Get the free APPLICATION FOR SALE/USE TAX EXEMPTION CERTIFICATE FOR AN INCORPORATED NONPROFIT ANI...

Show details

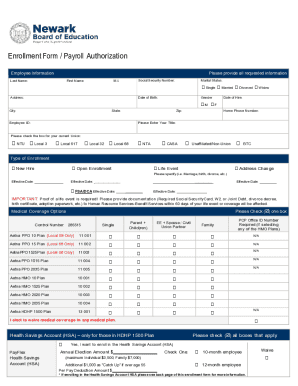

This document serves as an application for a sales/use tax exemption certificate specifically for incorporated nonprofit animal shelters. It requires verification of nonprofit status and may necessitate

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for saleuse tax

Edit your application for saleuse tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for saleuse tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application for saleuse tax online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit application for saleuse tax. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for saleuse tax

How to fill out APPLICATION FOR SALE/USE TAX EXEMPTION CERTIFICATE FOR AN INCORPORATED NONPROFIT ANIMAL SHELTERS

01

Obtain the APPLICATION FOR SALE/USE TAX EXEMPTION CERTIFICATE form from the appropriate tax authority or their website.

02

Fill in the organization’s name and address at the top of the application.

03

Indicate the type of organization, specifying that it is an incorporated nonprofit animal shelter.

04

Provide the organization's tax identification number (EIN).

05

Describe the purpose of the organization briefly and how it fits into the nonprofit category.

06

Clearly list the items or services for which the tax exemption is requested.

07

Sign and date the application, ensuring that the authorized representative of the organization has signed.

08

Submit the completed application to the appropriate state or local tax authority, along with any required documents.

Who needs APPLICATION FOR SALE/USE TAX EXEMPTION CERTIFICATE FOR AN INCORPORATED NONPROFIT ANIMAL SHELTERS?

01

Nonprofit organizations that operate as animal shelters and seek tax exemptions for purchases related to their exempt activities need the APPLICATION FOR SALE/USE TAX EXEMPTION CERTIFICATE.

Fill

form

: Try Risk Free

People Also Ask about

What are the requirements for a 501c3 to be tax-exempt?

Exemption requirements - 501(c)(3) organizations To be tax-exempt under section 501(c)(3) of the Internal Revenue Code, an organization must be organized and operated exclusively for exempt purposes set forth in section 501(c)(3), and none of its earnings may inure to any private shareholder or individual.

How to get a Texas sales and use tax resale certificate?

Step-by-Step Guide to Obtaining a Texas Resale Certificate Step 1: Obtain a Texas Sales and Use Tax Permit. Step 2: Download the Resale Certificate Form. Step 3: Complete the Form with Accurate Business Information. Step 4: Sign and Date the Certificate. Step 5: Present the Completed Certificate to Your Supplier.

What qualifies for sales tax exemption in Texas?

Some customers are exempt from paying sales tax under Texas law. Examples include government agencies, some nonprofit organizations, and merchants purchasing goods for resale. Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction.

How much does a Texas resale certificate cost?

Resale certificates are free in Texas.

How to apply for a Texas sales and use tax resale certificate?

HOW TO GET A RESALE CERTIFICATE IN TEXAS ✔ STEP 1 : Complete the Texas Sales Tax Form. ✔ STEP 2 : Fill out the Texas resale certificate form. ✔ STEP 3 : Present a copy of this certificate to suppliers when you wish to purchase items for resale.

What is the difference between tax-exempt and 501c3?

501(c)(3) means a nonprofit organization that has been recognized by the IRS as being tax-exempt by virtue of its charitable programs. Tax-exemption is the result of a nonprofit organization being recognized by the IRS as being organized for any purpose allowable under 501(c)(3) – 501(c)(27).

Is a sales tax permit the same as a resale permit Texas?

While resale certificates require the purchaser's Texas taxpayer number, the customer's sales tax permit number or a copy of the customer's permit is not a substitute for a resale certificate and does not relieve a seller's responsibility for collecting sales tax.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is APPLICATION FOR SALE/USE TAX EXEMPTION CERTIFICATE FOR AN INCORPORATED NONPROFIT ANIMAL SHELTERS?

The APPLICATION FOR SALE/USE TAX EXEMPTION CERTIFICATE FOR AN INCORPORATED NONPROFIT ANIMAL SHELTERS is a legal document that allows nonprofit animal shelters that are incorporated to be exempt from paying sales and use taxes on purchases made for their operations.

Who is required to file APPLICATION FOR SALE/USE TAX EXEMPTION CERTIFICATE FOR AN INCORPORATED NONPROFIT ANIMAL SHELTERS?

Incorporated nonprofit animal shelters that seek to obtain exemption from sales and use tax must file this application. Specifically, organizations that are registered as 501(c)(3) public charities are typically required to file.

How to fill out APPLICATION FOR SALE/USE TAX EXEMPTION CERTIFICATE FOR AN INCORPORATED NONPROFIT ANIMAL SHELTERS?

To fill out the application, provide the organization's name, address, tax identification number, and details about the nature of the nonprofit activities. Additionally, include information about the items for which the exemption is being sought and certify that the purchases are for the exempt purpose.

What is the purpose of APPLICATION FOR SALE/USE TAX EXEMPTION CERTIFICATE FOR AN INCORPORATED NONPROFIT ANIMAL SHELTERS?

The purpose of the application is to enable incorporated nonprofit animal shelters to minimize their operational costs by being exempt from sales and use taxes on purchases related to their charitable activities.

What information must be reported on APPLICATION FOR SALE/USE TAX EXEMPTION CERTIFICATE FOR AN INCORPORATED NONPROFIT ANIMAL SHELTERS?

The application must report the organization's name, address, federal tax ID number, and a description of the nonprofit activities. It should also specify the types of purchases being made and confirm that they are for exempt purposes.

Fill out your application for saleuse tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Saleuse Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.