Get the free CREDIT FOR EDUCATIONAL OPPORTUNITY WORKSHEET FOR EMPLOYERS - 2009

Show details

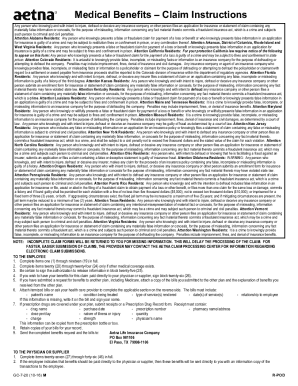

This worksheet is designed for employers in Maine to calculate and claim tax credits for eligible education loan payments made on behalf of qualified employees who are graduates from Maine colleges

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit for educational opportunity

Edit your credit for educational opportunity form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit for educational opportunity form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit credit for educational opportunity online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit credit for educational opportunity. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit for educational opportunity

How to fill out CREDIT FOR EDUCATIONAL OPPORTUNITY WORKSHEET FOR EMPLOYERS - 2009

01

Gather all necessary employee information such as name, Social Security number, and employment details.

02

Review the eligibility criteria for the Credit for Educational Opportunity to ensure that the employee qualifies.

03

Fill out the employee's name and Social Security number in the appropriate sections of the worksheet.

04

Indicate the type of educational program the employee is participating in.

05

Enter the dates of participation in the educational program.

06

Calculate the total educational expenses incurred by the employee during the period specified.

07

Submit the completed worksheet along with any required documentation to the appropriate tax authority.

Who needs CREDIT FOR EDUCATIONAL OPPORTUNITY WORKSHEET FOR EMPLOYERS - 2009?

01

Employers who wish to claim tax credits for providing educational opportunities to their employees.

02

Businesses that have employees participating in approved educational programs.

03

HR departments responsible for managing employee educational benefits.

Fill

form

: Try Risk Free

People Also Ask about

Do I have to pay back the American Opportunity Credit?

You can get a maximum annual credit of $2,500 per eligible student. If the credit brings the amount of tax you owe to zero, you can have 40 percent of any remaining amount of the credit (up to $1,000) refunded to you.

Who is ineligible to claim the American Opportunity Tax Credit?

Who cannot claim an education credit? You cannot claim an education credit when: Someone else, such as your parents, list you as a dependent on their tax return. Your filing status is married filing separately.

What is the Opportunity Tax Credit for education?

The American opportunity tax credit (AOTC) is a credit for qualified education expenses paid for an eligible student for the first four years of higher education. You can get a maximum annual credit of $2,500 per eligible student.

Who gets the work opportunity tax credit?

For TANF recipients, veterans, ex-felons, designated community residents, vocational rehabilitation referrals, summer youth workers, SNAP recipients, SSI recipients, or long-term unemployed: 40% tax credit if the employee works at least 400 hours. 25% tax credit if the employee works 120–399 hours.

Who qualifies for the American Opportunity Tax Credit?

A student eligible for the American Opportunity tax credit: has not completed the first four years of post-secondary education. enrolls in at least one academic semester during the applicable tax year. maintains at least half-time status in a program leading to a degree or other credential.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CREDIT FOR EDUCATIONAL OPPORTUNITY WORKSHEET FOR EMPLOYERS - 2009?

The CREDIT FOR EDUCATIONAL OPPORTUNITY WORKSHEET FOR EMPLOYERS - 2009 is a document used by employers to calculate the tax credits available for providing educational assistance to their employees under certain IRS guidelines.

Who is required to file CREDIT FOR EDUCATIONAL OPPORTUNITY WORKSHEET FOR EMPLOYERS - 2009?

Employers who provide educational assistance to their employees and wish to claim tax credits for such expenses are required to file this worksheet.

How to fill out CREDIT FOR EDUCATIONAL OPPORTUNITY WORKSHEET FOR EMPLOYERS - 2009?

To fill out the worksheet, employers must provide information about the educational assistance provided, the eligible expenses, and the number of employees who benefited. Accurate calculations are necessary to determine the eligible tax credit.

What is the purpose of CREDIT FOR EDUCATIONAL OPPORTUNITY WORKSHEET FOR EMPLOYERS - 2009?

The purpose of the worksheet is to assist employers in calculating and documenting their eligibility for a tax credit based on the educational opportunities they provide to their employees.

What information must be reported on CREDIT FOR EDUCATIONAL OPPORTUNITY WORKSHEET FOR EMPLOYERS - 2009?

Employers must report the types and amounts of educational assistance provided, details regarding the employees receiving the assistance, and any qualifying expenses incurred related to the educational benefits.

Fill out your credit for educational opportunity online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit For Educational Opportunity is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.