Get the free Massachusetts Partnership Return Form 3 and Schedule 3K-1 Instructions

Show details

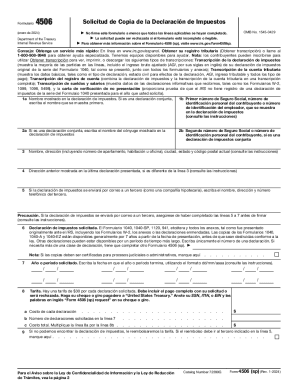

This document provides instructions for completing the Massachusetts Partnership Return (Form 3) and Schedule 3K-1, including details about taxation, filing requirements, major tax changes, and partner

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign massachusetts partnership return form

Edit your massachusetts partnership return form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your massachusetts partnership return form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit massachusetts partnership return form online

To use the services of a skilled PDF editor, follow these steps:

1

Sign into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit massachusetts partnership return form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out massachusetts partnership return form

How to fill out Massachusetts Partnership Return Form 3 and Schedule 3K-1 Instructions

01

Gather necessary information about the partnership, including name, address, and federal employer identification number (EIN).

02

Complete the top section of Form 3 by entering the partnership's name, address, and federal EIN.

03

Fill out the income section on Form 3, including gross income, deductions, and any other adjustments.

04

Report each partner's share of the income, loss, and deductions on Schedule 3K-1.

05

Ensure all numerical entries are accurate and match supporting documents such as financial statements.

06

Review the entire form for completeness and accuracy before signing.

07

Submit Form 3 and Schedule 3K-1 to the Massachusetts Department of Revenue by the deadline.

Who needs Massachusetts Partnership Return Form 3 and Schedule 3K-1 Instructions?

01

Any partnership doing business in Massachusetts.

02

Partnerships that have income to report for state tax purposes.

03

Partners in a Massachusetts partnership who need to report their share of income, deductions, and credits.

Fill

form

: Try Risk Free

People Also Ask about

What is a Schedule E 3 in Massachusetts?

Form 1 and Form 1-NR/PY filers must use Schedule E-3 to report income and loss from estates, trusts, REMICs and farms. Separate Schedule(s) E-3 must be filed for each individual entity.

How do I file a partnership tax return?

Partnerships don't generally pay taxes, but use Form 1065 to prepare Schedule K-1s (and Schedule K-3s, if needed) to pass through income and losses to partners. Form 1065 is due by the 15th day of the 3rd month after your partnership's tax year ends, unless you file for an extension.

How much is $70,000 a year after taxes in Massachusetts?

Estimated Take-Home Pay for $70,000 Salary in MA The table above explains the take-home pay will be between $51,922 and $54,462 after the taxes for $70,000 annual salary in Massachusetts before considering specific deductions like retirement savings as well as health insurance.

Who must file Massachusetts Form 3?

A Massachusetts partnership return, Form 3, must be filed if the partnership: ◗ Has a usual place of business in Massachusetts; ◗ Receives federal gross income of more than $100 during the taxable year that is subject to Massachusetts taxation jurisdiction under the U.S. Constitution.

What is form 3 in Massachusetts?

Operating Partnerships: Partnerships actively conducting business in Massachusetts are required to file. 2. Tax Compliance: To comply with tax regulations and avoid penalties, Form 3 must be submitted. 3. Income Reporting: This form is necessary to report the income earned by partners throughout the year.

What is a schedule 3K-1?

The 3K-1 form, officially known as Schedule Partner's Share of Income, Deductions, Credits, etc., is a crucial document for partnerships operating in Wisconsin.

What is Form 3 in USA?

Form 3 is an SEC filing filed with the US Securities and Exchange Commission to indicate a preliminary insider transaction by an officer, director, or beneficial (10%) owner of the company's securities. These are typically seen after a company IPOs when insiders make their first transactions.

What information does Part III of Schedule K 3 provide to partners?

Schedule K-3 (Form 1065) Part III. Other Information for Preparation of Form 1116 or 1118. This section reports your share of the foreign taxes paid or accrued by the partnership by separate category and source.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Massachusetts Partnership Return Form 3 and Schedule 3K-1 Instructions?

Massachusetts Partnership Return Form 3 is used by partnerships operating in Massachusetts to report their income, deductions, and tax liabilities. Schedule 3K-1 is the form that details each partner's share of the partnership's income, deductions, and credits.

Who is required to file Massachusetts Partnership Return Form 3 and Schedule 3K-1 Instructions?

All partnerships doing business in Massachusetts, including general partnerships, limited partnerships, and limited liability partnerships, are required to file Form 3 and provide Schedule 3K-1 to each partner.

How to fill out Massachusetts Partnership Return Form 3 and Schedule 3K-1 Instructions?

To fill out Form 3, partnerships must report their total income, allowable deductions, and calculate the taxes owed. Schedule 3K-1 must be filled out for each partner, detailing their specific share of the partnership's financial results. Instructions provided by the Massachusetts Department of Revenue should be followed for specific line items.

What is the purpose of Massachusetts Partnership Return Form 3 and Schedule 3K-1 Instructions?

The purpose of Form 3 and Schedule 3K-1 is to ensure that partnerships report their financial data accurately to the Massachusetts Department of Revenue, allowing for proper tax assessment and compliance with state tax laws.

What information must be reported on Massachusetts Partnership Return Form 3 and Schedule 3K-1 Instructions?

Form 3 requires the reporting of partnership income, deductions, credits, and taxes. Schedule 3K-1 must report each partner's share of income, deductions, credits, and distributions, along with the partner's identification information.

Fill out your massachusetts partnership return form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Massachusetts Partnership Return Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.