Get the free MI-1041D

Show details

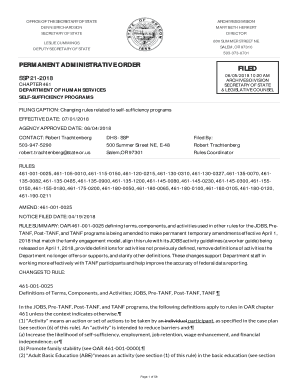

This form is used to adjust Michigan taxable income for estates or trusts with capital gains or losses that arise from various transactions, as specified under Michigan's tax regulations.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mi-1041d

Edit your mi-1041d form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mi-1041d form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing mi-1041d online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit mi-1041d. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mi-1041d

How to fill out MI-1041D

01

Obtain the MI-1041D form from the Michigan Department of Treasury website or your local tax office.

02

Begin by filling in your name and address in the designated fields at the top of the form.

03

Provide your Business Identification Number (BIN) and other relevant tax identification information.

04

Complete the income section by detailing your business income and expenses as required.

05

Fill out any adjustments applicable to your specific tax situation.

06

Review the instructions for any credits or deductions that may apply to your business.

07

Add up your figures carefully to ensure accuracy.

08

Sign and date the form at the bottom before submission.

Who needs MI-1041D?

01

Businesses that are registered in Michigan and need to report specific tax information relating to their operations.

02

Taxpayers who are involved in pass-through entities such as partnerships or S corporations that elect to file on behalf of their members.

Fill

form

: Try Risk Free

People Also Ask about

What is tax exempt income for a trust?

Distributed income is taxed to the beneficiary who receives it. Charitable remainder trust (CRT): This is a tax-exempt trust. As long as income is retained by the trust, no taxes are recognized under current rules. Distributions are taxed to the noncharitable beneficiary.

What does mi translate to in english?

How to use mi in Spanish Spanish possessive adjectiveEnglish possessive adjective mi my tu your su her/his/their (singular)/its nuestro/a our2 more rows • Aug 25, 2023

Is trust income taxable in Michigan?

Michigan cannot impose an income tax on income accumulated by a trust that became irrevocable by the death of the settlor (while a Michigan resident) when all of the following conditions are met: • The trustee is not a Michigan resident. The assets of the trust are neither held, located, nor administered in Michigan.

Do you have to pay taxes on a house in a trust?

Is property inherited from a trust taxable? Yes. The real question is who pays the taxes. That depends upon whether the property was in a revocable or irrevocable trust at the time of the grantor's passing.

Are trusts taxed in Michigan?

Michigan cannot impose an income tax on income accumulated by a trust that became irrevocable by the death of the settlor (while a Michigan resident) when all of the following conditions are met: • The trustee is not a Michigan resident. The assets of the trust are neither held, located, nor administered in Michigan.

Do I have to pay taxes on trust income?

When a portion of a beneficiary's distribution from a trust or the entirety of it originates from the trust's interest income, they generally will be required to pay income taxes on it, unless the trust has already paid the income tax.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is MI-1041D?

MI-1041D is a tax form used in Michigan for reporting the income of estates and trusts.

Who is required to file MI-1041D?

Estates and trusts that have taxable income or owe Michigan tax are required to file MI-1041D.

How to fill out MI-1041D?

To fill out MI-1041D, gather the estate or trust's financial information, complete the necessary sections of the form detailing income, deductions, and calculate the tax due.

What is the purpose of MI-1041D?

The purpose of MI-1041D is to report the income, deductions, and tax liability of estates and trusts to the state of Michigan.

What information must be reported on MI-1041D?

Information that must be reported on MI-1041D includes the estate or trust's gross income, deductions, tax credits, and the names and addresses of beneficiaries.

Fill out your mi-1041d online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mi-1041d is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.