Get the free CREDIT FOR EDUCATIONAL OPPORTUNITY WORKSHEET FOR INDIVIDUALS - 2009

Show details

This worksheet is designed for individuals to determine their eligibility for the Credit for Educational Opportunity program in Maine, which provides an income tax credit for education-related costs

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit for educational opportunity

Edit your credit for educational opportunity form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit for educational opportunity form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credit for educational opportunity online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit credit for educational opportunity. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit for educational opportunity

How to fill out CREDIT FOR EDUCATIONAL OPPORTUNITY WORKSHEET FOR INDIVIDUALS - 2009

01

Gather all required documents including tax statements, educational institution statements, and any previous tax returns.

02

Obtain the form 'CREDIT FOR EDUCATIONAL OPPORTUNITY WORKSHEET FOR INDIVIDUALS - 2009' from the IRS website or a tax professional.

03

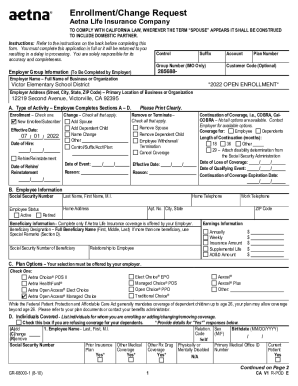

Start by entering your personal information at the top of the worksheet including your name, Social Security Number, and filing status.

04

Follow the instructions on the worksheet step-by-step, making sure to enter the correct figures from your educational expenses.

05

Calculate the total qualified education expenses and any scholarships or grants that you received.

06

Use the calculations provided on the worksheet to determine your eligible tax credit amount.

07

Double-check your arithmetic and ensure all sections of the worksheet are filled out completely.

08

Sign and date the worksheet, then keep a copy with your tax files for future reference.

Who needs CREDIT FOR EDUCATIONAL OPPORTUNITY WORKSHEET FOR INDIVIDUALS - 2009?

01

Individuals who have incurred educational expenses for themselves, their spouse, or their dependents.

02

Students attending college, university, or other higher education institutions seeking tax credits.

03

Taxpayers who qualify for tax credits for educational benefits under IRS rules for the 2009 tax year.

Fill

form

: Try Risk Free

People Also Ask about

How do I claim an education credit on Form 1040 or 1040 SR?

To claim the American opportunity credit complete Form 8863 and submit it with your Form 1040 or 1040-SR. Enter the nonrefundable part of the credit on Schedule 3 (Form 1040 or 1040-SR), line 3. Enter the refundable part of the credit on Form 1040 or 1040-SR, line 29.

What is the Opportunity tax credit for education?

The American opportunity tax credit (AOTC) is a credit for qualified education expenses paid for an eligible student for the first four years of higher education. You can get a maximum annual credit of $2,500 per eligible student.

How to get $2500 American Opportunity Credit?

The American Opportunity Tax Credit may be claimed for a student who (1) is enrolled in 6 credits or more, (2) is in one of the first four years of post-secondary education, (3) is enrolled in a program leading to a degree or certificate, and (4) is free of any conviction for a Federal or State felony offense

How can I find Form 8863?

If you can't find it, or if your school didn't send you one, it's possible you can get an electronic copy from your school's online portal. Or, they may have emailed it to you. While there are some circumstances where you can file without a form, this may raise questions with the IRS.

Where is educator credit on 1040?

You can claim the educator expense deduction on line 11 of Schedule 1 (Form 1040), Additional Income and Adjustments to Income.

How do I claim the education credit on my 1040?

If you filed a tax return (or if married, you and your spouse filed a joint tax return), the total education credits can be found on IRS Form 1040 Schedule 3-line 3. If you and your spouse filed separate tax returns, add IRS Form 1040 Schedule 3-line 3 from both tax returns and enter the total amount.

Why am I not getting the full education tax credit?

Not getting the full AOTC The credit is only available for the first four years of post-secondary education (undergrad). Enrolls in at least one academic semester during the applicable tax year. Maintains at least half-time status in a program leading to a degree or other credential.

How to file a 2009 tax return?

How to File a 2009 Return Today? Fill out and sign the 2009 IRS tax forms. Download, print, and mail them to the IRS using the address provided on Form 1040. Select your state(s), download, complete, print, and sign your state forms.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CREDIT FOR EDUCATIONAL OPPORTUNITY WORKSHEET FOR INDIVIDUALS - 2009?

The CREDIT FOR EDUCATIONAL OPPORTUNITY WORKSHEET FOR INDIVIDUALS - 2009 is a form used to help individuals calculate the amount of educational tax credits they may qualify for, specifically the American Opportunity Credit and the Lifetime Learning Credit.

Who is required to file CREDIT FOR EDUCATIONAL OPPORTUNITY WORKSHEET FOR INDIVIDUALS - 2009?

Individuals who are claiming the American Opportunity Credit or the Lifetime Learning Credit on their tax return are required to file the CREDIT FOR EDUCATIONAL OPPORTUNITY WORKSHEET FOR INDIVIDUALS - 2009.

How to fill out CREDIT FOR EDUCATIONAL OPPORTUNITY WORKSHEET FOR INDIVIDUALS - 2009?

To fill out the worksheet, individuals need to provide information about their qualifying educational expenses, the students' enrollment status, and any previous credits claimed. It is important to follow the instructions on the form carefully to ensure accurate calculations.

What is the purpose of CREDIT FOR EDUCATIONAL OPPORTUNITY WORKSHEET FOR INDIVIDUALS - 2009?

The purpose of the worksheet is to assist taxpayers in determining their eligibility for education-related tax credits, ensuring they maximize their potential tax benefits when filing their tax returns.

What information must be reported on CREDIT FOR EDUCATIONAL OPPORTUNITY WORKSHEET FOR INDIVIDUALS - 2009?

Individuals must report information such as the student's name, Social Security number, enrollment status, the amount of qualified education expenses, and any applicable adjustments or previous credits claimed.

Fill out your credit for educational opportunity online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit For Educational Opportunity is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.