Get the free Form 20

Show details

This is a form used by beneficiaries in Massachusetts to claim a no tax status exemption from income tax, detailing eligibility criteria and income reporting requirements.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form 20

Edit your form 20 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form 20 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form 20 online

Follow the steps down below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form 20. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

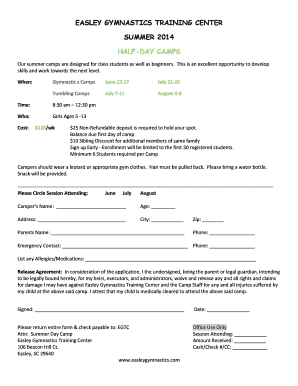

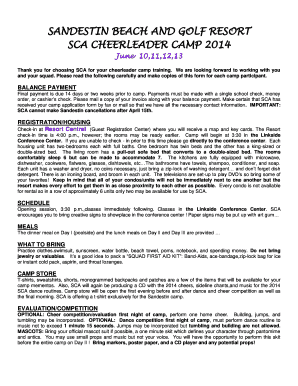

How to fill out form 20

How to fill out Form 20

01

Obtain Form 20 from the appropriate agency or website.

02

Read the instructions carefully to understand the requirements.

03

Fill in your personal information in the designated fields.

04

Provide any required supporting documentation as specified.

05

Review the completed form for accuracy and completeness.

06

Sign and date the form where required.

07

Submit the form to the designated authority by the deadline.

Who needs Form 20?

01

Individuals applying for a specific permit or license.

02

Organizations needing to update or report information to an agency.

03

Those required to submit information for compliance with regulations.

04

Anyone involved in legal or regulatory processes necessitating this form.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between 10k and 20f?

SEC Form 20-F is the primary disclosure document for foreign private issuers that are listed on U.S. exchanges. Equivalent to the 10-K, Form 20-F provides reporting information about the company's key operational details, market risks, corporate governance and financial statements.

Can Form 20-F be completed in any language?

The Form 20-F registration statement or annual report must be in the English language as required by Regulation S-T Rule 306 (17 CFR 232.306). You must provide the signatures required for the Form 20-F registration statement or annual report in ance with Regulation S-T Rule 302 (17 CFR 232.302).

Is a 20F like a 10K?

Introduction to SEC Form 20-F for Foreign Private Issuers This form is tailored for foreign private issuers (FPIs) as a means of reporting their financial performance and operations, mirroring the Form 10-K filed by U.S. domestic companies.

What is the difference between Form 40 F and 20-F?

Form 40-F is filed by specific Canadian companies registered with the SEC and Form 20-F is filed by other non-U.S. registrants. These forms are similar to Form 10-K and contain financial disclosures, including a summary of financial data, management's discussion and analysis (MD&A), and audited financial statements.

What is the difference between Form 20-F and 40 F?

Form 40-F is filed by specific Canadian companies registered with the SEC and Form 20-F is filed by other non-U.S. registrants. These forms are similar to Form 10-K and contain financial disclosures, including a summary of financial data, management's discussion and analysis (MD&A), and audited financial statements.

What is the difference between Form F 1 and 20-F?

SEC Form F-1 is the registration required for foreign companies that want to be listed on a U.S. stock exchange. Any amendments or changes that have to be made by the issuer are filed under SEC Form F-1/A. After the foreign issuer's securities are issued, the company is required to file Form 20-F annually.

Is Form 20-F the same as 10-K?

SEC Form 20-F is the primary disclosure document for foreign private issuers that are listed on U.S. exchanges. Equivalent to the 10-K, Form 20-F provides reporting information about the company's key operational details, market risks, corporate governance and financial statements.

Is a 20F like a 10K?

Introduction to SEC Form 20-F for Foreign Private Issuers This form is tailored for foreign private issuers (FPIs) as a means of reporting their financial performance and operations, mirroring the Form 10-K filed by U.S. domestic companies.

What is the difference between Form 20-F and 10k?

SEC Form 20-F is the primary disclosure document for foreign private issuers that are listed on U.S. exchanges. Equivalent to the 10-K, Form 20-F provides reporting information about the company's key operational details, market risks, corporate governance and financial statements.

What is the difference between Form F 1 and 20-F?

SEC Form F-1 is the registration required for foreign companies that want to be listed on a U.S. stock exchange. Any amendments or changes that have to be made by the issuer are filed under SEC Form F-1/A. After the foreign issuer's securities are issued, the company is required to file Form 20-F annually.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Form 20?

Form 20 is a document used for various regulatory purposes, including the registration of certain securities.

Who is required to file Form 20?

Entities involved in securities offerings or other regulatory matters that require disclosure are typically required to file Form 20.

How to fill out Form 20?

To fill out Form 20, gather the necessary information about the entity and its securities, then accurately complete each section as outlined in the instructions provided with the form.

What is the purpose of Form 20?

The purpose of Form 20 is to provide regulators and the public with essential information regarding the entity's securities and compliance with applicable laws.

What information must be reported on Form 20?

Information that must be reported on Form 20 typically includes the entity's financial statements, business operations, management details, and specifics about the securities being offered.

Fill out your form 20 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form 20 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.