MI Form 4622 2015 free printable template

Show details

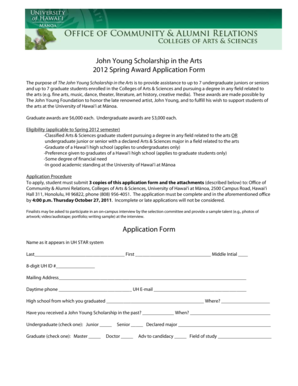

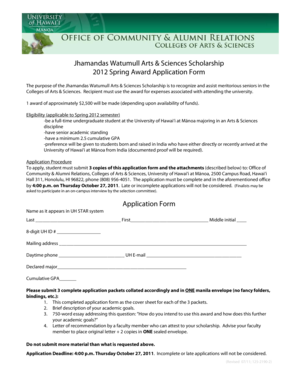

Michigan Department of Treasury 4622 (Rev. 10-10) Worksheet for Determining Support Issued under authority of Public Act 281 of 1967. Keep a copy for your records. Refer to Internal Revenue Service

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MI Form 4622

Edit your MI Form 4622 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MI Form 4622 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MI Form 4622 online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit MI Form 4622. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MI Form 4622 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MI Form 4622

How to fill out MI Form 4622

01

Begin by downloading MI Form 4622 from the official website or obtaining a physical copy.

02

Fill out the personal information section, including your name, address, and contact details.

03

Provide details about the purpose of the form in the designated section.

04

If applicable, include any relevant identification numbers or references.

05

Review the form for accuracy and completeness before signing.

06

Submit the completed form to the designated agency or organization as specified in the instructions.

Who needs MI Form 4622?

01

Individuals applying for assistance or benefits related to state programs.

02

Organizations or entities that require documentation for compliance with state regulations.

Fill

form

: Try Risk Free

People Also Ask about

Do I need to file a Michigan tax return as a non resident?

You must file a Michigan Individual Income Tax return. Required forms include (not limited to): MI-1040, Schedule 1, Schedule NR, and Schedule W. You were a non-resident of Michigan. You had income earned in Michigan and/or attributable to Michigan.

What is the personal exemption allowance in Michigan?

For the 2022 income tax returns, the individual income tax rate for Michigan taxpayers is 4.25 percent, and the personal exemption is $5,000 for each taxpayer and dependent. An additional personal exemption is available if you are the parent of a stillborn child in 2022.

What is the income tax exemption for 2023?

2023 Standard Deduction Amounts Filing statusAmountFor single filers$13,850For heads of household$20,800For married joint filers$27,700 Feb 28, 2023

What is the personal exemption for 2023 in Michigan?

The personal exemption amount for 2023 is $5,400.

Can I file a Michigan extension electronically?

If you choose to make your extension payment electronically, you do not need to mail Form 4 to Treasury. Estimate tax liability for the year and pay any unpaid portion of the estimate with the application for extension.

How many exemptions should I claim on my Michigan W4?

MICHIGAN WITHHOLDING EXEMPTION CERTIFICATE (Form MI-W4) Your employer is required to notify the Michigan Department of Treasury if you have claimed 10 or more personal or dependency exemptions or claimed that you are exempt from withholding.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in MI Form 4622 without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your MI Form 4622, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I create an eSignature for the MI Form 4622 in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your MI Form 4622 and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I complete MI Form 4622 on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your MI Form 4622. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

What is MI Form 4622?

MI Form 4622 is a form used for reporting specific financial transactions in Michigan, typically related to tax assessments or audits.

Who is required to file MI Form 4622?

Individuals and businesses in Michigan who have conducted certain financial transactions that require reporting to the state are required to file MI Form 4622.

How to fill out MI Form 4622?

To fill out MI Form 4622, gather the necessary financial information, complete each section of the form accurately, and ensure that all required signatures are included before submission.

What is the purpose of MI Form 4622?

The purpose of MI Form 4622 is to provide the Michigan Department of Treasury with detailed information regarding certain financial activities, aiding in tax compliance and enforcement.

What information must be reported on MI Form 4622?

MI Form 4622 requires reporting information such as transaction amounts, dates, involved parties, and any relevant financial details specific to the transactions being reported.

Fill out your MI Form 4622 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MI Form 4622 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.