Get the free 2002 Michigan SBT Investment Tax Credit

Show details

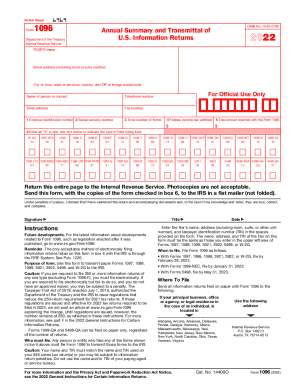

This form calculates the Investment Tax Credit (ITC) for taxpayers in Michigan based on eligible capital investments made during the tax year.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2002 michigan sbt investment

Edit your 2002 michigan sbt investment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2002 michigan sbt investment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2002 michigan sbt investment online

To use the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit 2002 michigan sbt investment. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2002 michigan sbt investment

How to fill out 2002 Michigan SBT Investment Tax Credit

01

Obtain the 2002 Michigan SBT Investment Tax Credit application form from the Michigan Department of Treasury website.

02

Review the eligibility criteria to ensure your business qualifies for the tax credit.

03

Gather required documentation related to your investments, including records of eligible equipment purchases and improvements.

04

Complete the application form by providing all necessary information, including business details, tax identification number, and financial data.

05

Calculate the tax credit amount based on the eligible investments made during the relevant tax year.

06

Attach all required documentation to support your claims on the application form.

07

Double-check the completed application for accuracy and completeness.

08

Submit the application by the specified deadline, either online or via mail to the Michigan Department of Treasury.

Who needs 2002 Michigan SBT Investment Tax Credit?

01

Businesses operating in Michigan that have made eligible investments in equipment or improvements.

02

Companies that participate in the Michigan Single Business Tax program and meet the investment threshold.

03

Manufacturers and certain other qualified businesses looking to reduce their tax liability through investment.

04

Businesses seeking to reinvest in their operations to enhance productivity and competitiveness.

Fill

form

: Try Risk Free

People Also Ask about

How does the investment tax credit work?

Investment tax credits are basically a federal tax incentive for business investment. They let individuals or businesses deduct a certain percentage of investment costs from their taxes. These credits are in addition to normal allowances for depreciation.

What does ITC tax credit mean?

Investment Tax Credit (ITC)

How much is the investment tax credit?

Quick facts. The ITC is a 30 percent tax credit for individuals installing solar systems on residential property (under Section 25D of the tax code).

Who qualifies for an ITC tax credit?

The ITC is a 30 percent tax credit for individuals installing solar systems on residential property (under Section 25D of the tax code). The Section 48 commercial credit can be applied to both customer-sited commercial solar systems and large-scale utility solar farms.

What is the purpose of the investment tax credit?

Investment tax credits are basically a federal tax incentive for business investment. They let individuals or businesses deduct a certain percentage of investment costs from their taxes. These credits are in addition to normal allowances for depreciation.

Can you sell investment tax credits?

A seller can transfer all of part of the tax credits. For example, the sale can be for a set dollar amount of tax credits. It can be for a percentage of the tax credits. Some tax equity investors want the ability to direct a partnership to sell only the tax credits that would otherwise be allocated to them.

Do you actually get money back from solar tax credit?

When you purchase solar equipment for your home and have tax liability, you generally can claim a solar tax credit to lower your tax bill. The Residential Clean Energy Credit is non-refundable meaning that it can offset your income tax liability dollar-for-dollar, but any excess credit won't be refunded.

What is the US investment Tax Credit ITC?

Investment tax credit Base credit: The ITC is 30% of eligible costs for projects 1 megawatt (MW) or smaller in size and 6% for projects larger than 1 MW. Increased credit: Projects larger than 1 MW can increase their credit to 30% by meeting prevailing wage and apprenticeship requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2002 Michigan SBT Investment Tax Credit?

The 2002 Michigan SBT Investment Tax Credit is a tax incentive program designed to encourage businesses to invest in property and equipment in Michigan, allowing eligible companies to reduce their Single Business Tax liability based on their investment.

Who is required to file 2002 Michigan SBT Investment Tax Credit?

Businesses that have made eligible investments in tangible assets and are subject to the Michigan Single Business Tax are required to file the 2002 Michigan SBT Investment Tax Credit.

How to fill out 2002 Michigan SBT Investment Tax Credit?

To fill out the 2002 Michigan SBT Investment Tax Credit, businesses need to complete the designated forms provided by the Michigan Department of Treasury, reporting their eligible investments and calculating the credit amount based on their investment activities.

What is the purpose of 2002 Michigan SBT Investment Tax Credit?

The purpose of the 2002 Michigan SBT Investment Tax Credit is to stimulate economic growth by incentivizing businesses to invest in the state, ultimately leading to job creation and enhanced competitiveness for Michigan's economy.

What information must be reported on 2002 Michigan SBT Investment Tax Credit?

The information that must be reported includes details of the eligible investments made, the type of tangible assets acquired, the cost of these assets, and the calculations used to determine the credit amount.

Fill out your 2002 michigan sbt investment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2002 Michigan Sbt Investment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.