Get the free Loan or Origination Rights Transfer

Show details

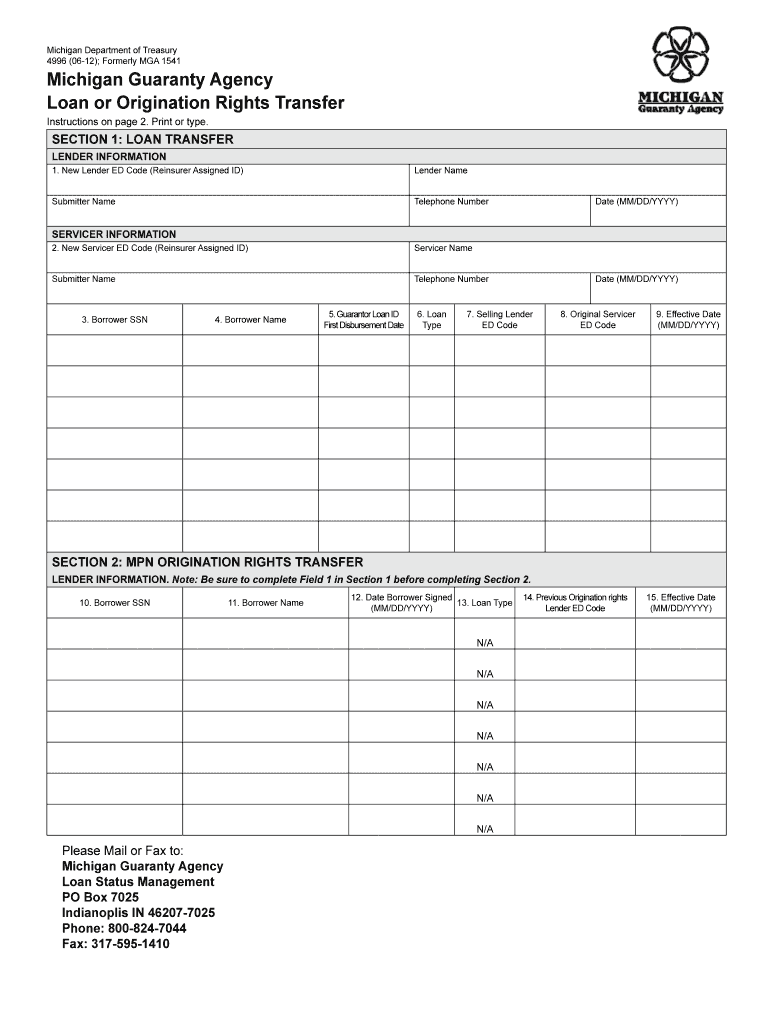

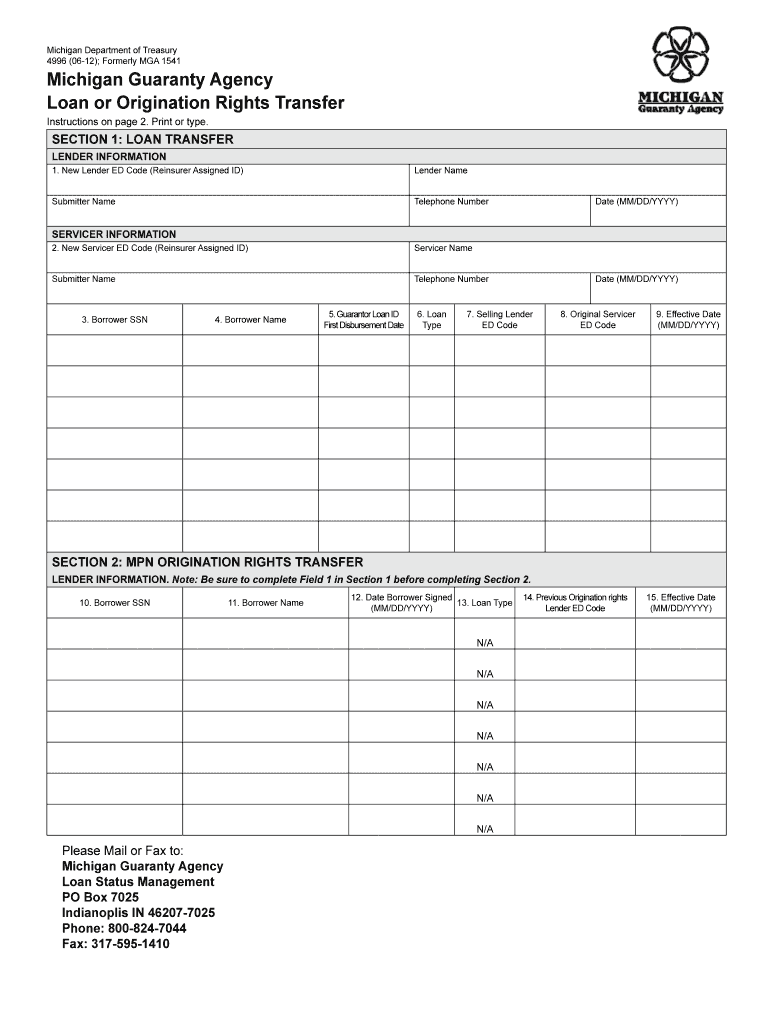

This form is used to report the sale or transfer of loans and the transfer of origination rights for loans. It includes sections for lender and servicer information, borrower details, and instructions

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign loan or origination rights

Edit your loan or origination rights form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your loan or origination rights form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing loan or origination rights online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit loan or origination rights. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out loan or origination rights

How to fill out Loan or Origination Rights Transfer

01

Gather necessary documents such as loan agreements and borrower information.

02

Complete the Loan or Origination Rights Transfer form with accurate details.

03

Ensure all parties involved sign the document.

04

Submit the completed form to the relevant financial institution or authority.

05

Keep a copy of the submitted form for your records.

Who needs Loan or Origination Rights Transfer?

01

Lenders looking to transfer loan rights to another party.

02

Financial institutions involved in buying or selling loan portfolios.

03

Investors interested in acquiring origination rights for financial returns.

Fill

form

: Try Risk Free

People Also Ask about

What is a loan agreement in English law?

A loan agreement is a legally binding contract so before signing the loan agreement it is wise to review the contract to understand the obligations placed on you when acquiring the loan. Each loan agreement will be unique to match to the circumstances of the borrower and to the specific transaction.

What does it mean when your mortgage loan is transferred?

key takeaways. A transfer of mortgage is the reassignment of an existing mortgage from the current holder to another person or entity. Not all mortgages can be transferred to another person. If a mortgage can be transferred, the lender has the right to approve the person assuming the loan.

Is it normal for a mortgage loan to be transferred?

Mortgage companies often sell loans to other financial institutions or investors for various reasons. One common reason is that it allows them to free up capital and have more funds available to issue new loans. Selling loans also helps manage risk and maintain liquidity for the lending institution.

