructions.

Fill out your jobs and investment tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Jobs And Investment Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.