Get the free Personal Income Tax Software Developer’s Guide

Show details

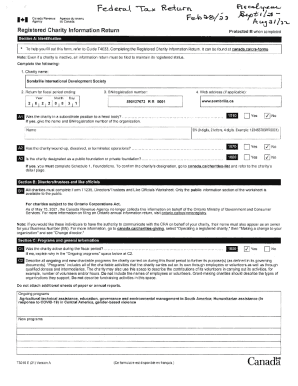

This document provides guidelines and specifications for software developers creating tax preparation software for personal income tax forms in Massachusetts. It includes details on barcode layout,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign personal income tax software

Edit your personal income tax software form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your personal income tax software form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit personal income tax software online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit personal income tax software. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out personal income tax software

How to fill out Personal Income Tax Software Developer’s Guide

01

Gather all necessary documentation, including income statements and deductions.

02

Access the Personal Income Tax Software Developer’s Guide online or through the software interface.

03

Read the introduction section to understand the purpose and scope of the guide.

04

Follow the step-by-step instructions for each function in the software, including data entry points.

05

Review the examples provided in the guide to understand usage and application.

06

Test the software using sample data to ensure accuracy in calculation and reporting.

07

Refer to the troubleshooting section for common issues and how to resolve them.

08

Keep the guide handy for future reference as software updates may change functionalities.

Who needs Personal Income Tax Software Developer’s Guide?

01

Software developers who are building or updating personal income tax preparation software.

02

Tax professionals who require detailed instructions on integrating software features.

03

Quality assurance testers who need to understand the software requirements for testing.

04

Educators teaching software development related to tax applications.

Fill

form

: Try Risk Free

People Also Ask about

What are the benefits of preparing your taxes electronically?

With electronic filing, taxpayer privacy and security are guaranteed. Taxpayers select their own personal identification numbers (PINs). Within 48 hours of transmission, the IRS sends an electronic acknowledgment that the return has been received and accepted for processing.

Who is Ero on the tax form?

The Electronic Return Originator (ERO) is the authorized IRS e-file provider who originates the electronic submission of a return to the IRS. The ERO is usually the first point of contact for most taxpayers filing a return using IRS e-file.

What is the best software for tax preparation?

Top Tax Software for Accountants Lacerte. Drake Tax. FreeTaxUSA. TurboTax. TaxAct. IRS Direct File. H&R Block. It's the second-most popular tax software, ing to a 2024 CivicScience report. TurboTax. More than one in three U.S. taxpayers used TurboTax in 2024, ing to a CivicScience survey.

What is the MeF system?

Modernized e-File (MeF) is an electronic system for filing tax returns with the Internal Revenue Service (IRS) of the United States. The MeF system describes tax forms in terms of XML and supports web-based filing. Modernized e-File was originally introduced in 2004, exclusively for corporate tax returns.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Personal Income Tax Software Developer’s Guide?

The Personal Income Tax Software Developer’s Guide is a comprehensive resource that provides guidelines and instructions for software developers to create applications that facilitate the preparation and filing of personal income tax returns.

Who is required to file Personal Income Tax Software Developer’s Guide?

Software developers who are creating or maintaining applications for personal income tax filing must refer to the Personal Income Tax Software Developer’s Guide to ensure compliance with regulations and technical standards.

How to fill out Personal Income Tax Software Developer’s Guide?

Filling out the Personal Income Tax Software Developer’s Guide involves following the structured sections outlined in the guide, which typically include requirements, standards, and examples for tax software development; developers must adhere to these guidelines as they build their applications.

What is the purpose of Personal Income Tax Software Developer’s Guide?

The purpose of the Personal Income Tax Software Developer’s Guide is to standardize the process of tax software development, ensuring that software can accurately calculate, prepare, and electronically file personal income tax returns while meeting legal compliance.

What information must be reported on Personal Income Tax Software Developer’s Guide?

The Personal Income Tax Software Developer’s Guide requires reporting information such as taxpayer identification details, income sources, deductions, credits, and filing status, along with any additional information necessary for accurate tax reporting.

Fill out your personal income tax software online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Personal Income Tax Software is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.