Get the free Schedule HM Harbor Maintenance Tax Credit

Show details

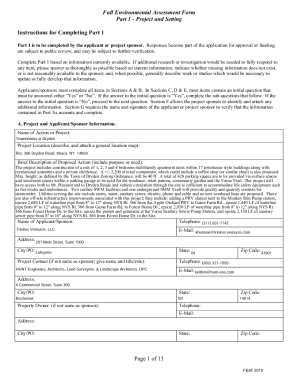

This document serves as a tax credit application for harbor maintenance taxes paid for using Massachusetts ports, detailing qualifications and instructions for claiming the credit.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign schedule hm harbor maintenance

Edit your schedule hm harbor maintenance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your schedule hm harbor maintenance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing schedule hm harbor maintenance online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit schedule hm harbor maintenance. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out schedule hm harbor maintenance

How to fill out Schedule HM Harbor Maintenance Tax Credit

01

Obtain Schedule HM from the IRS website or tax forms office.

02

Gather documentation related to harbor maintenance fees paid.

03

Fill in your name, identification number, and any other required personal information.

04

Report the total amount of harbor maintenance fees paid during the tax year.

05

Complete any applicable sections regarding business and shipping details.

06

Review the filled form for accuracy and completeness.

07

Attach the form to your tax return when filing, if required.

Who needs Schedule HM Harbor Maintenance Tax Credit?

01

Individuals or businesses who have paid harbor maintenance fees.

02

Taxpayers seeking to claim credit for fees paid to maintain U.S. harbors.

03

Shipping companies or operators of vessels operating in U.S. waters.

Fill

form

: Try Risk Free

People Also Ask about

Does Massachusetts have circuit breaker tax credit?

MA residents who are 65 or older by Dec. 31 of the 2024 tax year who meet income eligibility guidelines may be able to receive a maximum of $2,730 through this state-level program. Both homeowners and renters who are MA residents may apply.

What is the safe harbor rule in Massachusetts?

The safe harbor method provides for an estimated use tax amount based on income ranges. Safe harbor reporting minimizes record keeping and taxpayers will not be assessed additional use tax if audited. Use tax on any purchase of $1,000 or more must be added to the safe harbor amount.

What is federal harbor maintenance tax?

The HMF is only collected on imports, domestic shipments, Foreign-Trade Zone admissions, and passengers. The fee is assessed based on the value of the shipment. They are required to pay . 125% of the value of the commercial cargo shipped if the loading and unloading occurs at a port.

What is the harbor maintenance tax credit in Massachusetts?

The harbor maintenance tax credit is a dollar-for-dollar state tax credit that may be claimed by a corporation subject to the corporate excise of G.L. c. 63, §§ 32 or 39, that has "paid qualifying harbor maintenance tax" to the federal government during the taxable year.

What is the new Massachusetts tax credit?

Senior Circuit Breaker Tax Credit – Governor Healey doubled the Senior Circuit Breaker Tax Credit for Massachusetts residents. If you're 65 years of age or older, you may qualify for a credit of up to $2,730 for tax year 2024. More than 64,000 seniors received this credit last year.

What is harbor tax?

0:07 1:26 By following the safe harbor rule taxpayers can avoid potential penalties for underpayment of taxes.MoreBy following the safe harbor rule taxpayers can avoid potential penalties for underpayment of taxes. It offers a straightforward way to stay compliant with tax regulations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Schedule HM Harbor Maintenance Tax Credit?

Schedule HM Harbor Maintenance Tax Credit is a tax form used by taxpayers to claim a credit for certain harbor maintenance taxes paid on qualified imports and exports.

Who is required to file Schedule HM Harbor Maintenance Tax Credit?

Taxpayers who have paid harbor maintenance taxes and are eligible for a credit should file Schedule HM. This includes individuals and businesses who pay these taxes on their shipping and transportation activities.

How to fill out Schedule HM Harbor Maintenance Tax Credit?

To fill out Schedule HM, taxpayers need to provide their name, taxpayer identification number, details of the harbor maintenance taxes paid, and any other required information as specified in the schedule's instructions.

What is the purpose of Schedule HM Harbor Maintenance Tax Credit?

The purpose of Schedule HM is to allow taxpayers to claim a credit for the harbor maintenance taxes they have paid, thereby reducing their overall tax liability.

What information must be reported on Schedule HM Harbor Maintenance Tax Credit?

Taxpayers must report the total amount of harbor maintenance taxes paid, relevant identification information, and any calculations that support their claim for the credit.

Fill out your schedule hm harbor maintenance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Schedule Hm Harbor Maintenance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.