Get the free Massachusetts Financial Institution Excise Tax Return Form 63 FI

Show details

This document is used by financial institutions in Massachusetts to file their excise tax returns, providing necessary schedules and instructions for compliance with state tax laws.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign massachusetts financial institution excise

Edit your massachusetts financial institution excise form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your massachusetts financial institution excise form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing massachusetts financial institution excise online

Follow the steps down below to take advantage of the professional PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit massachusetts financial institution excise. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out massachusetts financial institution excise

How to fill out Massachusetts Financial Institution Excise Tax Return Form 63 FI

01

Obtain the Massachusetts Financial Institution Excise Tax Return Form 63 FI from the Massachusetts Department of Revenue website or your local tax office.

02

Gather necessary documentation such as your financial institution's financial statements for the applicable tax year.

03

Fill in your institution's name, address, and federal identification number at the top of the form.

04

Calculate your gross receipts and ensure you have accurate figures for total assets and net income.

05

Complete the sections related to excise tax based on your calculations following the guidelines provided in the form.

06

Review all entries for accuracy and completeness.

07

Sign and date the form before submission.

08

Submit the completed form by the deadline specified by the Massachusetts Department of Revenue, either electronically or by mail.

Who needs Massachusetts Financial Institution Excise Tax Return Form 63 FI?

01

Financial institutions operating within Massachusetts, including banks, credit unions, and savings institutions, must complete the Massachusetts Financial Institution Excise Tax Return Form 63 FI.

Fill

form

: Try Risk Free

People Also Ask about

Is the MA 63D extension automatic?

The extension process is automated so that all PTE taxpayers are given an extension of time to file their tax returns if certain payment requirements are met . PTE taxpayers must have paid at least 80% of the tax due for the taxable year by the original due date for filing the return .

What is the financial institution excise tax in Massachusetts?

S Corporation Financial Institutions Financial institution S corporations with receipts of $9,000,000 or more pay an income measure of excise at a rate of 4.0% on income allocated or apportioned to Massachusetts. S corporations with receipts of at least $6,000,000 but less than $9,000,000 pay tax at a rate of 2.67%.

Why am I paying excise tax?

Excise tax is an indirect tax on specific goods, services and activities. Federal excise tax is usually imposed on the sale of things like fuel, airline tickets, heavy trucks and highway tractors, indoor tanning, tires, tobacco and other goods and services.

Do LLC pay excise tax in Massachusetts?

While LLCs and partnerships aren't subject to excise tax, any personal income made is subject to taxation under individual state tax returns. Corporations that operate in Massachusetts are subject to Massachusetts's corporate excise tax.

What is the excise tax in Massachusetts?

The excise rate is $25 per $1,000 of your vehicle's value. It is charged for a full calendar year and billed by the community where the vehicle is usually garaged. If your vehicle is registered in Massachusetts but garaged outside of Massachusetts, the Commissioner of Revenue will bill the excise.

What is 63D tax in Massachusetts?

If this election is made, the shareholder, partner, or beneficiary is then eligible to claim a credit equal to 90% of their share of the PTE excise tax paid on their individual MA return. Form 63D-ELT is used to report and pay the 5% pass-through entity tax excise tax for an electing entity.

Is pass-through entity tax a good idea?

The key advantages include: Double taxation. Pass-through entities avoid double taxation, meaning owners are taxed just once. The corporate income is reported on the owner's individual income tax return and taxed at the individual income tax rate.

What is MA 63 D tax?

The MA 63D-ELT is a new form starting with tax year 2021. A pass-through entity can elect to pay the PTE Excise tax at the partnership, S corp, or fiduciary return level. The election must be made annually and cannot be changed for the reporting year once made.

Why am I paying excise tax?

Excise tax is an indirect tax on specific goods, services and activities. Federal excise tax is usually imposed on the sale of things like fuel, airline tickets, heavy trucks and highway tractors, indoor tanning, tires, tobacco and other goods and services.

How do I file an excise tax return?

Filing excise tax returns Complete Form 720, Quarterly Federal Excise Tax Return. File Form 720 electronically for immediate acknowledgement of receipt and faster service with an IRS-approved software provider.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

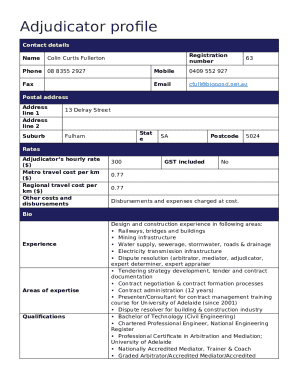

What is Massachusetts Financial Institution Excise Tax Return Form 63 FI?

Massachusetts Financial Institution Excise Tax Return Form 63 FI is a tax return form used by financial institutions operating in Massachusetts to report their excise tax liability to the state.

Who is required to file Massachusetts Financial Institution Excise Tax Return Form 63 FI?

All financial institutions doing business in Massachusetts, including banks, credit unions, and other entities defined as financial institutions under Massachusetts law, are required to file Form 63 FI.

How to fill out Massachusetts Financial Institution Excise Tax Return Form 63 FI?

To fill out Form 63 FI, financial institutions must enter their income, deductions, and calculate their excise tax based on the given rates. The form includes sections for reporting financial data and requires relevant schedules and documentation.

What is the purpose of Massachusetts Financial Institution Excise Tax Return Form 63 FI?

The purpose of the form is to facilitate the assessment of excise taxes owed by financial institutions in Massachusetts, ensuring compliance with state tax laws.

What information must be reported on Massachusetts Financial Institution Excise Tax Return Form 63 FI?

The form requires reporting of gross income, deductions, taxes paid, and other financial details related to the operations of the institution, including any applicable credits and adjustments.

Fill out your massachusetts financial institution excise online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Massachusetts Financial Institution Excise is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.