Get the free FINAL DECISION OF THE COMMISSIONER OF FINANCIAL AND INSURANCE SERVICES

Show details

This document outlines the final decision regarding the denial of an adjuster license application for a petitioner involved in workers' compensation claims, detailing the licensing requirements and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign final decision of form

Edit your final decision of form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your final decision of form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit final decision of form online

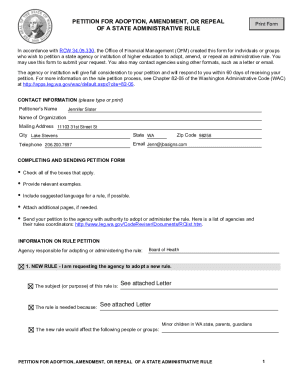

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit final decision of form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out final decision of form

How to fill out FINAL DECISION OF THE COMMISSIONER OF FINANCIAL AND INSURANCE SERVICES

01

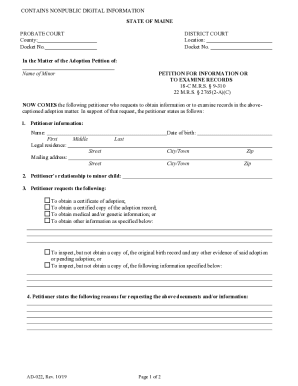

Obtain the FINAL DECISION OF THE COMMISSIONER OF FINANCIAL AND INSURANCE SERVICES form from the official website or relevant office.

02

Read the instructions carefully to understand the requirements and sections of the form.

03

Fill out the section with your personal information, including your name, address, and contact details.

04

Provide detailed information about the nature of your case or the issue being addressed.

05

Include any supporting documents or evidence that may be required to support your case.

06

Review the completed form for accuracy and completeness.

07

Submit the form by the specified deadline, either online or through the designated mailing address.

Who needs FINAL DECISION OF THE COMMISSIONER OF FINANCIAL AND INSURANCE SERVICES?

01

Individuals or organizations involved in disputes related to insurance or financial services.

02

Policyholders seeking clarification on a decision made by an insurance provider.

03

Financial service providers responding to regulatory decisions.

04

Consumers looking for formal documentation of decisions made by the commissioner.

Fill

form

: Try Risk Free

People Also Ask about

How often must the Commissioner examine books and records of each licensed insurer in this state?

Audit the books and records of all Domestic insurers at least every 3 years.

How often must the Commissioner examine all insurers to guard against insurance company insolvency?

The Commissioner of Insurance must examine all insurers at least once a year to prevent insolvency. This annual assessment is crucial for ensuring that insurance companies remain financially stable and can fulfill their obligations. Regular examinations help maintain consumer trust and market integrity.

How often must the insurance commissioner examine the affairs and transactions of every authorized insurer?

(b) The commissioner may conduct an examination under this article of any company as often as the commissioner in his or her discretion deems appropriate but shall, at a minimum, conduct an examination of every insurer admitted in this state not less frequently than once every five years.

What is the Commissioner of insurance responsible for quizlet?

the commissioner has the power to examine and investigate the affairs for every person engaged in the business of insurance, in order to determine whether the person has been or is engaged in any unfair trade practices.

Who is the commissioner of the California Department of Insurance?

Ricardo Lara is California's 8th Insurance Commissioner since voters created the elected position in 1988. As leader of the nation's largest state consumer protection agency he will protect Californians' futures.

How often are insurance companies examined by the Commissioner?

The Commissioner must examine all authorized insurers at least once every 5 years.

What is the commissioner of insurance responsible for?

The purpose of insurance commissioners is to maintain fair pricing for insurance products, protect the solvency of insurance companies, prevent unfair practices by insurance companies, and ensure availability of insurance coverage.

How often may the director examine an insurer?

The Director must conduct an examination of an insurer at least every 5 years or as often as the Director considers appropriate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is FINAL DECISION OF THE COMMISSIONER OF FINANCIAL AND INSURANCE SERVICES?

The FINAL DECISION OF THE COMMISSIONER OF FINANCIAL AND INSURANCE SERVICES is a formal ruling or judgement issued by the Commissioner regarding matters related to financial and insurance regulations and compliance.

Who is required to file FINAL DECISION OF THE COMMISSIONER OF FINANCIAL AND INSURANCE SERVICES?

Entities or individuals that are subject to the jurisdiction of the Commissioner, typically those involved in financial and insurance services, are required to file the FINAL DECISION.

How to fill out FINAL DECISION OF THE COMMISSIONER OF FINANCIAL AND INSURANCE SERVICES?

To fill out the FINAL DECISION, one must follow the specific guidelines provided by the Commissioner, including providing accurate information, answering all required fields, and attaching necessary documents.

What is the purpose of FINAL DECISION OF THE COMMISSIONER OF FINANCIAL AND INSURANCE SERVICES?

The purpose of the FINAL DECISION is to communicate the outcomes of regulatory investigations, enforce compliance, and outline any penalties or corrective actions needed to ensure adherence to financial and insurance laws.

What information must be reported on FINAL DECISION OF THE COMMISSIONER OF FINANCIAL AND INSURANCE SERVICES?

The information that must be reported includes the details of the case, findings of the investigation, applicable laws, the decision made by the Commissioner, and any required actions or penalties.

Fill out your final decision of form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Final Decision Of Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.