Get the free 2010 MICHIGAN Business Tax Miscellaneous Credits for Insurance Companies

Show details

This form is used by insurance companies to calculate certain refundable and nonrefundable credits under the Michigan Business Tax (MBT). It details eligibility requirements for various credits, including

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2010 michigan business tax

Edit your 2010 michigan business tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2010 michigan business tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2010 michigan business tax online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2010 michigan business tax. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

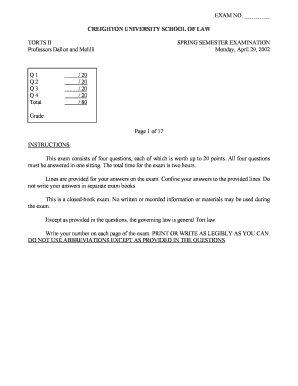

How to fill out 2010 michigan business tax

How to fill out 2010 MICHIGAN Business Tax Miscellaneous Credits for Insurance Companies

01

Obtain the 2010 Michigan Business Tax Miscellaneous Credits for Insurance Companies form from the Michigan Department of Treasury website.

02

Ensure you have all relevant financial documents and records related to your insurance company's operations for the tax year.

03

Fill in the company information at the top of the form, including the name, address, and tax identification number.

04

Complete each section of the form meticulously, providing detailed information about the credits you are claiming.

05

Calculate the total amount of miscellaneous credits based on the instructions provided on the form.

06

Review the form for accuracy, ensuring all calculations are correct and all necessary documentation is attached.

07

Sign and date the form before submission.

08

Submit the completed form by the deadline specified by the Michigan Department of Treasury, either electronically or via mail.

Who needs 2010 MICHIGAN Business Tax Miscellaneous Credits for Insurance Companies?

01

Insurance companies operating in Michigan that are subject to the Michigan Business Tax and are eligible for miscellaneous credits.

Fill

form

: Try Risk Free

People Also Ask about

What is the insurance premium tax in Michigan?

The premiums tax is calculated at 1.25% of gross direct premiums written on property or risk located in Michigan. Insurance companies are permitted certain exclusions from the tax base and a limited number of insurance-specific credits.

Who must file a Michigan trust return?

You must file a Michigan Fiduciary Income Tax Return (Form MI-1041) and pay the tax due if you are the fiduciary for an estate or trust that was required to file a U.S. Form 1041 or 990-T or that had income taxable to Michigan that was not taxable on the U.S. Form 1041.

Who must file form 4567 in Michigan?

In Michigan, a UBG with standard members must file Form 4567. A Designated Member (DM) must file the return on behalf of the standard members of the group. In a parent- subsidiary controlled group, the controlling member must serve as DM if it has nexus with Michigan.

Who needs to file a Michigan state tax return?

Who has to file Michigan state income tax? If you are a Michigan resident, you must file a return if you file a federal return or if your income exceeds the exemption allowance. In addition, nonresidents who earn income from Michigan sources—like business or rental income—may also need to file.

Is there a Michigan tax credit?

Under the new law, starting with taxes filed in 2023 (for tax year 2022), the Michigan credit was increased to 30% of the federal credit. In the same example, a family qualifying for a $3000 federal EITC refund will now receive an additional $900 ($3000 x 30%) from the state of Michigan.

Who must file Michigan Form 4567?

In Michigan, a UBG with standard members must file Form 4567. A Designated Member (DM) must file the return on behalf of the standard members of the group. In a parent- subsidiary controlled group, the controlling member must serve as DM if it has nexus with Michigan.

Who has to file a Michigan corporate tax return?

The Corporate Income Tax (CIT) has a flat rate of 6% and has to be filed by profit corporations in the state of Michigan. This is one of the important Michigan Corporation taxes and will not be applicable if the apportioned gross receipts are less than $350,000.

What tax credits are available for businesses?

Claim credits Employer-provided childcare credit. Businesses that provide childcare for their employees are eligible for a tax credit. Opportunity Zones. Fuel Tax Credit. Clean vehicle credits. Credit for builders of energy-efficient homes. Advanced energy project credit. Work Opportunity Tax Credit. Research credit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2010 MICHIGAN Business Tax Miscellaneous Credits for Insurance Companies?

The 2010 MICHIGAN Business Tax Miscellaneous Credits for Insurance Companies is a specific set of tax credits that insurance companies operating in Michigan can apply for to reduce their overall business tax liability. These credits may be based on various factors, including investments, employment, and local development activities.

Who is required to file 2010 MICHIGAN Business Tax Miscellaneous Credits for Insurance Companies?

Insurance companies that are subject to the Michigan Business Tax and are claiming miscellaneous credits designed for tax reduction are required to file the 2010 MICHIGAN Business Tax Miscellaneous Credits form.

How to fill out 2010 MICHIGAN Business Tax Miscellaneous Credits for Insurance Companies?

To fill out the 2010 MICHIGAN Business Tax Miscellaneous Credits form, companies need to gather relevant financial information, correctly complete sections related to their business activities, calculate eligible credits, and ensure all figures align with supporting documentation before submitting the form along with their regular business tax filing.

What is the purpose of 2010 MICHIGAN Business Tax Miscellaneous Credits for Insurance Companies?

The purpose of the 2010 MICHIGAN Business Tax Miscellaneous Credits for Insurance Companies is to incentivize insurance companies to invest in the Michigan economy, promote growth, and maintain operations in the state by providing financial relief through tax credits.

What information must be reported on 2010 MICHIGAN Business Tax Miscellaneous Credits for Insurance Companies?

The information that must be reported includes the type and amount of credits being claimed, detailed financial data relevant to eligibility, and any other pertinent business operational information that supports the application for the miscellaneous credits.

Fill out your 2010 michigan business tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2010 Michigan Business Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.