Get the free T-108: Schedule of Other Tobacco Products Sales (Disbursements)

Show details

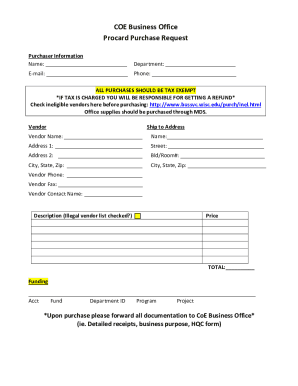

This form is used by Michigan licensed wholesalers, secondary wholesalers, and unclassified acquirers to report the sales of other tobacco products, indicating various schedule types and transaction

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign t-108 schedule of oformr

Edit your t-108 schedule of oformr form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your t-108 schedule of oformr form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing t-108 schedule of oformr online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit t-108 schedule of oformr. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out t-108 schedule of oformr

How to fill out T-108: Schedule of Other Tobacco Products Sales (Disbursements)

01

Obtain the T-108 form from the relevant tax authority's website or office.

02

Fill in your business name, address, and taxpayer identification number at the top of the form.

03

In Section 1, enter the total disbursements for other tobacco products sold during the reporting period.

04

In Section 2, provide detailed information on the types of tobacco products sold.

05

Attach any required supporting documentation, such as purchase invoices or sales records.

06

Review all entries for accuracy to ensure compliance with regulations.

07

Sign and date the form before submission.

08

Submit the completed T-108 form to the designated tax authority by the due date.

Who needs T-108: Schedule of Other Tobacco Products Sales (Disbursements)?

01

Businesses that sell other tobacco products and are required to report their sales disbursements for tax purposes.

02

Tobacco product wholesalers and retailers who meet the thresholds set by tax regulations.

Fill

form

: Try Risk Free

People Also Ask about

What is classed as a tobacco product?

Consumable tobacco products can be broadly categorized into smoked tobacco, smokeless tobacco, heated tobacco products, and nicotine-only products.

What is a deemed product or covered tobacco product as that term relates to tobacco products regulated by FDA?

Covered tobacco product means any tobacco product deemed to be subject to the FD&C Act pursuant to § 1100.2 of this chapter (i.e., subchapter K), but excludes any component or part that is not made or derived from tobacco (parts 1140, 1143).

How much tax money comes from tobacco?

Tobacco tax revenue and forecast in the United States from 2000 to 2029 (in billion U.S. dollars) CharacteristicTobacco tax revenue in billion U.S. dollars '22 11.26 '21 12.14 '20 12.35 '19 12.4626 more rows • Nov 18, 2024

What is the new tobacco rule?

As of December 20, 2019, the federal age of sale for tobacco products is 21 with no exemption for military personnel.

What counts as tobacco products?

A product containing, made, or derived from tobacco or nicotine that is intended for human consumption, whether smoked, heated, chewed, absorbed, dissolved, inhaled, snorted, sniffed, or ingested by any other means, including, but not limited to, cigarettes, cigars, little cigars, chewing tobacco, pipe tobacco, or

What qualifies as tobacco use for insurance?

ing to the federal Department of Health and Human Services, insurance companies consider folks tobacco users if they use tobacco products – including cigarettes, cigars, pipe tobacco, and chewing tobacco – on average four or more times a week during the past six months.

What are 5 examples of tobacco products?

Tobacco products encompass multiple varieties of products, including cigarettes, cigarette tobacco, roll-your-own tobacco, smokeless tobacco, electronic cigarettes, cigars, hookahs, pipe tobacco, nicotine gels, and dissolvables.

What products are considered tobacco products?

You may recognize some of the forms, such as cigarettes, cigars, pipes, and chewing tobacco. Others — such as cigarillos or small cigars, e-cigarettes, snus or tobacco pouches, tobacco strips, orbs or other dissolvables, bidis, kreteks or clove cigars, dhoka, and or water pipes — may not be as familiar to you.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is T-108: Schedule of Other Tobacco Products Sales (Disbursements)?

T-108: Schedule of Other Tobacco Products Sales (Disbursements) is a form used to report the sales and disbursements of other tobacco products by licensed dealers to ensure compliance with tax regulations.

Who is required to file T-108: Schedule of Other Tobacco Products Sales (Disbursements)?

Licensed dealers and distributors of other tobacco products who are subject to taxation are required to file T-108.

How to fill out T-108: Schedule of Other Tobacco Products Sales (Disbursements)?

To fill out T-108, provide details of tobacco product sales, including quantities, values, and transaction dates, and ensure all sections are completed accurately before submission.

What is the purpose of T-108: Schedule of Other Tobacco Products Sales (Disbursements)?

The purpose of T-108 is to track and report sales of other tobacco products for tax purposes, ensuring that all applicable taxes are collected and remitted.

What information must be reported on T-108: Schedule of Other Tobacco Products Sales (Disbursements)?

The T-108 must report sales quantities, types of tobacco products, corresponding sales values, dates of transactions, and any applicable tax information.

Fill out your t-108 schedule of oformr online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

T-108 Schedule Of Oformr is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.