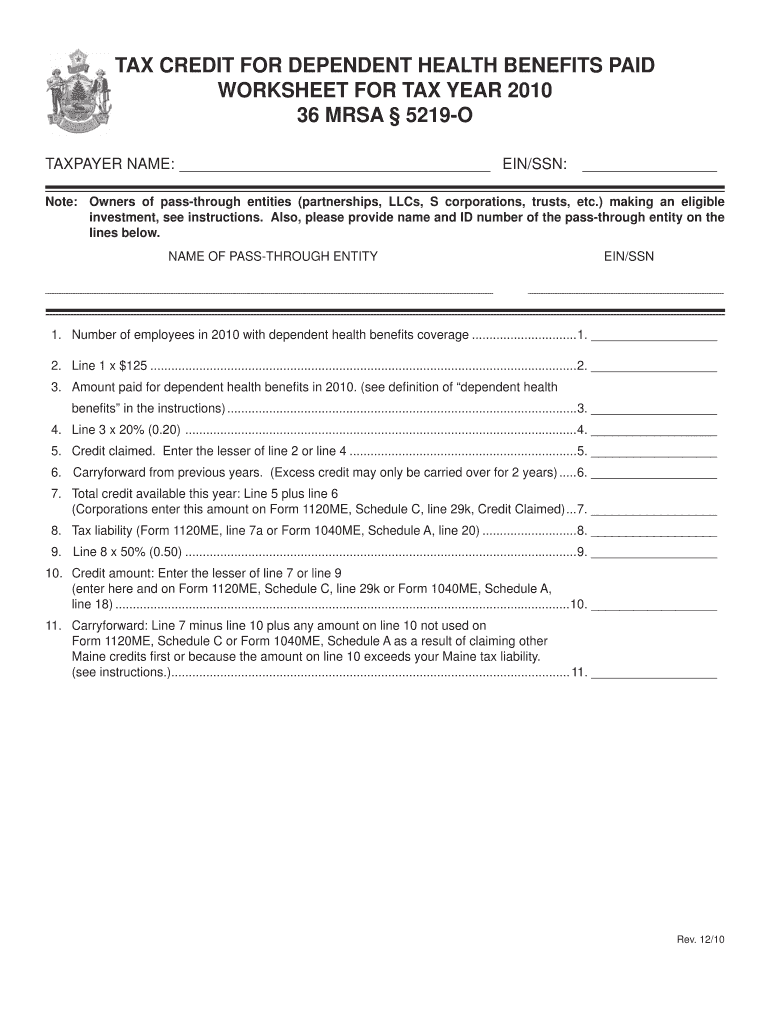

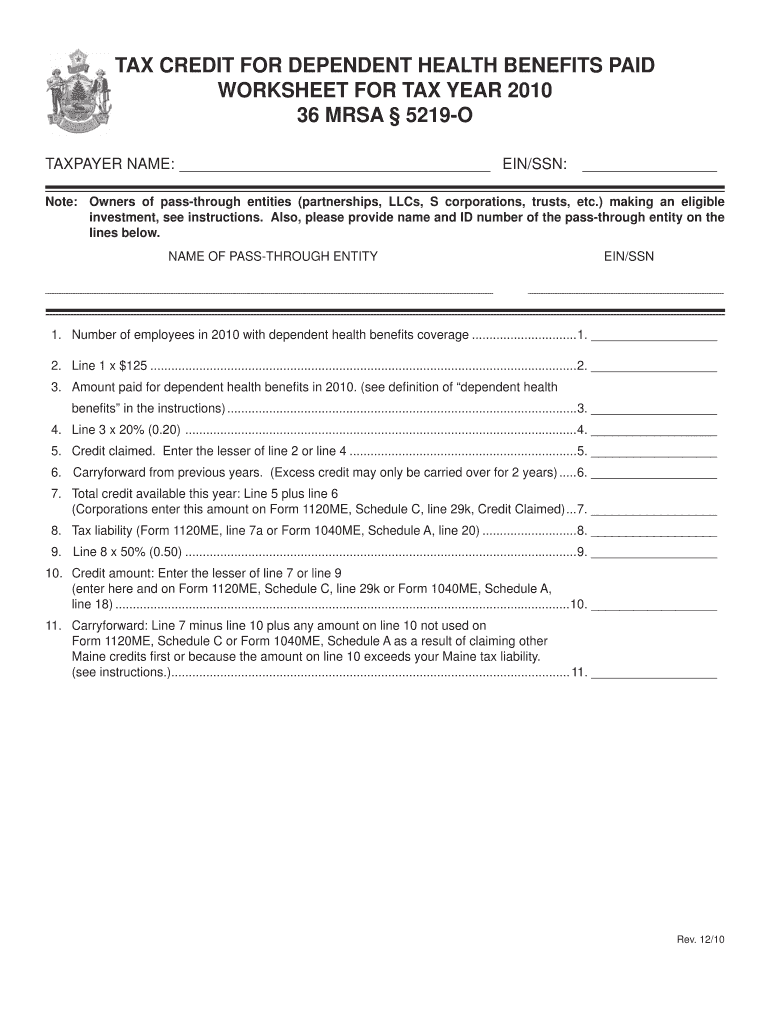

Get the free TAX CREDIT FOR DEPENDENT HEALTH BENEFITS PAID WORKSHEET FOR TAX YEAR 2010

Show details

This worksheet is used to compute the tax credit for employers providing dependent health benefits to eligible low-income employees, detailing calculations and requirements as per Maine tax law.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax credit for dependent

Edit your tax credit for dependent form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax credit for dependent form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax credit for dependent online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit tax credit for dependent. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax credit for dependent

How to fill out TAX CREDIT FOR DEPENDENT HEALTH BENEFITS PAID WORKSHEET FOR TAX YEAR 2010

01

Gather all necessary documents related to dependent health benefits paid for the year 2010.

