Get the free SBT Loss Adjustment Worksheet for the Small Business Credit

Show details

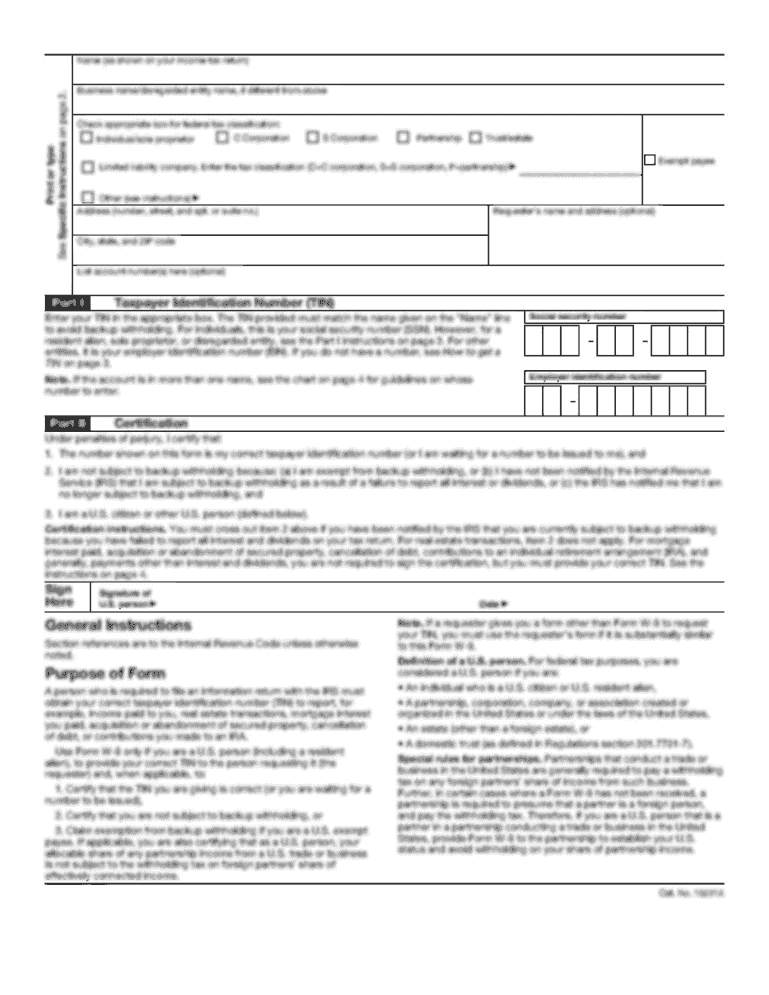

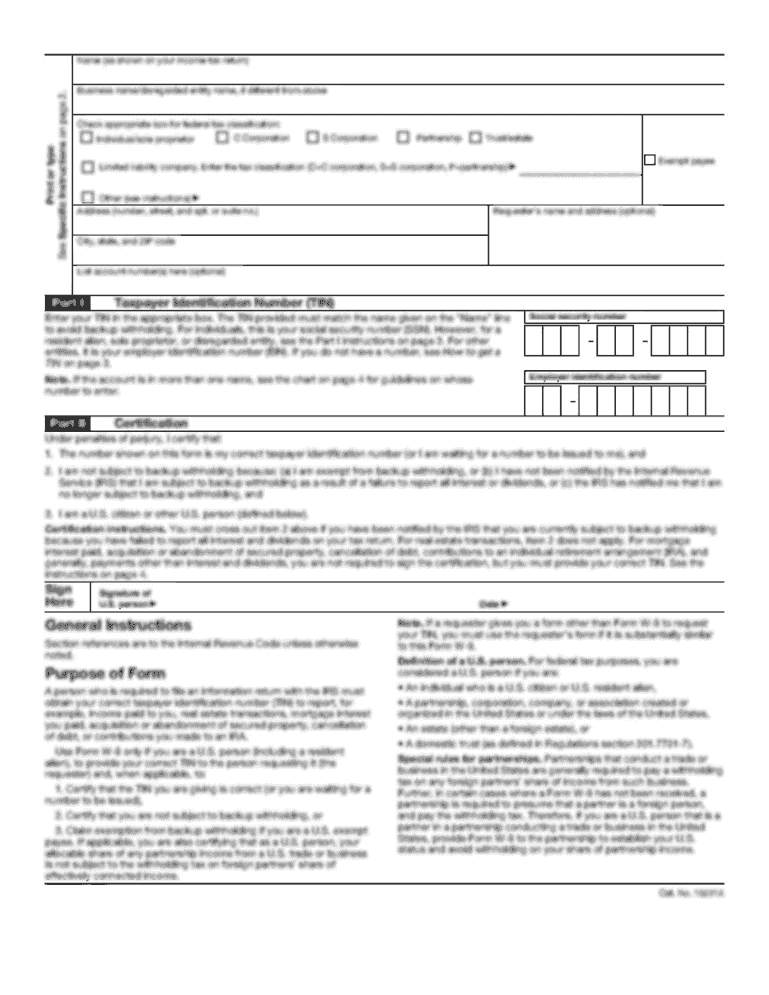

This worksheet is used to qualify for a small business credit or alternate tax by adjusting current year adjusted business income, specifically for taxpayers who experienced losses in previous tax

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sbt loss adjustment worksheet

Edit your sbt loss adjustment worksheet form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sbt loss adjustment worksheet form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sbt loss adjustment worksheet online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit sbt loss adjustment worksheet. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sbt loss adjustment worksheet

How to fill out SBT Loss Adjustment Worksheet for the Small Business Credit

01

Gather all necessary financial documents including income statements, balance sheets, and tax returns.

