Get the free Cigarette Inventory Tax Return

Show details

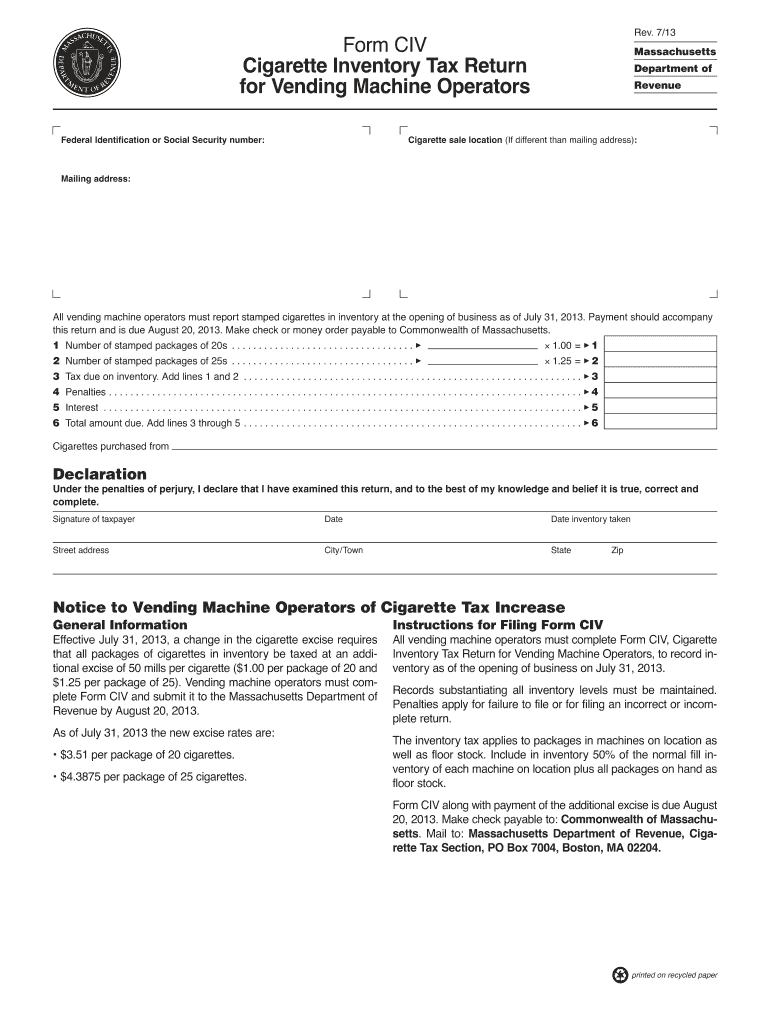

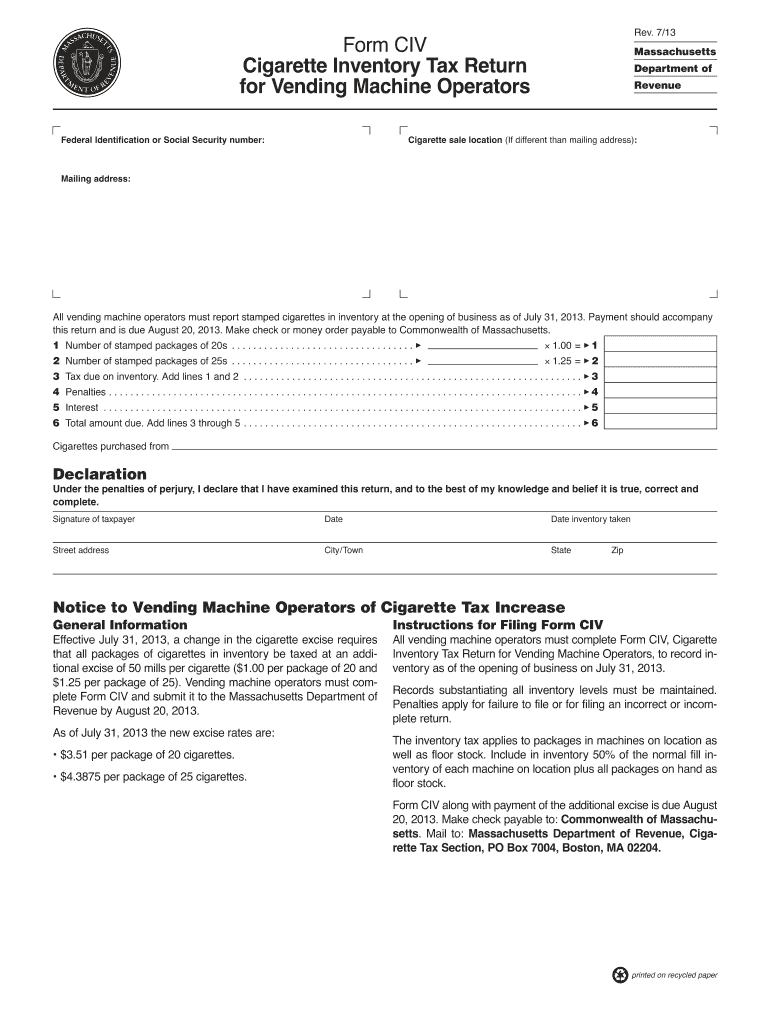

This form is used by vending machine operators to report the inventory of stamped cigarettes and pay the corresponding excise tax based on new rates effective from July 31, 2013.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cigarette inventory tax return

Edit your cigarette inventory tax return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cigarette inventory tax return form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing cigarette inventory tax return online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit cigarette inventory tax return. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cigarette inventory tax return

How to fill out Cigarette Inventory Tax Return

01

Obtain the Cigarette Inventory Tax Return form from your local tax authority or their website.

