Get the free MAINE ESTIMATED MONTHLY RETURN FOR FIRE INVESTIGATION AND PREVENTION TAX

Show details

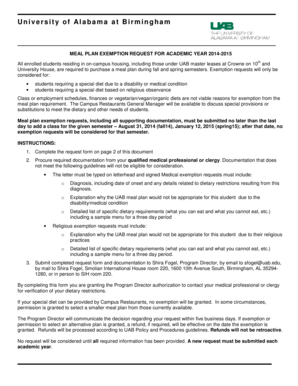

FORM INS-2 MAINE ESTIMATED MONTHLY RETURN FOR FIRE INVESTIGATION AND PREVENTION TAX January 2012 1231000 Due 1/31/2012 Company MRS Fire Tax Account Number - Address Signature Estimated Payment see instructions below Name/Title PAYMENT MUST ACCOMPANY RETURN Telephone Must be signed by President Treasurer Secretary Chief Accounting Of cer or Attorney-in-Fact of a Reciprocal Insurer.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign maine estimated monthly return

Edit your maine estimated monthly return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your maine estimated monthly return form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit maine estimated monthly return online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit maine estimated monthly return. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out maine estimated monthly return

How to fill out MAINE ESTIMATED MONTHLY RETURN FOR FIRE INVESTIGATION AND PREVENTION TAX

01

Obtain the MAINE ESTIMATED MONTHLY RETURN FOR FIRE INVESTIGATION AND PREVENTION TAX form from the Maine government website or appropriate office.

02

Fill in your business information at the top of the form, including your name, address, and tax identification number.

03

Determine the total taxable revenue for the reporting month from your business operations.

04

Calculate the fire investigation and prevention tax due based on the applicable rate for your total taxable revenue.

05

Enter the calculated tax amount on the form.

06

Review your calculations for accuracy.

07

Sign and date the form to certify that the information provided is correct.

08

Submit the completed form to the appropriate tax authority by the specified deadline.

Who needs MAINE ESTIMATED MONTHLY RETURN FOR FIRE INVESTIGATION AND PREVENTION TAX?

01

Businesses in Maine that are required to collect fire investigation and prevention taxes.

02

Establishments that are engaged in activities subject to this specific tax requirement.

Fill

form

: Try Risk Free

People Also Ask about

What are surplus lines fees?

Appendix A StateStatutory Citation to Insurance CodeTax Rate Applied California §1775.5 §1775.1(a) 3% (+ stamping fee of 0.18%, effective Jan. 1, 2023) (monthly or annual based on prior year tax liability). Colorado §10-5-111 3% Connecticut §38(a)-743 4% (quarterly) Delaware §1925 3%101 more rows

What is the fire investigation prevention tax in Maine?

Every fire insurance company or association that does business or collects premiums or assessments in Maine must pay a fire premiums tax equal to 1.4% of the gross direct premiums for fire risks written in the State, less the amount of all direct return premiums and all dividends paid to policyholders on direct fire

What is the penalty for filing sales tax late in Maine?

If a return is filed after the due date, a late filing penalty is charged. The penalty is $25 or 10% of the tax due, whichever is greater.

What is the tax rate for long term capital gains in Maine?

What Is The Maine Capital Gains Tax? Taxable Income (Single Filers)Taxable Income (Married Filing Jointly)Tax Rate on This Income $0 to $26,800 $0 to $53,600 5.80% $26,800 to $63,450 $53,600 to $126,900 6.75% $63,450 or more $126,900 or more 7.15% Feb 19, 2025

What is the surplus lines tax rate in Maine?

Surplus lines tax: 3% (applied retroactively to January 1, 2023) of difference between gross premiums and return premiums (within 45 days of end of each quarter and annually), payable by broker. Bureau of Insurance Bulletin 378 discusses the NRRA implementation in Maine.

What is taxed at 8% in Maine?

The sales tax rate in Maine is currently 5.5% for tangible personal property and taxable services. However, a few transactions are subject to their own unique sales tax rates: 8% on the sale of prepared food and alcoholic drinks sold in certain establishments. 9% on specified living quarter rentals.

What is the REW tax in Maine?

The buyer of the property will withhold and remit the Real Estate Withholding money to Maine Revenue Services using form REW-1. The amount to be withheld is equal to 2.5% of the sale price.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is MAINE ESTIMATED MONTHLY RETURN FOR FIRE INVESTIGATION AND PREVENTION TAX?

The MAINE ESTIMATED MONTHLY RETURN FOR FIRE INVESTIGATION AND PREVENTION TAX is a tax form that businesses must complete to report and remit the fire investigation and prevention tax collected from sales.

Who is required to file MAINE ESTIMATED MONTHLY RETURN FOR FIRE INVESTIGATION AND PREVENTION TAX?

Any business in Maine that is required to collect the fire investigation and prevention tax from customers must file this monthly return.

How to fill out MAINE ESTIMATED MONTHLY RETURN FOR FIRE INVESTIGATION AND PREVENTION TAX?

To fill out the form, businesses must accurately report the total sales on which the tax was collected, calculate the total tax due, and provide any required identification and signature information.

What is the purpose of MAINE ESTIMATED MONTHLY RETURN FOR FIRE INVESTIGATION AND PREVENTION TAX?

The purpose of the return is to ensure that the collected fire investigation and prevention tax is reported properly and remitted to the state for funding fire prevention and investigation services.

What information must be reported on MAINE ESTIMATED MONTHLY RETURN FOR FIRE INVESTIGATION AND PREVENTION TAX?

The return must report total gross sales, the amount of tax collected, the business identification number, the reporting period, and any other relevant details as required by the state.

Fill out your maine estimated monthly return online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Maine Estimated Monthly Return is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.