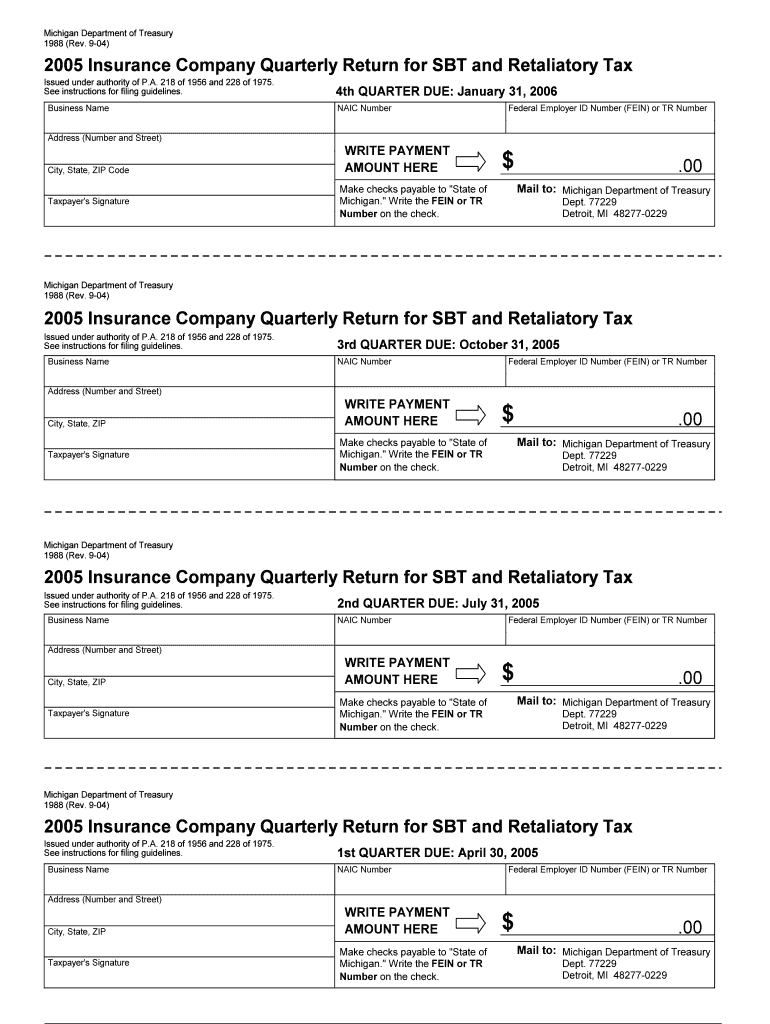

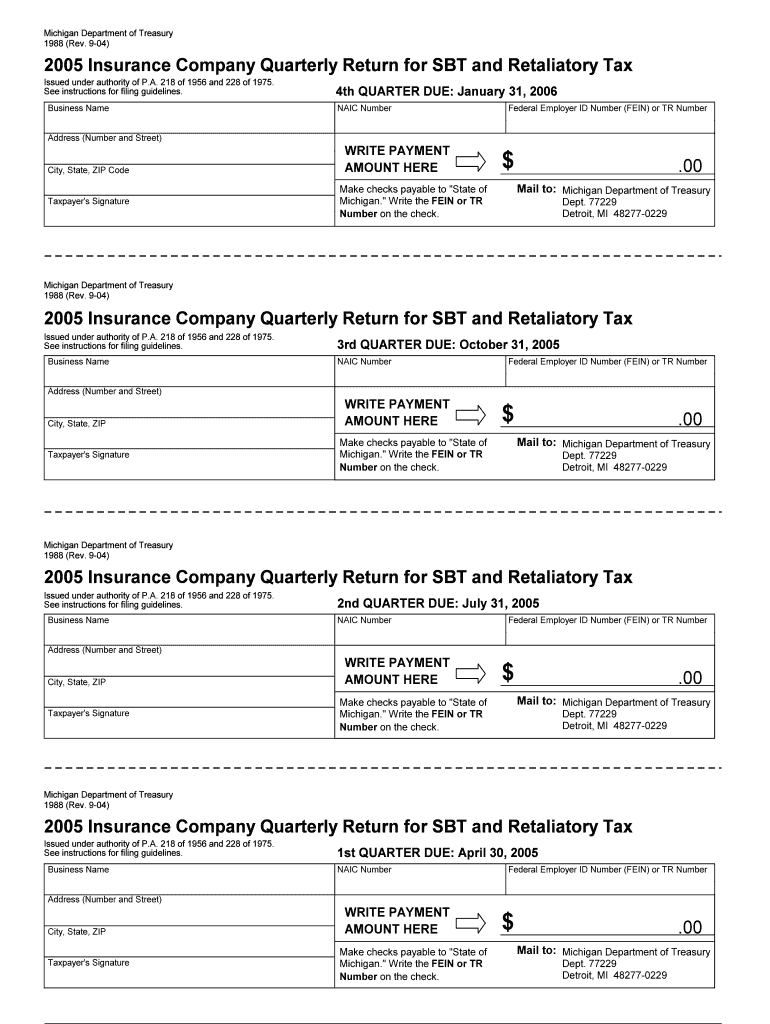

Get the free 2005 Insurance Company Quarterly Return for SBT and Retaliatory Tax

Show details

This document serves as a quarterly return form for insurance companies to report their Single Business Tax (SBT) and Retaliatory Tax obligations. It includes sections for business identification,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2005 insurance company quarterly

Edit your 2005 insurance company quarterly form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2005 insurance company quarterly form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2005 insurance company quarterly online

To use our professional PDF editor, follow these steps:

1

Log into your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 2005 insurance company quarterly. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2005 insurance company quarterly

How to fill out 2005 Insurance Company Quarterly Return for SBT and Retaliatory Tax

01

Obtain the 2005 Insurance Company Quarterly Return form from the appropriate regulatory agency or their website.

