Get the free Irrevocable Standby Letter of Credit

Show details

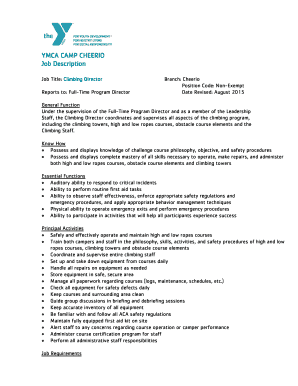

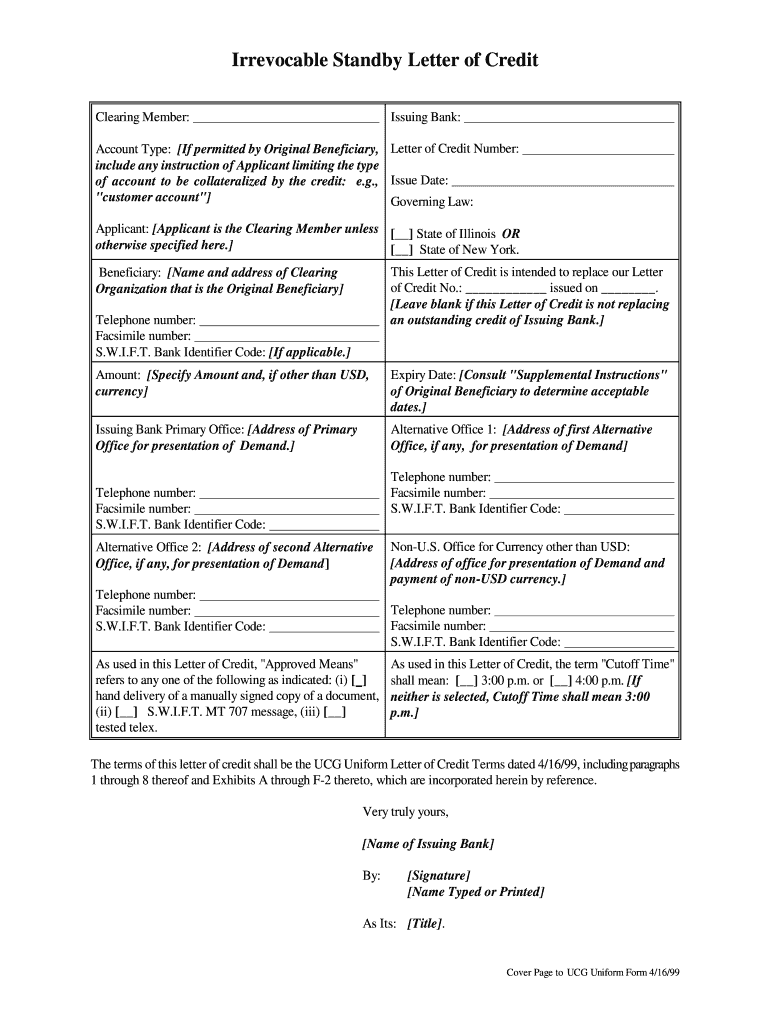

This document outlines the terms and conditions for an Irrevocable Standby Letter of Credit, detailing the roles of the Issuing Bank, Applicant, and Beneficiary, along with the procedures for making

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign irrevocable standby letter of

Edit your irrevocable standby letter of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your irrevocable standby letter of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing irrevocable standby letter of online

To use the services of a skilled PDF editor, follow these steps:

1

Log in to account. Click on Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit irrevocable standby letter of. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out irrevocable standby letter of

How to fill out Irrevocable Standby Letter of Credit

01

Begin by obtaining a blank Irrevocable Standby Letter of Credit form from your bank or financial institution.

02

Fill in the date on which the letter of credit is being issued.

03

Provide the name and address of the issuing bank.

04

Specify the applicant's name and address (the party requesting the letter of credit).

05

Identify the beneficiary's name and address (the party that will receive the payment).

06

Clearly state the amount of money that the letter of credit covers.

07

Outline the conditions under which the beneficiary can draw on the letter of credit.

08

Indicate the validity period of the letter of credit, including the expiration date.

09

Include any additional terms or conditions required by the issuing bank or the parties involved.

10

Sign and date the document and submit it to the bank for processing.

Who needs Irrevocable Standby Letter of Credit?

01

Businesses that require assurance of payment for their goods or services.

02

Companies engaged in international trade that need security against default.

03

Parties involved in contractual agreements where performance guarantees are necessary.

04

Sellers looking to mitigate risk in transactions with new or untested buyers.

Fill

form

: Try Risk Free

People Also Ask about

How much does an irrevocable standby letter of credit cost?

LC: LCs can be amended or cancelled by the issuing bank with the consent of all parties involved. SBLC: SBLCs are usually irrevocable and cannot be amended or cancelled without the consent of all parties.

What is the irrevocable LC?

An irrevocable letter of credit (LC) is a type of LC that cannot be modified or canceled without the agreement of all parties involved, including the buyer, seller, and issuing bank. The issuing bank is responsible for making payments without fail, provided the seller complies with the stipulated guidelines in the LC.

What is the difference between SBLC and irrevocable LC?

A revocable letter of credit is uncommon because it can be changed or cancelled by the bank that issued it at any time and for any reason. An irrevocable letter of credit cannot be changed or cancelled unless everyone involved agrees. Irrevocable letters of credit provide more security than revocable ones.

What is the difference between standby and irrevocable letter of credit?

Irrevocable letters of credit can also be referred to as standby letters of credit. Once an irrevocable letter of credit is issued, all parties are contractually bound by it. This means that even if the buyer in a transaction doesn't pay, the bank is obligated to make payment to the seller to satisfy the agreement.

Which is better, LC or SBLc?

Practical Tips for Choosing the Right Instrument Understand Your Needs: For immediate payment assurances, choose LC. For backup financial security, SBLC is the better option.

What is an irrevocable standby letter of credit?

The primary cost associated with an SBLC is the fee charged by the bank for issuing it. This fee typically ranges from 1% to 10% per year of the SBLC's face value, depending on the bank's assessment of risk. The riskier the client's business proposition or the lower their creditworthiness, the higher the fee.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Irrevocable Standby Letter of Credit?

An Irrevocable Standby Letter of Credit is a financial document issued by a bank guaranteeing payment to a beneficiary if the applicant fails to fulfill contractual obligations. It is 'irrevocable' because it cannot be amended or canceled without the consent of all parties involved.

Who is required to file Irrevocable Standby Letter of Credit?

Typically, a business or individual entering into a contractual agreement that involves risk of non-performance is required to file an Irrevocable Standby Letter of Credit. This is often done in scenarios involving loans, lease agreements, or trade contracts.

How to fill out Irrevocable Standby Letter of Credit?

Filling out an Irrevocable Standby Letter of Credit generally involves providing details such as the beneficiary's name, the applicant's name, the amount guaranteed, expiration date, terms and conditions for drawing on the letter, and required documentation to present when making a claim.

What is the purpose of Irrevocable Standby Letter of Credit?

The purpose of an Irrevocable Standby Letter of Credit is to provide assurance to the beneficiary that they will receive payment if the applicant defaults on their duties. It acts as a safety net, encouraging trust and facilitating business transactions.

What information must be reported on Irrevocable Standby Letter of Credit?

Information that must be reported on an Irrevocable Standby Letter of Credit includes the names of the applicant and beneficiary, the maximum amount covered, the expiration date, the conditions under which the credit can be drawn upon, and any expiration of the credit itself.

Fill out your irrevocable standby letter of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irrevocable Standby Letter Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.