Get the free MBT Additional Tax Credit for Qualified Utilities Worksheet

Show details

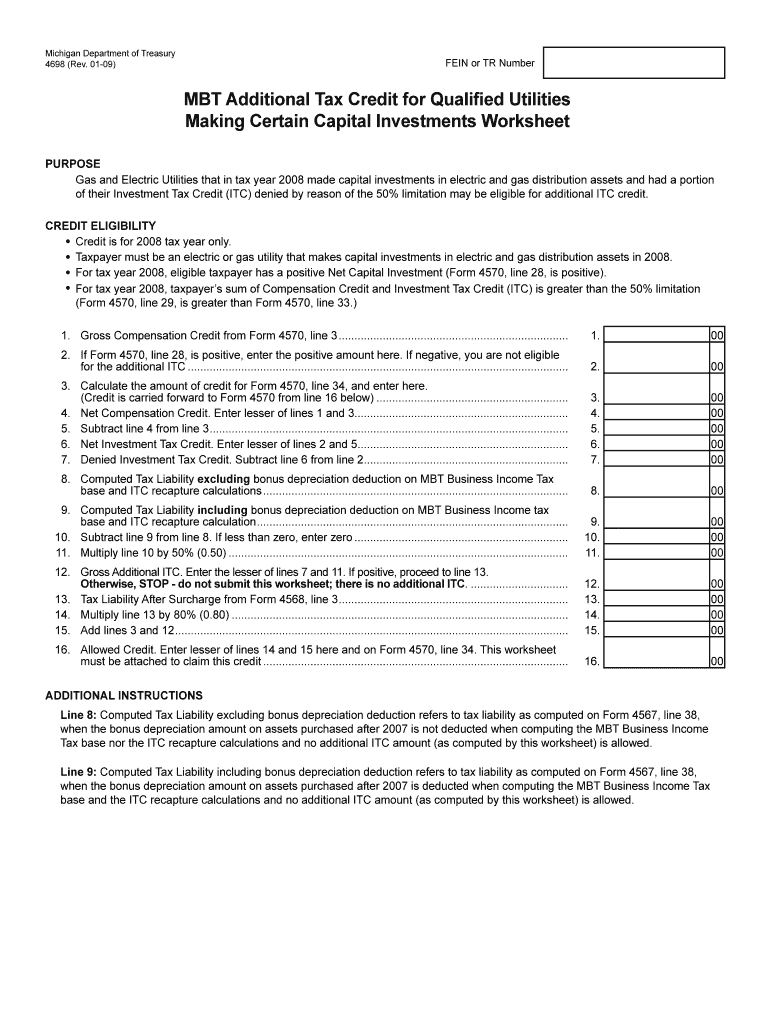

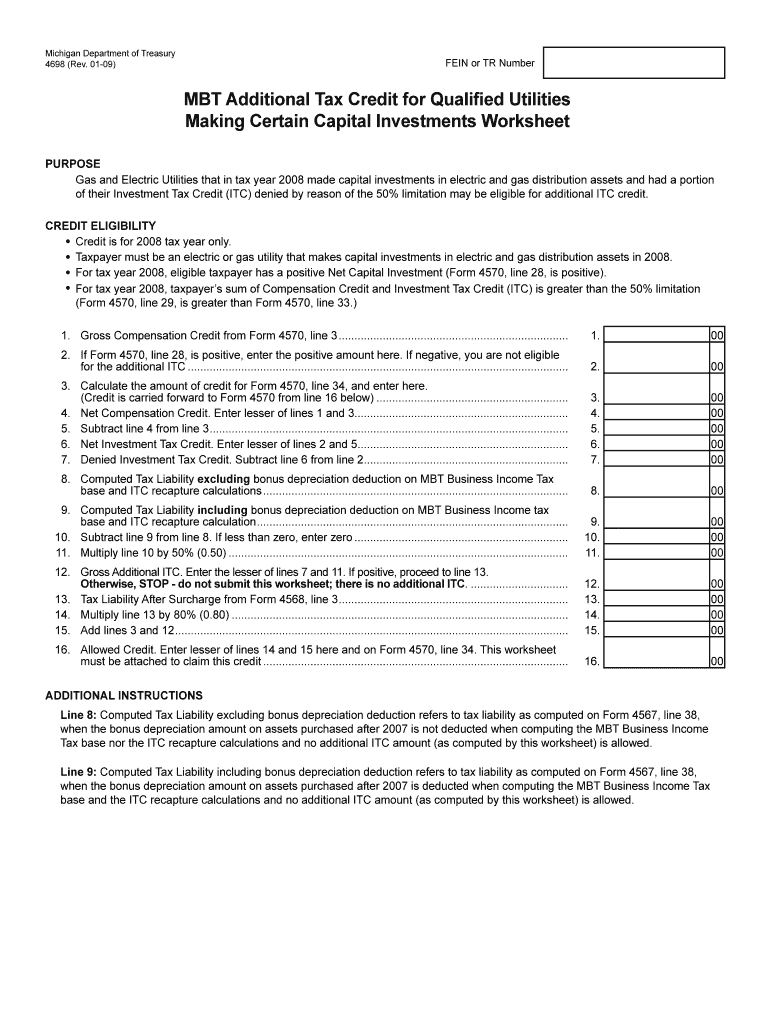

This worksheet is used by gas and electric utilities to determine eligibility for an additional Investment Tax Credit (ITC) based on capital investments made in the 2008 tax year.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mbt additional tax credit

