Get the free Missouri Schedule CC Brownfield Redevelopment Program Application for Claiming Brown...

Show details

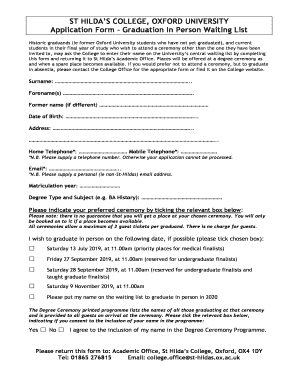

This document is an application for claiming brownfield tax benefits or remediation tax credits in Missouri, requiring details about retained employees and business information.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign missouri schedule cc brownfield

Edit your missouri schedule cc brownfield form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your missouri schedule cc brownfield form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing missouri schedule cc brownfield online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit missouri schedule cc brownfield. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out missouri schedule cc brownfield

How to fill out Missouri Schedule CC Brownfield Redevelopment Program Application for Claiming Brownfield Tax Benefits or Remediation Tax Credits Verification of Retained Employees

01

Obtain the Missouri Schedule CC application form from the Missouri Department of Revenue website.

02

Fill out the applicant's information section including name, address, and contact details.

03

Provide details of the project site including the address of the brownfield property.

04

Specify the type of tax benefits or credits being applied for relevant to the Brownfield Redevelopment Program.

05

List the retained employees and their respective roles, salaries, and start dates under the employment verification section.

06

Attach any necessary supporting documents such as proof of employment and relevant financial information.

07

Review all entries to ensure accuracy and completeness.

08

Submit the completed application form along with supporting documents to the appropriate state department.

Who needs Missouri Schedule CC Brownfield Redevelopment Program Application for Claiming Brownfield Tax Benefits or Remediation Tax Credits Verification of Retained Employees?

01

Businesses seeking tax benefits for rehabilitating brownfield properties in Missouri.

02

Property owners looking to claim remediation tax credits.

03

Developers involved in projects that result in the retention of employees as part of brownfield redevelopment activities.

Fill

form

: Try Risk Free

People Also Ask about

Can you sell brownfield tax credits?

The guaranteed return stemming from the tax credit can attract private banks not normally interested in housing or brownfields projects. A non-profit can sell the tax credits to investors or syndicators and become the principal partner in the project.

What is the brownfield remediation tax credit?

The Brownfields Tax Incentive first passed as part of the Taxpayer Relief Act of 1997. It allowed taxpayers to deduct remediation expenditures for the cleanup of a property if the property was used for trade, business, or producing income.

What is the brownfield remediation process?

Brownfield remediation process Typically, this includes completion of Phase I and Phase II Environmental Site Assessments, Hazardous Materials Surveys, and Property Condition Assessments. These assessments identify conditions that represent potential environmental liability and redevelopment concerns.

How does the 30% tax credit work for geothermal?

In August 2022, the 30% tax credit for geothermal heat pump installations was extended through 2032 and can be retroactively applied to installations “placed in service” on January 1, 2022 or later. Property is usually considered to be placed in service when installation is complete and equipment is ready for use.

What is the brownfield redevelopment incentive?

However, the high costs of remediation often deter private investment. The Brownfields Redevelopment Tax Incentive directly addresses this challenge by allowing developers to fully deduct the cleanup costs of contaminated sites in the year the expenses are incurred, rather than spreading them out over a decade.

What is the brownfield remediation?

Brownfield remediation is the removal or sealing off of that contaminant so that a site may be used again without health concerns. There are hundreds of thousands of brownfields in the United States, including many prime downtown and waterfront properties.

Can you sell brownfield tax credits?

The guaranteed return stemming from the tax credit can attract private banks not normally interested in housing or brownfields projects. A non-profit can sell the tax credits to investors or syndicators and become the principal partner in the project.

How do brownfield tax credits work?

Under this program, states are allocated tax credits each year based on population. Developers submit applications to state housing agencies, who select which developments receive the tax credits. The program is used either to construct buildings or rehabilitate buildings on a brownfield site.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Missouri Schedule CC Brownfield Redevelopment Program Application for Claiming Brownfield Tax Benefits or Remediation Tax Credits Verification of Retained Employees?

The Missouri Schedule CC is a form used by businesses to apply for claiming tax benefits associated with the remediation of brownfield sites, specifically focusing on verifying the number of retained employees as part of the redevelopment process.

Who is required to file Missouri Schedule CC Brownfield Redevelopment Program Application for Claiming Brownfield Tax Benefits or Remediation Tax Credits Verification of Retained Employees?

Businesses that are engaged in qualified brownfield redevelopment projects and seek to claim tax benefits or remediation tax credits are required to file the Missouri Schedule CC.

How to fill out Missouri Schedule CC Brownfield Redevelopment Program Application for Claiming Brownfield Tax Benefits or Remediation Tax Credits Verification of Retained Employees?

To fill out the Missouri Schedule CC, the applicant must provide accurate information regarding their business, the brownfield site, the number of retained employees, and any relevant financial data that supports their claim for tax benefits or credits.

What is the purpose of Missouri Schedule CC Brownfield Redevelopment Program Application for Claiming Brownfield Tax Benefits or Remediation Tax Credits Verification of Retained Employees?

The purpose of the Missouri Schedule CC is to facilitate the verification process for businesses claiming tax benefits related to the cleanup and redevelopment of contaminated sites while ensuring that job retention is maintained as a part of the redevelopment effort.

What information must be reported on Missouri Schedule CC Brownfield Redevelopment Program Application for Claiming Brownfield Tax Benefits or Remediation Tax Credits Verification of Retained Employees?

The information that must be reported includes the business's identification details, the location and description of the brownfield site, the number of employees retained, financial information regarding remediation efforts, and any other relevant data necessary to support the tax benefits claim.

Fill out your missouri schedule cc brownfield online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Missouri Schedule Cc Brownfield is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.