02

Enter your business information, including name, address, and tax identification number.

03

List the total number of cigarette packages in your inventory at the beginning of the reporting period.

04

Include any additional packages acquired during the reporting period.

05

Calculate the total tax owed by multiplying the number of cigarette packages by the applicable tax rate.

06

Report any credits or deductions, if applicable.

07

Sign and date the form to certify that the information is accurate.

08

Submit the completed form along with any payment due to the appropriate tax authority by the deadline.

Who needs Cigarette Inventory Tax Return?

01

Any business or individual that sells, distributes, or stores cigarettes and is subject to cigarette tax regulations.

02

Retailers of cigarettes needing to report their inventory levels for tax purposes.

03

Wholesalers and distributors who must account for the cigarettes they handle.

Fill

form

: Try Risk Free

People Also Ask about

What is the markup on a pack of cigarettes?

In 2023, revenues from tobacco tax in the United States amounted to 10.3 billion U.S. dollars. The forecast predicts a decrease in tobacco tax revenues down to 8.06 billion U.S. dollars in 2029. Total U.S. government revenue was around 4.4 trillion U.S. dollars in 2023.

How much is the federal tax on cigarettes?

Federal tobacco taxes were last increased in 2009, with the cigarette tax being increased by $0.62 per pack. The current federal cigarette tax is $1.01 per pack. The American Lung Association supports increasing the federal cigarette tax and making federal tax rates on other tobacco products equal to the cigarette tax.

What is the extra tax on cigarettes called?

Excise taxes are usually levied on the sale and production for sale of tobacco products, resulting in the price offered to buyers being higher relative to the cost of other goods and services.

What type of tax is imposed on cigarettes?

Excise taxes are usually levied on the sale and production for sale of tobacco products, resulting in the price offered to buyers being higher relative to the cost of other goods and services.

What is the federal tax on a pack of cigarettes?

The current federal cigarette tax is $1.01 per pack. The American Lung Association supports increasing the federal cigarette tax and making federal tax rates on other tobacco products equal to the cigarette tax.

Which state has the highest tax on cigarettes?

Stamping Agent Three states apply markups at this level, ranging from 0.875%- 1.7% (1.15% average). Wholesaler/Distributor Twenty-six states apply markups at this level, ranging from 2%-6% (3.67% average). Retailer/Dealer Twenty-four states apply markups at this level, ranging from 4%-25% (8.02% average).

What is the markup on cigarettes?

The two most commonly regulated distribution levels are wholesalers and retailers. Wholesalers (24 states) While two states use minimum pricing to regulate price at the wholesale level, 22 states use markups, which range from 2%- 5.25%, and average 3.39%.

How much is federal tax on a pack of cigarettes?

The current federal cigarette tax is $1.01 per pack. The American Lung Association supports increasing the federal cigarette tax and making federal tax rates on other tobacco products equal to the cigarette tax.

What states have cigarette taxes?

Twelve states (Alaska, Arizona, California, Delaware, Illinois, Maine, Michigan, New Jersey, New Mexico, Oklahoma, Pennsylvania, and Wisconsin) have a cigarette excise tax from $2.000 to $2.999 per pack.

What are the benefits of cigarette tax?

Federal Level: On the federal level, revenue from cigarette and tobacco taxes helps fund programs that support children and adults across the country, including the Children's Health Insurance Program (CHIP). CHIP provides health insurance to many children in the U.S. who would otherwise be uninsured.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Cigarette Inventory Tax Return?

The Cigarette Inventory Tax Return is a form used by businesses to report the amount of cigarettes held in inventory and calculate the applicable taxes owed on those cigarettes.

Who is required to file Cigarette Inventory Tax Return?

Retailers, distributors, and wholesalers of cigarettes are typically required to file the Cigarette Inventory Tax Return to report their cigarette inventory and ensure compliance with tax regulations.

How to fill out Cigarette Inventory Tax Return?

To fill out the Cigarette Inventory Tax Return, businesses must provide details such as the total number of cigarettes in inventory, the tax rate, and calculate the total tax owed. This form should be submitted to the relevant tax authority by the designated deadline.

What is the purpose of Cigarette Inventory Tax Return?

The purpose of the Cigarette Inventory Tax Return is to ensure that businesses accurately report their cigarette inventory and pay the correct amount of taxes on those products, thereby supporting public health funding and compliance with tobacco laws.

What information must be reported on Cigarette Inventory Tax Return?

The information that must be reported on the Cigarette Inventory Tax Return typically includes the business name, address, total number of cigarettes in inventory, applicable tax rates, and any previous taxes paid.

Fill out your cigarette inventory tax return online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cigarette Inventory Tax Return is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.