Get the free Sales Tax Exemption Application for Commercial Agriculture

Show details

This document is used to apply for a sales tax exemption card for purchasing depreciable machinery, equipment, repair parts, and electricity used in commercial agricultural production.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sales tax exemption application

Edit your sales tax exemption application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sales tax exemption application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

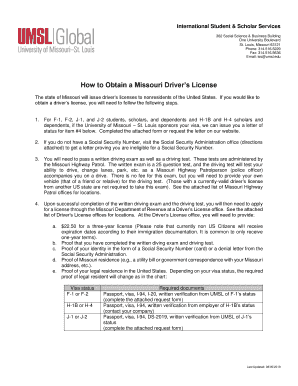

How to edit sales tax exemption application online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit sales tax exemption application. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sales tax exemption application

How to fill out Sales Tax Exemption Application for Commercial Agriculture

01

Obtain the Sales Tax Exemption Application form from your local tax authority or their website.

02

Fill in your business name, address, and contact information in the designated fields.

03

Provide your agricultural business license number or identification as required.

04

Specify the type of agricultural products or services you provide.

05

List any specific tax-exempt purchases you plan to make related to your agricultural operations.

06

Attach any required documentation, such as proof of agricultural status or previous tax-exempt purchases.

07

Review the application for accuracy and completeness.

08

Sign and date the application form.

09

Submit the completed application to your local tax authority, either online or through mail.

Who needs Sales Tax Exemption Application for Commercial Agriculture?

01

Farmers and ranchers engaged in producing agricultural products.

02

Businesses involved in processing or selling agricultural goods.

03

Non-profit organizations supporting agricultural activities.

04

Landowners leasing property for agricultural purposes.

Fill

form

: Try Risk Free

People Also Ask about

How many acres do you need to be considered a farm for taxes?

Another question that frequently comes up in this discussion is “how big does my farm have to be to be considered a farm?” Since property taxes are handled at the local level rather than the federal level, the answer will vary from state to state. Generally speaking, there is no minimum acreage for farm tax exemption.

How do you get an agricultural exemption?

Qualifications for agricultural tax exemptions vary from state to state, too. Some states base eligibility on the size of the property, while others set a minimum dollar amount for agricultural sales of goods produced on the property. Many use a combination of gross sales and acreage requirements.

How to apply for agricultural tax exemption?

0:25 1:27 Such as a farm plan income statements and proof of ownership. Four wait for approval the process canMoreSuch as a farm plan income statements and proof of ownership. Four wait for approval the process can take several weeks but once approved you'll start saving on taxes.

How long does it take to get an ag exemption in Texas?

Requirements: The farming operation must either 1) own or encompass at least 7 acres and gross at least $50,000 annually or 2) own more than 7 acres and gross at least $10,000 or more annually. Woodland products can account for up to $2,000 of the $10,000 minimum requirement.

What is the Ohio agriculture exemption?

Under Ohio law, the agricultural sales tax exemption applies to most items that will be directly used, consumed or incorporated in the production of agricultural products for sale. Because of the diverse nature of products and their uses, there is no comprehensive list of items that qualify for the exemption.

Who qualifies for farm tax exemption in NY?

Requirements: The farming operation must either 1) own or encompass at least 7 acres and gross at least $50,000 annually or 2) own more than 7 acres and gross at least $10,000 or more annually. Woodland products can account for up to $2,000 of the $10,000 minimum requirement.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Sales Tax Exemption Application for Commercial Agriculture?

The Sales Tax Exemption Application for Commercial Agriculture is a form used by agricultural producers to apply for exemption from sales tax on certain purchases related to their agricultural operations, such as seeds, fertilizers, and equipment.

Who is required to file Sales Tax Exemption Application for Commercial Agriculture?

Individuals or businesses engaged in commercial agricultural production, such as farmers and ranchers, are typically required to file the Sales Tax Exemption Application for Commercial Agriculture.

How to fill out Sales Tax Exemption Application for Commercial Agriculture?

To fill out the Sales Tax Exemption Application for Commercial Agriculture, applicants need to provide their business information, describe the agricultural activities, list exempt purchases, and sign the application according to the guidelines provided by the state tax authority.

What is the purpose of Sales Tax Exemption Application for Commercial Agriculture?

The purpose of the Sales Tax Exemption Application for Commercial Agriculture is to enable qualifying agricultural producers to obtain exemptions from sales tax, reducing their operational costs and promoting agricultural production.

What information must be reported on Sales Tax Exemption Application for Commercial Agriculture?

The application must report information such as the applicant's name and address, type of agricultural activity, a description of the materials or equipment to be purchased, and any relevant identification numbers or certifications related to agriculture.

Fill out your sales tax exemption application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sales Tax Exemption Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.