02

Locate the 'Dependent Health Benefits Paid Worksheet' in tax form instructions for that year.

03

Fill in your personal information at the top of the worksheet, including your name, Social Security number, and filing status.

04

List all dependents for whom you have paid health benefits during the year on the designated lines.

05

Enter the total amount you paid for each dependent's health benefits in the corresponding boxes.

06

Calculate the total health benefits paid for all dependents combined.

07

Follow the worksheet instructions to determine if you qualify for a tax credit based on the amounts entered.

08

Complete any additional calculations as instructed on the worksheet to finalize your credit amount.

09

Review your entries for accuracy before submitting this worksheet with your tax return.

Who needs TAX CREDIT FOR DEPENDENT HEALTH BENEFITS PAID WORKSHEET FOR TAX YEAR 2010?

01

Taxpayers who have paid health benefits for dependents in the year 2010 and wish to claim a credit.

02

Parents or guardians responsible for dependent children or relatives who require health coverage.

03

Individuals seeking to reduce their overall tax liability through eligible health benefit credits.

Fill

form

: Try Risk Free

People Also Ask about

What is the $4000 Child Tax Credit?

For example, a taxpayer with two qualifying children may be eligible for a $4,000 credit. Taxpayers may receive the child tax credit as a reduction in tax liability (the nonrefundable portion of the credit), a refundable credit (the amount of the credit in excess of income tax liability), or a combination of both.

Why am I only getting $2500 Child Tax Credit for 2 kids?

Why am I only getting child tax credit for one child when I have two?? You've entered something wrong. Your child may be too old (over 16). Your income is too high. Your income is too low. You are the custodial parent and the non-custodial parent is claiming the dependent this year.

What is the child tax credit for 2010?

The Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA; P.L. 107-16) made four significant changes to the child tax credit. First, EGTRRA increased the maximum amount of the credit per child in scheduled increments until it reached $1,000 per child in 2010.

How to claim $3600 Child Tax Credit?

You can claim the Child Tax Credit by entering your children and other dependents on Form 1040, U.S. Individual Income Tax Return, and attaching a completed Schedule 8812, Credits for Qualifying Children and Other Dependents.

Do you get the Child Tax Credit at 17 or 18?

The child tax credit provides a credit of up to $2,000 per child under age 17. If the credit exceeds taxes owed, families may receive up to $1,700 per child as a refund. Other dependents—including children ages 17–18 and full-time college students ages 19–23—can be claimed for a nonrefundable credit of up to $500 each.

Who qualifies for dependent tax credit?

Qualifying child Age: Be under age 19 or under 24 if a full-time student, or any age if permanently and totally disabled. Residency: Live with you for more than half the year, with some exceptions. Support: Get more than half their financial support from you.

Why am I only getting $2500 child tax credit for 2 kids?

Why am I only getting child tax credit for one child when I have two?? You've entered something wrong. Your child may be too old (over 16). Your income is too high. Your income is too low. You are the custodial parent and the non-custodial parent is claiming the dependent this year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is TAX CREDIT FOR DEPENDENT HEALTH BENEFITS PAID WORKSHEET FOR TAX YEAR 2010?

The TAX CREDIT FOR DEPENDENT HEALTH BENEFITS PAID WORKSHEET FOR TAX YEAR 2010 is a form used by taxpayers to calculate and claim the credit for expenses related to health benefits provided for dependents, which can help reduce overall tax liability.

Who is required to file TAX CREDIT FOR DEPENDENT HEALTH BENEFITS PAID WORKSHEET FOR TAX YEAR 2010?

Taxpayers who have paid for health benefits for their dependents during the tax year 2010 and wish to claim a tax credit for those expenses are required to file the worksheet.

How to fill out TAX CREDIT FOR DEPENDENT HEALTH BENEFITS PAID WORKSHEET FOR TAX YEAR 2010?

To fill out the worksheet, taxpayers need to gather information about their dependent health benefit expenses, enter the total amounts paid, and follow the instructions on the worksheet to calculate the eligible credit based on those expenses.

What is the purpose of TAX CREDIT FOR DEPENDENT HEALTH BENEFITS PAID WORKSHEET FOR TAX YEAR 2010?

The purpose of the worksheet is to provide a structured way for taxpayers to compute the tax credit for health benefits provided to dependents, thereby providing potential tax relief.

What information must be reported on TAX CREDIT FOR DEPENDENT HEALTH BENEFITS PAID WORKSHEET FOR TAX YEAR 2010?

Taxpayers must report the total amount of health benefits paid for qualifying dependents, any amounts reimbursed, and relevant personal information such as the taxpayer and dependent details on the worksheet.

Fill out your tax credit for dependent online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Credit For Dependent is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.