Get the free T-102: Schedule of Other Tobacco Products Credits (Adjustments)

Show details

This schedule is used by Michigan licensed wholesalers and unclassified acquirers to report adjustments for other tobacco products, detailing credits for tax-paid and tax-unpaid products.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign t-102 schedule of oformr

Edit your t-102 schedule of oformr form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your t-102 schedule of oformr form via URL. You can also download, print, or export forms to your preferred cloud storage service.

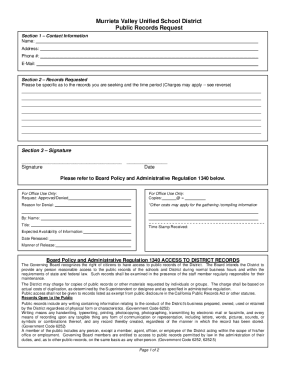

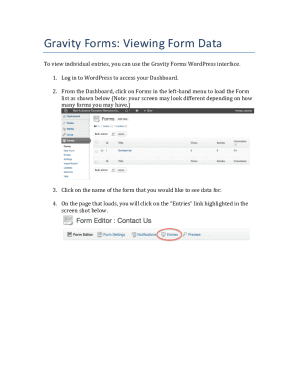

Editing t-102 schedule of oformr online

Follow the steps below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit t-102 schedule of oformr. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

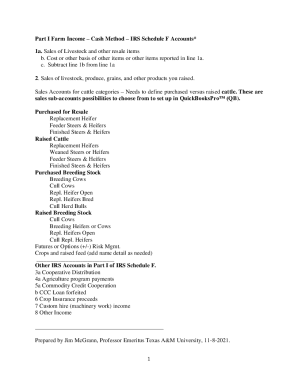

How to fill out t-102 schedule of oformr

How to fill out T-102: Schedule of Other Tobacco Products Credits (Adjustments)

01

Gather all necessary documentation related to other tobacco products.

02

Review the instructions for completing the T-102 form to understand the categories of credits and adjustments.

03

Begin filling out the form by entering your business details at the top of the page.

04

List each type of tobacco product in the appropriate section, specifying the quantity and any relevant details.

05

Calculate the total credits for each category and enter them in the designated fields.

06

Include any adjustments based on your records, ensuring accurate calculations.

07

Review the completed form for accuracy and compliance with the guidelines.

08

Submit the form to the relevant tax authority by the specified deadline.

Who needs T-102: Schedule of Other Tobacco Products Credits (Adjustments)?

01

Manufacturers of other tobacco products.

02

Distributors managing inventory of tobacco products.

03

Retailers engaged in the sale of tobacco products.

Fill

form

: Try Risk Free

People Also Ask about

What is the tobacco tax in Illinois?

State Legislated Actions on Tobacco Issues (SLATI) State (sort A-Z)Tax Rate (sort ↑↓) Georgia 0.370 Hawaii 3.200 Idaho 0.570 Illinois 2.98046 more rows • Jul 22, 2024

Which state has the highest tobacco tax?

New York has the largest state cigarette tax at $5.35 per pack, and New York City levies an additional $1.50 cigarette tax per pack. Layers of taxation force state and federal governments to consider each other's tax policies.

Why are cigarettes so expensive in Illinois?

Illinois is 10th in the nation for cigarette smuggling, where people sell packs from other states because Illinois state cigarette taxes are $2.98 for a package of 20 cigarettes. For Chicagoans, state and local taxes push the total tax burden to $7.16 per pack, the highest of any city in the nation.

Is tobacco tax deductible?

A heated tobacco product (HTP) is a tobacco product that heats the tobacco at a lower temperature than conventional cigarettes. These products contain nicotine, which is a highly addictive chemical. The heat generates an aerosol or smoke to be inhaled from the tobacco, which contains nicotine and other chemicals.

What is the purpose of the Tobacco Control Act?

You can only deduct ordinary and necessary business expenses under IRC section 162. Smoking is neither ordinary or necessary.

What is Illinois tobacco tax?

State Legislated Actions on Tobacco Issues (SLATI) State (sort A-Z)Tax Rate (sort ↑↓) Georgia 0.370 Hawaii 3.200 Idaho 0.570 Illinois 2.98046 more rows • Jul 22, 2024

Did Illinois raise cigarette tax?

The biggest increase in smuggling from 2019-2020 came in Illinois. Illinois increased its cigarette tax rate by $1.00 per pack, resulting in a new state excise tax of $2.98. Including the $3.00 per pack tax in Cook County and $1.18 per pack in the city of Chicago brings the total taxes in Chicago to $7.16 per pack.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is T-102: Schedule of Other Tobacco Products Credits (Adjustments)?

T-102: Schedule of Other Tobacco Products Credits (Adjustments) is a tax form used to report adjustments and claims for credits related to other tobacco products, ensuring accurate calculation of tax liabilities.

Who is required to file T-102: Schedule of Other Tobacco Products Credits (Adjustments)?

Entities and individuals who manufacture, import, or deal in other tobacco products and wish to claim credits or adjustments to their tax liabilities are required to file T-102.

How to fill out T-102: Schedule of Other Tobacco Products Credits (Adjustments)?

To fill out T-102, gather all necessary data about tobacco product transactions, complete the form sections detailing the applicable credits or adjustments, and ensure accurate calculations before submission.

What is the purpose of T-102: Schedule of Other Tobacco Products Credits (Adjustments)?

The purpose of T-102 is to provide a structured process for reporting any adjustments to taxes owed on other tobacco products, allowing for accurate compliance with tax regulations.

What information must be reported on T-102: Schedule of Other Tobacco Products Credits (Adjustments)?

Information that must be reported includes details of the tobacco products, the nature of the adjustments or credits claimed, the respective tax periods, and any supporting documentation as required.

Fill out your t-102 schedule of oformr online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

T-102 Schedule Of Oformr is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.