Get the free Informational Guideline Release No. 10-208 - Municipal Tax Amnesty Program

Show details

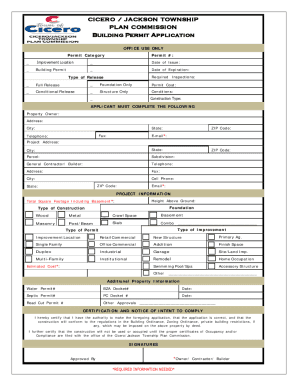

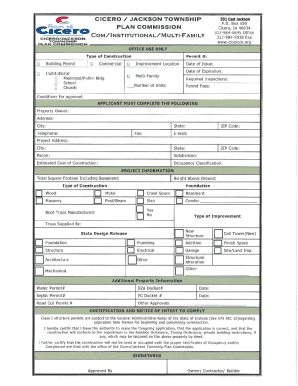

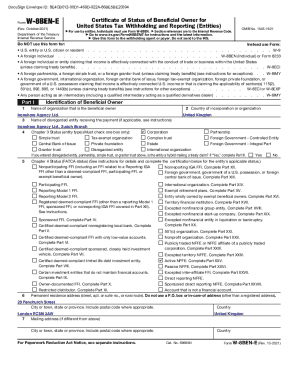

This document outlines the implementation of a temporary tax amnesty program for municipalities, detailing the legal framework, eligibility requirements, and procedural guidelines for local officials

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign informational guideline release no

Edit your informational guideline release no form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your informational guideline release no form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing informational guideline release no online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit informational guideline release no. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out informational guideline release no

How to fill out Informational Guideline Release No. 10-208 - Municipal Tax Amnesty Program

01

Read the Informational Guideline Release No. 10-208 thoroughly to understand the Municipal Tax Amnesty Program.

02

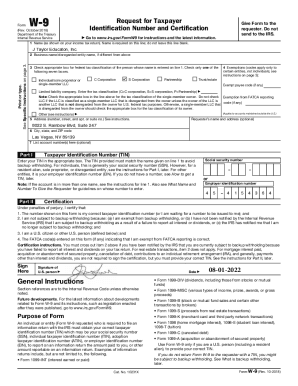

Gather all relevant tax documents and records for the taxes you are seeking amnesty for.

03

Determine if you are eligible for the program based on the criteria provided in the guideline.

04

Complete the required application forms as specified in the guideline.

05

Calculate the amount of tax owed and any applicable penalties that are eligible for forgiveness.

06

Submit the completed application and any supporting documentation to the designated authority by the deadline.

07

Wait for confirmation of your application and any further instructions from the tax authority.

Who needs Informational Guideline Release No. 10-208 - Municipal Tax Amnesty Program?

01

Taxpayers who have outstanding municipal tax liabilities.

02

Individuals or businesses that have been notified of tax assessments and penalties.

03

Residents seeking to resolve their tax issues without incurring additional penalties or interest.

04

Anyone eligible wishing to take advantage of the tax amnesty offered under the program.

Fill

form

: Try Risk Free

People Also Ask about

When was the last tax amnesty?

The 2005 amnesty, with the exception of taxpayers that had engaged in abusive tax shelters or were already under criminal investigation, allowed taxpayers an opportunity to pay any unpaid balances from tax years prior to 2003 in exchange for forgiveness of penalties, fees, and criminal prosecution.

What is the Massachusetts tax amnesty program?

The amnesty program will allow non-filers and taxpayers with outstanding tax liabilities to catch up on back taxes and save on penalties.

Does the IRS offer tax amnesty?

IRS amnesty programs are initiatives designed by the Internal Revenue Service (IRS) to encourage taxpayers to disclose and correct previously unreported income or tax errors voluntarily. These programs offer significant benefits, including reduced penalties and avoidance of criminal prosecution.

What is the Massachusetts tax amnesty program?

Under the amnesty program, eligible non-filers can benefit from a limited three-year look-back period. Qualifying non-filers only need to submit returns which are due between January 1, 2022 and December 31, 2024.

What is the tax penalty amnesty program?

Under this program, a late filer can just come clean with the IRS with possibly no penalties by filing tax returns, with all required information returns, for the prior three years and any delinquent Foreign Bank and Financial Account Report (FBAR) for the prior six years.

What is the tax amnesty payment?

The tax amnesty covers penalties, surcharges and interests from all unpaid real property taxes, including the Special Education Fund, idle land tax and other special levy taxes, prior to the effectivity of RA No. 12001 on 5 July 2024.

What is the tax amnesty payment?

The tax amnesty covers penalties, surcharges and interests from all unpaid real property taxes, including the Special Education Fund, idle land tax and other special levy taxes, prior to the effectivity of RA No. 12001 on 5 July 2024.

When was the last tax reform bill passed?

Enacted on December 22, 2017, the TCJA was the largest piece of tax legislation since the Tax Reform Act of 1986.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

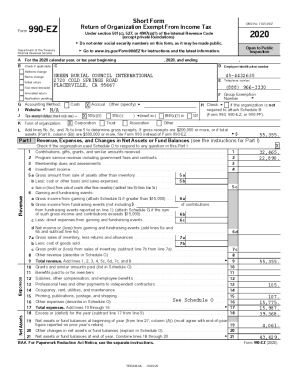

What is Informational Guideline Release No. 10-208 - Municipal Tax Amnesty Program?

Informational Guideline Release No. 10-208 - Municipal Tax Amnesty Program is a program designed to encourage municipalities to provide tax amnesty to individuals and businesses that owe back taxes, allowing them to settle their tax debts without penalties or interest for a limited time.

Who is required to file Informational Guideline Release No. 10-208 - Municipal Tax Amnesty Program?

Municipalities that wish to participate in the tax amnesty program and offer this opportunity to taxpayers are required to file the Informational Guideline Release No. 10-208.

How to fill out Informational Guideline Release No. 10-208 - Municipal Tax Amnesty Program?

To fill out the Informational Guideline Release No. 10-208, municipalities need to provide details about the tax amnesty program, including eligibility criteria, the timeframe of the amnesty, and any necessary forms or applications that taxpayers must complete.

What is the purpose of Informational Guideline Release No. 10-208 - Municipal Tax Amnesty Program?

The purpose of the Informational Guideline Release No. 10-208 is to provide guidance to municipalities on how to implement a tax amnesty program that allows taxpayers to pay outstanding tax liabilities without facing penalties, thereby increasing tax compliance and revenue collection.

What information must be reported on Informational Guideline Release No. 10-208 - Municipal Tax Amnesty Program?

The information that must be reported includes the specific taxes eligible for amnesty, the time period during which the amnesty is available, the conditions for eligibility, and the process by which taxpayers can apply for the amnesty program.

Fill out your informational guideline release no online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Informational Guideline Release No is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.