02

Obtain a copy of the SBT Loss Adjustment Worksheet from the appropriate government website or your financial advisor.

03

Begin filling out the worksheet by entering your business's identifying information such as name, address, and tax identification number.

04

Follow the instructions provided on the worksheet to report your gross receipts for the relevant period.

05

Document any business interruptions or losses incurred due to the event that the worksheet addresses.

06

Calculate your total loss using the formulas and guidelines provided in the worksheet.

07

Review the completed worksheet for accuracy and ensure all numbers are clearly legible.

08

Submit the worksheet according to the instructions, either electronically or by mail, ensuring to keep a copy for your records.

Who needs SBT Loss Adjustment Worksheet for the Small Business Credit?

01

Small business owners seeking financial assistance due to losses from qualifying events.

02

Businesses that experienced significant declines in revenue and meet the criteria established by the Small Business Administration.

03

Entrepreneurs looking to document their financial losses for potential relief programs or insurance claims.

Fill

form

: Try Risk Free

People Also Ask about

Where can I find my carryover amount?

Using your CRA My Account: Log in to your CRA My Account. Click Tax Returns. Scroll to Carryover amounts and click View carryover amounts. Find the Federal Tuition, Education and Textbook Amounts and Provincial Tuition, Education and Textbook Amounts tables.

Where to find capital loss carryover worksheet TurboTax?

Otherwise, follow these instructions: Open or continue your return. Navigate to the capital loss carryover section: TurboTax Online/Mobile: Go to capital loss carryover. Select Yes on the screen Did you have investment losses you couldn't claim last year? Enter the info about your capital loss on the following screens.

Where do I find my capital loss carryover amount?

Check line 16 on Schedule D of your 2023 tax return. If line 16 on Schedule D shows a loss, you could have a capital loss carryover to 2024. To calculate the amount of the carryover and whether it's short-term or long-term, use the Capital Loss Carryover Worksheet found in the 2024 Schedule D instructions.

What is the schedule D tax worksheet?

Use Schedule D (Form 1040) to report the following: The sale or exchange of a capital asset not reported on another form or schedule. Gains from involuntary conversions (other than from casualty or theft) of capital assets not held for business or profit.

What are the IRS rules for capital losses?

You can deduct capital losses up to the amount of your capital gains plus $3,000 ($1,500 if married filing separately). You may be able to use capital losses that exceed this limit in future years.

What line on 1040 is capital loss carryover?

The loss on Form 1040, line 7 becomes part of the adjusted gross income (AGI) on Form 1040. If the AGI on the return reduces Form 1040, line 11 to a negative amount, part or all of the line 7 loss is carried forward.

Do I need to fill out a 28 rate gain worksheet?

You will need to complete the 28 Rate Gain Worksheet in the Schedule D Instructions. Then, you take your short-term gain or loss and net it against your long-term gain or loss.

Where to find capital loss carryover worksheet?

The carryover amount is calculated using the Capital Loss Carryover Worksheet found in the instructions for Schedule D. This worksheet helps determine how much of the unused loss from the previous year can be applied to the current year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is SBT Loss Adjustment Worksheet for the Small Business Credit?

The SBT Loss Adjustment Worksheet for the Small Business Credit is a form used by small businesses to report losses incurred during a specific period to adjust their tax credits.

Who is required to file SBT Loss Adjustment Worksheet for the Small Business Credit?

Small businesses that have claimed the Small Business Credit and experienced financial losses are required to file the SBT Loss Adjustment Worksheet.

How to fill out SBT Loss Adjustment Worksheet for the Small Business Credit?

To fill out the SBT Loss Adjustment Worksheet, businesses should accurately report their financial losses, include necessary documentation, and follow the guidelines provided by the tax authority.

What is the purpose of SBT Loss Adjustment Worksheet for the Small Business Credit?

The purpose of the SBT Loss Adjustment Worksheet is to provide a method for small businesses to adjust their claimed tax credits based on verified financial losses.

What information must be reported on SBT Loss Adjustment Worksheet for the Small Business Credit?

The information that must be reported includes the total losses incurred, relevant financial data, tax identification numbers, and any supporting documentation required by the tax authority.

Fill out your sbt loss adjustment worksheet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sbt Loss Adjustment Worksheet is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.