Edit your mbt additional tax credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mbt additional tax credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mbt additional tax credit online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit mbt additional tax credit. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mbt additional tax credit

How to fill out MBT Additional Tax Credit for Qualified Utilities Worksheet

01

Obtain the MBT Additional Tax Credit for Qualified Utilities Worksheet from the Michigan Department of Treasury website.

02

Review the eligibility requirements for claiming the additional tax credit.

03

Gather documentation of your qualified utility expenditures, including invoices and receipts.

04

In the worksheet, enter your business information in the designated fields at the top.

05

Fill out the section that details your qualified utilities expenses, listing each expense type and amount.

06

Calculate the total qualified utilities expenses as directed on the worksheet.

07

Apply the appropriate percentage as specified for the credit calculation and compute the total credit amount.

08

Double-check all entries for accuracy.

09

Include the completed worksheet with your MBT return when filing.

Who needs MBT Additional Tax Credit for Qualified Utilities Worksheet?

01

Businesses operating in Michigan that have incurred qualified utility expenses and wish to claim a credit against their Michigan Business Tax.

Fill

form

: Try Risk Free

People Also Ask about

What is the most common mistake made on taxes?

Read below for some of the most common tax mistakes and learn how to avoid making them when you file. Filing past the deadline. Forgetting to file quarterly estimated taxes. Leaving out (or messing up) essential information. Failing to double-check your math. Missing out on a potential tax break.

Where is the tax computation worksheet?

The Tax Computation Worksheet is an internal TurboTax calculation based on the worksheet that is in the IRS Form 1040 instructions after the tax tables.

How do you qualify for additional tax credit?

To claim the ACTC, you need to meet the same income and dependent criteria as the CTC, and there are also additional rules to consider: You must have earned income of at least $2,500 or have three or more qualifying dependents.

What is the most overlooked tax break?

The 10 Most Overlooked Tax Deductions State sales taxes. Reinvested dividends. Out-of-pocket charitable contributions. Student loan interest paid by you or someone else. Moving expenses. Child and Dependent Care Credit. Earned Income Tax Credit (EITC) State tax you paid last spring.

How to calculate utilities for home office tax deduction?

You can write off a percentage of your electricity bill that is equal to the percentage of space that your office occupies in your home. For example, if your home office occupies 20% of the space (square footage) in your home, then 20% of your electricity bill can be used as a tax deduction.

What expenses are 100% tax deductible?

Small businesses can fully deduct the cost of advertising, employee wages, office supplies and equipment, business travel, and professional services like legal or accounting fees. Business insurance premiums, work-related education expenses, and bank fees are also typically 100% deductible.

What are the biggest tax loopholes?

Backdoor IRAs, carried interest, and life insurance are just some of the loopholes you can use to reduce your tax bills. It's important to plan correctly and use the right loopholes, credits, and deductions for your unique situation.

How do people get $10,000 tax refunds?

While a $10,000 tax refund might sound like a dream, it's achievable in certain situations. This typically happens when you've significantly overpaid taxes throughout the year or qualify for substantial tax credits. The key is understanding which credits and deductions you're eligible for.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is MBT Additional Tax Credit for Qualified Utilities Worksheet?

The MBT Additional Tax Credit for Qualified Utilities Worksheet is a form used by eligible utilities to calculate and claim additional tax credits available under the Michigan Business Tax (MBT) for investments or activities that meet certain criteria.

Who is required to file MBT Additional Tax Credit for Qualified Utilities Worksheet?

Utilities that qualify for the additional tax credits under the Michigan Business Tax are required to file the MBT Additional Tax Credit for Qualified Utilities Worksheet to claim these credits.

How to fill out MBT Additional Tax Credit for Qualified Utilities Worksheet?

To fill out the MBT Additional Tax Credit for Qualified Utilities Worksheet, a taxpayer must gather relevant financial and operational data related to their utilities, complete the required fields, and ensure all calculations are in accordance with the provided guidelines for eligibility.

What is the purpose of MBT Additional Tax Credit for Qualified Utilities Worksheet?

The purpose of the MBT Additional Tax Credit for Qualified Utilities Worksheet is to provide a structured means for qualifying utilities to report and claim additional tax credits, ultimately reducing their tax liability and encouraging investment in infrastructure and services.

What information must be reported on MBT Additional Tax Credit for Qualified Utilities Worksheet?

Information required on the MBT Additional Tax Credit for Qualified Utilities Worksheet typically includes details on eligible activities, financial data related to the projects or investments, calculations for the credits being claimed, and identification of the utility organization.

Fill out your mbt additional tax credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mbt Additional Tax Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.