Get the free Massachusetts Department of Revenue Notice of Intent to Levy

Show details

This document is a formal notice from the Massachusetts Department of Revenue indicating that the taxpayer has failed to pay the total amount due and warns of potential collection actions if payment

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign massachusetts department of revenue

Edit your massachusetts department of revenue form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your massachusetts department of revenue form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit massachusetts department of revenue online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit massachusetts department of revenue. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

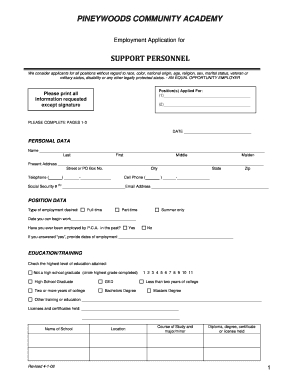

How to fill out massachusetts department of revenue

How to fill out Massachusetts Department of Revenue Notice of Intent to Levy

01

Obtain the Massachusetts Department of Revenue Notice of Intent to Levy form.

02

Fill in your name, address, and Taxpayer Identification Number at the top of the form.

03

Specify the tax type and period for which the levy is being issued.

04

Provide the necessary information regarding the property or assets that are subject to levy.

05

Indicate how you wish to handle any potential objections or appeals.

06

Sign and date the form to certify that the information provided is accurate.

07

Submit the completed form to the appropriate Department of Revenue office.

Who needs Massachusetts Department of Revenue Notice of Intent to Levy?

01

Individuals or businesses who have unpaid taxes owed to the Massachusetts Department of Revenue may need to use the Notice of Intent to Levy.

02

Taxpayers who have received prior notice of indebtedness and have not resolved the debt may be subject to this notice.

03

Tax professionals assisting clients with tax issues related to levies may also need to understand this process.

Fill

form

: Try Risk Free

People Also Ask about

What is a notice of intent from the IRS?

Notice of Intent to Levy and Notice of Your Right to a Hearing is mailed to taxpayers to notify them of their unpaid taxes and that the IRS intends to levy to collect the amount owed if it is not paid within 30 days. This letter is required by IRC § 6331 before the IRS issues a levy, unless collection is in jeopardy.

What does it mean if my refund was offset?

If you owe money to a federal or state agency, the federal government may use part or all of your federal tax refund to repay the debt. This is called a tax refund offset. If your tax refund is lower than you calculated, it may be due to a tax refund offset for an unpaid debt such as child support.

What is a notice of Massachusetts tax lien?

The Notice of Massachusetts Tax Lien indicates the tax type, the assessment date and the amount owed, including any statutory additions to tax, i.e., accrued interest and penalties. The amount owed is current as of the date of the lien notice.

What is the maximum property tax increase in Massachusetts?

A tax rate cannot be higher than $25.00 per $1,000 of valuation. The property tax levy limit cannot be increased more than 2 1/2% over the prior years' levy limit, with certain exceptions for new growth: or through overrides and exclusions as adopted by the voters.

What is the levy limit in Massachusetts?

A levy limit is a restriction on the amount of property taxes a community can levy. Proposition 21⁄2 established two types of levy limits: First, a community cannot levy more than 2.5 percent of the total full and fair cash value of all taxable real and per- sonal property in the community.

What is the tax levy in Massachusetts?

The property tax levy is the revenue a community can raise through real and personal property taxes. In Massachusetts, municipal revenues support local spending for schools, public safety and other public services, approved at Town Meeting.

What is a notice of intent to offset federal government payments Massachusetts?

If you receive a Notice of Intent to Offset, it means you have a federal or governmental debt – such as back taxes, unpaid child support, or delinquent student loans – which the IRS is going to use your tax refund to settle.

What does "offset payment" mean?

Treasury may withhold money to satisfy an overdue (delinquent) debt. The official term for withholding money from a payment is “offset” or, for a federal tax debt, “levy.” The program that offsets or levies payments for overdue debts is the Treasury Offset Program (TOP).

What does intent to offset federal payments mean?

What Is a Notice of Intent to Offset? The “Notice of Intent to Offset” is telling you that you have taxes owed and the government is going to seize part or all of your federal payments. The IRS commonly offsets Federal tax refunds, but they can also take other types of federal payments as well.

What is the levy ceiling in Massachusetts?

Under Proposition 2 ½, there are certain restrictions on the amount of property taxes that a municipality can levy: the levy cannot exceed 2.5% of the assessed value (AV) of the community. This is known as the levy ceiling.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Massachusetts Department of Revenue Notice of Intent to Levy?

The Massachusetts Department of Revenue Notice of Intent to Levy is a formal notification issued by the Department indicating its intention to collect outstanding taxes by seizing property or assets.

Who is required to file Massachusetts Department of Revenue Notice of Intent to Levy?

Taxpayers who owe back taxes and have received a notice from the Massachusetts Department of Revenue about unpaid balances are required to file this notice.

How to fill out Massachusetts Department of Revenue Notice of Intent to Levy?

To fill out the Notice of Intent to Levy, taxpayers must provide required personal information, including their name, address, taxpayer identification number, and details about the tax owed and any property subject to levy.

What is the purpose of Massachusetts Department of Revenue Notice of Intent to Levy?

The purpose of the Notice of Intent to Levy is to inform the taxpayer of the Department's intention to collect outstanding tax debts through the seizure of assets, and to give them an opportunity to resolve the debt prior to enforcement.

What information must be reported on Massachusetts Department of Revenue Notice of Intent to Levy?

The information that must be reported includes the taxpayer's name, address, identification number, details of the tax liability, and a description of the assets subject to levy.

Fill out your massachusetts department of revenue online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Massachusetts Department Of Revenue is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.