Get the free Application to Purchase Tax Foreclosed Property

Show details

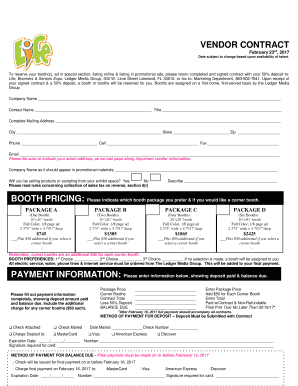

This form is used by governmental agencies to apply for the purchase of tax foreclosed property in Michigan. It requires applicant and deed issuance information, as well as bidding details, and must

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application to purchase tax

Edit your application to purchase tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application to purchase tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application to purchase tax online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit application to purchase tax. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application to purchase tax

How to fill out Application to Purchase Tax Foreclosed Property

01

Obtain the Application to Purchase Tax Foreclosed Property form from the relevant local government website or office.

02

Read through the instructions provided on the form carefully to understand the requirements.

03

Fill in your personal details, including your name, address, and contact information.

04

Provide information about the property you wish to purchase, including its address and parcel number.

05

Attach any necessary documentation, such as proof of identity and financial capability.

06

Review the application for accuracy and completeness.

07

Submit the application form along with any required fees to the designated office.

Who needs Application to Purchase Tax Foreclosed Property?

01

Individuals or investors interested in purchasing foreclosed properties due to unpaid taxes.

02

Real estate developers looking for investment opportunities in tax delinquent properties.

03

Property owners wishing to acquire adjacent or nearby foreclosed land for consolidation.

04

Non-profit organizations seeking to rehabilitate or develop affordable housing.

Fill

form

: Try Risk Free

People Also Ask about

What's the difference between tax foreclosure and mortgage foreclosure?

If the borrower defaults on the mortgage, the lender can foreclose on the property and sell it to recover the unpaid debt. However, if there is a tax lien on the property, the mortgage lien will have secondary priority. This means that the mortgage lender will only be paid after the tax lien has been satisfied.

Can you take ownership of a property by paying back taxes?

In California, paying someone else's taxes, even if done in good faith, is considered a gesture of goodwill or a means of avoiding a tax lien, but no matter the motive, payment does not transfer legal ownership.

Can you buy a property that has a tax lien on it?

Property with a lien attached to it cannot be sold or refinanced until the taxes are paid and the lien is removed. When a lien is issued, a tax lien certificate is created by the municipality that reflects the amount owed on the property plus any interest or penalties due.

What does it mean when a property is tax foreclosure?

Foreclosure is a legal proceeding by which the county enforces payment of real property taxes. The county acquires legal title to a property if the taxes aren't paid by a certain date.

How long can property taxes go unpaid in Colorado?

The property owner has three years to redeem the tax lien before the investor is eligible to apply for a treasurer's deed on the property. In addition to the amount of the delinquent taxes, the property owner pays an interest charge, which is credited to the tax lien investor.

How does tax foreclosure work?

Foreclosure is a legal proceeding by which the county enforces payment of real property taxes. The county acquires legal title to a property if the taxes aren't paid by a certain date.

How do I buy tax delinquent properties in SC?

0:12 2:05 After purchasing a tax lean you will receive a tax lean certificate. This certificate gives you aMoreAfter purchasing a tax lean you will receive a tax lean certificate. This certificate gives you a claim against the property.

What are the disadvantages of tax lien investing?

Many have an expiration date after the end of the redemption period. Once the lien expires, the lienholder becomes unable to collect any unpaid balance. If the property goes into foreclosure, the lienholder may discover other liens on the property, which can make it impossible to obtain the title.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Application to Purchase Tax Foreclosed Property?

The Application to Purchase Tax Foreclosed Property is a legal document that allows individuals or entities to apply for the opportunity to buy properties that have been foreclosed due to unpaid property taxes.

Who is required to file Application to Purchase Tax Foreclosed Property?

Typically, any individual or entity interested in purchasing a property that has been foreclosed due to tax delinquencies is required to file this application.

How to fill out Application to Purchase Tax Foreclosed Property?

To fill out the Application to Purchase Tax Foreclosed Property, applicants must complete the provided form with necessary details such as their personal information, the specific property they wish to purchase, and any additional required documentation as specified by the local tax authority.

What is the purpose of Application to Purchase Tax Foreclosed Property?

The purpose of the Application to Purchase Tax Foreclosed Property is to provide a formal process for interested buyers to submit their intent to purchase foreclosed properties, thereby facilitating the sale and transfer of these properties in accordance with local laws.

What information must be reported on Application to Purchase Tax Foreclosed Property?

The information that must be reported typically includes the applicant's name and contact information, the tax identification number of the property, the description of the property, the reason for purchase, and any other relevant details requested by the local authority.

Fill out your application to purchase tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application To Purchase Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.