Get the free Application and Agreement for Documentary Letter of Credit (Standby)

Show details

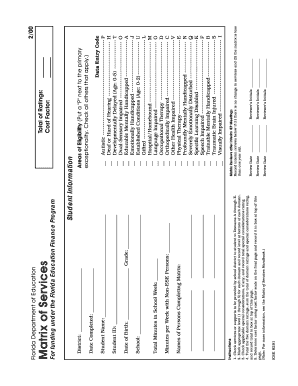

This document serves as a formal request and agreement for issuing an irrevocable letter of credit by Columbia State Bank, detailing the conditions, instructions, and obligations of the customer and

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application and agreement for

Edit your application and agreement for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application and agreement for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application and agreement for online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit application and agreement for. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application and agreement for

How to fill out Application and Agreement for Documentary Letter of Credit (Standby)

01

Gather necessary documents, including company details and purpose of the credit.

02

Fill out the Application form with accurate information such as applicant name, address, and contact details.

03

Specify the amount of the letter of credit and duration required.

04

Detail the beneficiary information, including their bank and account details.

05

Outline the terms and conditions of the standby letter of credit clearly.

06

Sign and date the Application and Agreement form.

07

Submit the completed form to the bank along with any required supporting documents.

Who needs Application and Agreement for Documentary Letter of Credit (Standby)?

01

Businesses seeking to guarantee payments for contracts or obligations.

02

Importers and exporters who need to assure their trading partners of payment.

03

Financial institutions facilitating international trade transactions.

04

Parties involved in large contracts requiring performance assurance.

Fill

form

: Try Risk Free

People Also Ask about

How much does SBLC cost?

Factors Determining SBLC Cost: This fee typically ranges from 1% to 10% per year of the SBLC's face value, depending on the bank's assessment of risk. The riskier the client's business proposition or the lower their creditworthiness, the higher the fee.

What is the difference between standby letter of credit and documentary?

In summary, SBLCs are standby guarantees used as a secondary payment method, LCs are standard financial instruments that guarantee payment upon fulfillment of conditions, and DLCs are LCs that require specific documentation to be presented by the seller for payment.

What documents are required for SBLC?

Documentation Requirements Business Financial Statements: Provide recent financial statements, including balance sheets and income statements, to demonstrate financial health. Trade Contract or Agreement: Submit a copy of the trade agreement or contract necessitating the SBLC, highlighting terms and obligations.

How long does it take to get a standby letter of credit?

Other Alternatives to Letter of Credit Purchase order financing: PO financing provides you cash up front to complete a purchase order. Invoice factoring: Factoring insurance for receivables is an agreement with a third-party company to purchase accounts receivables at a reduced amount of the face value of the invoices.

How to obtain a standby letter of credit?

The process of obtaining an SBLC is similar to a loan application process. The process starts when the buyer applies for an SBLC at a commercial bank. The bank will perform its due diligence on the buyer to assess its creditworthiness, based on past credit history and the most recent credit report.

How much does an SBLc cost?

More often than not, the bank will issue the Standby Letter of Credit (SBLC) within 48 hours of release. Once issued, a copy of the SBLC will be emailed to you as it is transmitted by a MT760 SWIFT message to the beneficiary, including the reference number of the SBLC.

How do I apply for a standby letter of credit?

The process of obtaining an SBLC is similar to a loan application process. The process starts when the buyer applies for an SBLC at a commercial bank. The bank will perform its due diligence on the buyer to assess its creditworthiness, based on past credit history and the most recent credit report.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Application and Agreement for Documentary Letter of Credit (Standby)?

The Application and Agreement for Documentary Letter of Credit (Standby) is a legal document that serves as a request for a financial institution to issue a standby letter of credit. This instrument provides a guarantee to a third party that the bank will fulfill payment obligations on behalf of the applicant if certain conditions are met.

Who is required to file Application and Agreement for Documentary Letter of Credit (Standby)?

The applicant, typically a business or individual seeking financial assurance for a transaction, is required to file the Application and Agreement for Documentary Letter of Credit (Standby) with their financial institution.

How to fill out Application and Agreement for Documentary Letter of Credit (Standby)?

To fill out the Application and Agreement for Documentary Letter of Credit (Standby), the applicant must provide detailed information including their name, address, details of the transaction, the beneficiary's information, the amount of credit requested, terms and conditions of the letter of credit, and any other specific instructions related to the standby letter.

What is the purpose of Application and Agreement for Documentary Letter of Credit (Standby)?

The purpose of this application is to establish a legally binding agreement between the applicant and the bank, enabling the issuance of a standby letter of credit which assures the beneficiary of payment in the event of the applicant's default or failure to perform.

What information must be reported on Application and Agreement for Documentary Letter of Credit (Standby)?

The application must report information such as the names and addresses of the applicant and beneficiary, the amount of the letter of credit, a description of the transactions or obligations covered, the expiration date, and any special terms and conditions that apply.

Fill out your application and agreement for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application And Agreement For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.