02

Fill in the company details including name, address, and contact information at the top of the form.

03

Report total premiums collected for the quarter in the designated box.

04

Provide details of any deductions as specified in the instructions, including any refunds or returns.

05

Calculate the taxable amount based on premiums collected and deductions taken.

06

Complete the sections related to the State-Based Tax (SBT) according to the guidelines provided in the form.

07

Calculate the retaliatory tax payable based on the state’s regulations and the information you have filled out.

08

Review all sections for accuracy and completeness before signing the document.

09

Submit the completed form via the method specified by the regulatory agency - either electronically or via mail.

Who needs 2005 Insurance Company Quarterly Return for SBT and Retaliatory Tax?

01

Insurance companies operating in the relevant jurisdiction that are required to report their financial details quarterly.

02

Companies that need to comply with state regulations concerning the taxation of insurance premiums.

03

Businesses that provide coverage under the insurance industry and are obligated to file quarterly returns.

Fill

form

: Try Risk Free

People Also Ask about

Is return of premium tax-free?

Generally, you do not pay taxes on the return of premium received from a return of premium life insurance policy, as it's considered a refund of your own money. However, consulting a tax professional for personalized advice regarding your situation is always advisable.

What portion of an insurance company's premiums is taxed?

Tax on gross premiums – All insurance companies are subject to tax on gross premiums.

Are health insurance premium rebates taxable income?

Are rebates taxable? In general, rebates are taxable if you pay health insurance premiums with pre-tax dollars or you received tax benefits by deducting premiums you paid on your tax return. Talk with your tax preparer to determine if you need to report your rebate as income when you file your next tax return.

Is a premium refund taxable?

For individual market consumers who purchased their coverage with after‐tax dollars, a rebate is not taxable income. However, if an individual deducted the prior year's premium payments on their Form 1040 Schedule A, then their MLR rebate is subject to federal income tax.

Are insurance premium refunds taxable?

For individual market consumers who purchased their coverage with after‐tax dollars, a rebate is not taxable income. However, if an individual deducted the prior year's premium payments on their Form 1040 Schedule A, then their MLR rebate is subject to federal income tax.

Are insurance premium reimbursements taxable?

When an HRA complies with federal rules, employers can reimburse medical expenses, such as health insurance premiums, with money free of payroll taxes for both the employer and employee. An HRA is also free of income tax for the employee.

Can insurance company request tax returns?

Although the insurer may make it sound like asking for large amounts of paperwork is just routine—thus snowing you under with completing tasks—it is usually a tactic used to 'encourage' the policyholder to back down. They may even require documents like your tax returns.

Are insurance company payouts taxable?

Generally, life insurance proceeds you receive as a beneficiary due to the death of the insured person, aren't includable in gross income and you don't have to report them. However, any interest you receive is taxable and you should report it as interest received. See Topic 403 for more information about interest.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2005 Insurance Company Quarterly Return for SBT and Retaliatory Tax?

The 2005 Insurance Company Quarterly Return for SBT (Single Business Tax) and Retaliatory Tax is a mandatory reporting form for insurance companies to report their income and calculate the taxes owed to the state. This form is typically required to be filed four times a year.

Who is required to file 2005 Insurance Company Quarterly Return for SBT and Retaliatory Tax?

Insurance companies operating in the state and subject to the Single Business Tax and Retaliatory Tax are required to file the 2005 Insurance Company Quarterly Return. This includes both domestic and foreign insurers.

How to fill out 2005 Insurance Company Quarterly Return for SBT and Retaliatory Tax?

To fill out the 2005 Insurance Company Quarterly Return, a taxpayer must provide information on their gross premiums, allowable deductions, and calculate the tax owed based on the taxable income. Instructions specific to the form are typically provided by the state department of revenue.

What is the purpose of 2005 Insurance Company Quarterly Return for SBT and Retaliatory Tax?

The purpose of the 2005 Insurance Company Quarterly Return is to ensure that insurance companies accurately report their earnings and pay the appropriate taxes to the state. This maintains compliance with state tax laws and helps fund public services.

What information must be reported on 2005 Insurance Company Quarterly Return for SBT and Retaliatory Tax?

The information that must be reported on the 2005 Insurance Company Quarterly Return includes gross premium amounts, taxable income, specific deductions allowed under the law, and the calculation of the taxes owed for both the Single Business Tax and Retaliatory Tax.

Fill out your 2005 insurance company quarterly online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2005 Insurance Company Quarterly is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.