Get the free Certification State Motor Vehicle Commuting Charge - dhmh maryland

Show details

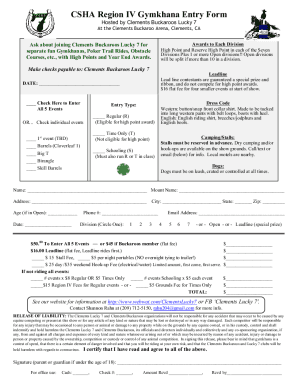

This document certifies the vehicle assignment and commute charge status for state-owned vehicles used by employees. It includes exemption requests based on the employee's duties and vehicle utilization.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign certification state motor vehicle

Edit your certification state motor vehicle form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your certification state motor vehicle form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing certification state motor vehicle online

To use the services of a skilled PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit certification state motor vehicle. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out certification state motor vehicle

How to fill out Certification State Motor Vehicle Commuting Charge

01

Gather necessary information about your commuting distances and routes.

02

Obtain the Certification State Motor Vehicle Commuting Charge form from the appropriate state agency or website.

03

Fill out your personal details such as name, address, and vehicle information.

04

Record your daily commuting miles, including start and end locations.

05

Calculate the total commuting miles for the specified period.

06

Provide any additional required documentation, such as proof of vehicle usage.

07

Review the completed form for accuracy before submission.

08

Submit the form according to the instructions provided. Ensure to keep a copy for your records.

Who needs Certification State Motor Vehicle Commuting Charge?

01

Individuals who regularly commute using a personal vehicle for work purposes.

02

Employees seeking reimbursement or tax deductions for commuting expenses.

03

Employers who need to certify their employees' commuting charges for tax purposes.

Fill

form

: Try Risk Free

People Also Ask about

Who requires the vehicle safety certification label?

Manufacturers of all motor vehicles manufactured for sale in the United States are required by statute to certify their vehicles' compliance with all applicable Federal motor vehicle safety standards.

What is NHTSA certification?

A certification label meeting the requirements of 49 CFR Part 567 that, among other things, identifies the vehicle's manufacturer (i.e., the actual assembler of the vehicle), states the vehicle's date of manufacture (month and year), and contains the following statement: “This vehicle conforms to all applicable Federal

What is considered personal use of a company vehicle?

Personal use of a company car (PUCC) is when an employee uses a company vehicle for personal reasons. Driving a company vehicle for personal use is a taxable noncash fringe benefit (aka benefit you provide in addition to wages).

What are the IRS rules for commuting?

ing to the IRS, any expenses related to commuting between your home and regular workplace are generally considered personal and nondeductible. Commuting is an everyday activity that is not considered a business expense.

What is a certificate of compliance for a vehicle?

0:30 2:01 Exactly simply put a certificate of compliance is a document that shows your vehicle has met theMoreExactly simply put a certificate of compliance is a document that shows your vehicle has met the required safety and emission standards. It's like a report card for your car. But instead of grades.

What is the difference between commute and personal use?

The general rule is that if you use your car every day to get to work, you are commuting, but if you only use it occasionally, you are only using your vehicle for pleasure. Insurance companies usually classify your driving "for pleasure" if you drive less than 7500 miles a year.

Is commuting considered personal use?

Examples of driving a company vehicle for personal use include: Your employee's commute between home and work, if it is on a regular basis. Trips unrelated to your organization's purpose, work, trade, etc. Use on a vacation or on the weekend.

What is the $1.50 commuting rule?

Using the Commuting Rule, the value of a vehicle provided to an employee for commuting use is calculated by multiplying each one-way commute by $1.50. This amount is included in the employee's wages or reimbursed by the employee.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Certification State Motor Vehicle Commuting Charge?

The Certification State Motor Vehicle Commuting Charge is a form or declaration that individuals or entities must fill out to report certain commuting-related charges associated with the use of state motor vehicles.

Who is required to file Certification State Motor Vehicle Commuting Charge?

Typically, state employees, contractors, or any individuals who use state motor vehicles for commuting purposes are required to file the Certification State Motor Vehicle Commuting Charge.

How to fill out Certification State Motor Vehicle Commuting Charge?

To fill out the Certification State Motor Vehicle Commuting Charge, individuals should gather the necessary commuting information, accurately report the distances traveled and associated costs, and provide required signatures and dates as specified on the form.

What is the purpose of Certification State Motor Vehicle Commuting Charge?

The purpose of the Certification State Motor Vehicle Commuting Charge is to ensure accountability and transparency regarding the use of state vehicles for commuting, allowing the state to manage transportation resources effectively.

What information must be reported on Certification State Motor Vehicle Commuting Charge?

The information that must be reported includes the distance traveled, purpose of travel, dates of commuting, vehicle details, and any charges incurred during the commuting process.

Fill out your certification state motor vehicle online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Certification State Motor Vehicle is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.