Get the free Medicare Supplement Plan

Show details

This document serves as a checklist for filing Medicare Supplement Plan forms with requirement confirmations based on Massachusetts law.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign medicare supplement plan

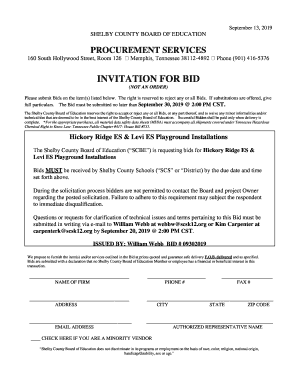

Edit your medicare supplement plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your medicare supplement plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing medicare supplement plan online

Follow the guidelines below to benefit from a competent PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit medicare supplement plan. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out medicare supplement plan

How to fill out Medicare Supplement Plan

01

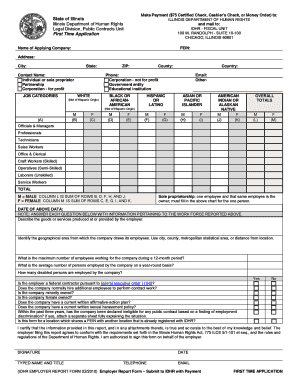

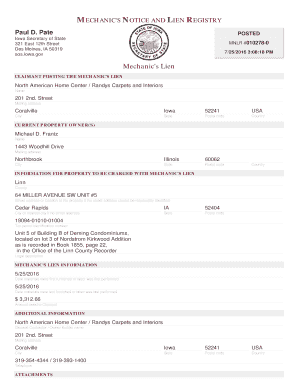

Gather your personal information (name, address, date of birth, Medicare number).

02

Review the different Medicare Supplement Plans (A through N) to understand the coverage options.

03

Determine which plan fits your healthcare needs and budget.

04

Contact the insurance company or agent to request an application for your chosen plan.

05

Complete the application form with accurate information.

06

Submit the application along with any required documentation (e.g., proof of Medicare eligibility, payment information).

07

Wait for approval from the insurance company and receive your policy documents.

Who needs Medicare Supplement Plan?

01

Individuals who are enrolled in Medicare Part A and Part B and want to cover additional healthcare costs.

02

Seniors who frequently use healthcare services and want predictable out-of-pocket expenses.

03

People who travel often and want nationwide coverage for healthcare services.

04

Individuals with chronic conditions who require regular medical care and want to minimize costs.

Fill

form

: Try Risk Free

People Also Ask about

What is the downside to Medicare supplement plans?

Plan F offers the most coverage, but it's not available to everyone. Plan G covers nearly as much as Plan F — and it's available for any Medicare member. Both Plans F and G also offer a high-deductible Medigap plan in some states.

Is medicare supplement plan F better than plan G?

Medicare Plan G provides almost the same coverage as Plan F, with one exception: it does not cover the Medicare Part B deductible. After meeting this deductible, Plan G covers: Medicare Part A deductible and coinsurance. Part B coinsurance or copayment.

Why switch from plan F to plan G?

If the premium savings on 'G' are greater than the deductible amount, then 'G' makes more sense than 'F'. Often, the premium differences between these two plans are $300/year or more. In some cases, the premium difference can be as much as $500/year, making 'G' a “no-brainer”.

What is the Medicare Supplement plan?

One of the most significant drawbacks of supplemental insurance policies is the coverage limits. For instance, with Mechanical Repair Coverage, you'll typically need to pay out of pocket until your deductible is met on your primary policy before supplemental insurance takes over to cover a costly vehicle repair.

What are the disadvantages of Medicare Part G?

Plan G covers the Part A deductible, but Plan A does not. Plan G does not cover the Part B deductible, while Plans C and F do cover it. Plan G covers 80% of foreign travel emergencies, while Plans A, B, K, and L do not.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Medicare Supplement Plan?

A Medicare Supplement Plan, also known as Medigap, is a type of health insurance that helps cover some of the out-of-pocket costs not covered by Original Medicare, such as copayments, coinsurance, and deductibles.

Who is required to file Medicare Supplement Plan?

Individuals who are enrolled in Medicare Part A and Part B and wish to have additional coverage to help pay for healthcare costs may choose to purchase a Medicare Supplement Plan. There are no specific requirements to file, but it is available to those who qualify.

How to fill out Medicare Supplement Plan?

To fill out a Medicare Supplement Plan application, an individual typically needs to provide personal information such as their Medicare number, details about their current health insurance coverage, and select the specific Medigap plan they want to enroll in. It is often recommended to do this through an insurance agent or directly with the insurance provider.

What is the purpose of Medicare Supplement Plan?

The purpose of a Medicare Supplement Plan is to help bridge the coverage gap left by Original Medicare by covering additional costs, thereby providing more comprehensive health care coverage for beneficiaries.

What information must be reported on Medicare Supplement Plan?

When applying for a Medicare Supplement Plan, individuals must report personal information, including their Medicare identification number, date of birth, and information regarding any existing health coverage, among other details.

Fill out your medicare supplement plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Medicare Supplement Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.