Is balance transfer a good idea for a personal loan?

A longer repayment tenure allows you to repay your loan EMIs flexibly, fitting within your monthly budget. You may benefit from a Personal Loan Balance Transfer if you feel that the services provided by your new potential lender may be better than what is currently on offer to you.

Why would a mortgage company transfer your loan?

A straight port means the principal amount of the mortgage on the new property is the same as the remaining principal amount of the original mortgage. The interest rate for the new mortgage will be the same as the original mortgage, and the term will be the same as the remaining term of the original mortgage.

What is the meaning of loan origination?

Loan origination is the process by which a borrower applies for a new loan, and a lender processes that application. Origination generally includes all the steps from taking a loan application up to disbursal of funds (or declining the application). For mortgages, there is a specific mortgage origination process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Loan or Origination Rights Transfer?

Loan or Origination Rights Transfer refers to the process of transferring the rights to a loan or the origination rights of a mortgage from one party to another, allowing the new holder to manage or receive payments on the loan.

Who is required to file Loan or Origination Rights Transfer?

Typically, the lender or the person/entity that is assigning the loan or origination rights is required to file the Loan or Origination Rights Transfer.

How to fill out Loan or Origination Rights Transfer?

To fill out a Loan or Origination Rights Transfer, parties must complete the required forms with relevant details such as loan identification, information about the parties involved, terms of the transfer, and signatures.

What is the purpose of Loan or Origination Rights Transfer?

The purpose of Loan or Origination Rights Transfer is to legally formalize the change in ownership or management of a loan or mortgage, ensuring that all parties have clear records and responsibilities.

What information must be reported on Loan or Origination Rights Transfer?

Information that must be reported includes loan details (loan number, amount), names and addresses of the transferring and receiving parties, any special terms related to the transfer, and date of the transfer.

Fill out your loan or origination rights online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Loan Or Origination Rights is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.