Get the free SEED CAPITAL INVESTMENT TAX CREDIT WORKSHEET FOR TAX YEAR 2009

Show details

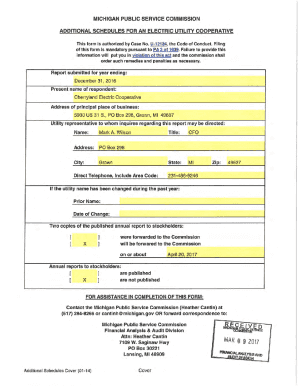

This worksheet is used to calculate the Seed Capital Investment Tax Credit for investments made in eligible Maine businesses, primarily for tax year 2009. It includes sections for reporting investment

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign seed capital investment tax

Edit your seed capital investment tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your seed capital investment tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing seed capital investment tax online

Follow the steps below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit seed capital investment tax. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out seed capital investment tax

How to fill out SEED CAPITAL INVESTMENT TAX CREDIT WORKSHEET FOR TAX YEAR 2009

01

Begin by gathering all necessary financial documents related to seed capital investments for the tax year 2009.

02

Fill out the taxpayer identification information at the top of the worksheet, including your name and Social Security number or Employer Identification Number.

03

In the investment details section, list all eligible seed capital investments made during 2009 with the corresponding dates and investment amounts.

04

Next, calculate the total amount of seed capital investments made during the year and enter this figure in the provided space.

05

Complete the required calculations to determine the percentage of the investment that qualifies for the tax credit based on current regulations.

06

Document any prior year carryforwards of the tax credit, if applicable, and add them to the current tax credit calculation.

07

Review all entries for accuracy before submitting the worksheet to ensure that all the information is complete and correct.

08

Finally, attach the completed worksheet to your tax return when filing for the tax year 2009.

Who needs SEED CAPITAL INVESTMENT TAX CREDIT WORKSHEET FOR TAX YEAR 2009?

01

Individuals and businesses that made seed capital investments in qualified businesses during the tax year 2009 and wish to claim the tax credit.

Fill

form

: Try Risk Free

People Also Ask about

How do I claim my investment tax credit?

Complete a separate Form 3468 to claim an investment credit for each facility or property. You must complete Part I to report facility or property information and the appropriate part (Part II– VII) to compute your investment credit for such facility or property.

What disqualifies you from a solar tax credit?

You must own the system: To use the tax credit, you must purchase the solar panels with cash or a loan. You will not get the tax credit if your solar panels are installed through a solar lease or a power purchase agreement (PPA) because you are not the owner of the system. You must have taxable income.

What was the 1962 investment tax credit?

The Revenue Act of 1962 included a measure sponsored by the Kennedy administration to encourage capital investment and thus spur economic growth. It provided for an investment tax credit (ITC) which reduced income taxes by a specified percentage of the cost of new equipment and machinery.

What is the seed capital investment tax credit?

EXPLANATION OF THE SEED CAPITAL INVESTMENT TAX CREDIT Section 57-38.5-03 provides for a seed capital investment tax credit. The incentive is available to all income taxpayers and allows for a credit against state income tax liability for qualified investments made in a qualifying business.

Who is eligible for the investment tax credit?

Taxpayers with a qualified facility and energy storage technology placed in service after Dec. 31, 2024 may claim the credit. Elective payment and transfer of credits may be available to certain applicable entities to include tax-exempt organizations and government entities.

What is investment tax credit example?

The Investment Tax Credit applies to any technologies that result in less greenhouse gas emissions than traditional ones available at that time – such as solar panels, wind turbines, and geothermal pumps.

Who qualifies for the investment tax credit?

If a homeowner buys a newly built home with solar and owns the system outright, the homeowner is eligible for the ITC the year that they move into the house.

What makes you eligible for a tax credit?

No more than $31,950 in earned income. For tax year 2022 forward, no earned income is required. You may even have a net loss of as much as $34,602 for tax year 2024 if you otherwise meet the CalEITC requirements. Have a qualifying child under 6 years old at the end of the tax year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is SEED CAPITAL INVESTMENT TAX CREDIT WORKSHEET FOR TAX YEAR 2009?

The SEED Capital Investment Tax Credit Worksheet for Tax Year 2009 is a form used by investors to calculate and claim tax credits for investments made in qualifying seed capital businesses.

Who is required to file SEED CAPITAL INVESTMENT TAX CREDIT WORKSHEET FOR TAX YEAR 2009?

Individuals or entities who made eligible investments in qualifying seed capital businesses during the tax year 2009 and wish to claim the associated tax credit are required to file this worksheet.

How to fill out SEED CAPITAL INVESTMENT TAX CREDIT WORKSHEET FOR TAX YEAR 2009?

To fill out the worksheet, taxpayers should gather information about their eligible investments, including the amount invested, the date of investment, and details about the seed capital business. They should then follow the instructions provided on the form carefully to enter the required information.

What is the purpose of SEED CAPITAL INVESTMENT TAX CREDIT WORKSHEET FOR TAX YEAR 2009?

The purpose of the worksheet is to provide a structured method for calculating the tax credits that eligible investors can claim, thus incentivizing investment in emerging businesses within the seed capital sector.

What information must be reported on SEED CAPITAL INVESTMENT TAX CREDIT WORKSHEET FOR TAX YEAR 2009?

The information that must be reported includes the total amount of qualified investments made, identification details of the seed capital businesses, and any previous credits claimed against the investment.

Fill out your seed capital investment tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Seed Capital Investment Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.