Get the free Nonprotested Sales Tax Payment Report - dor mo

Show details

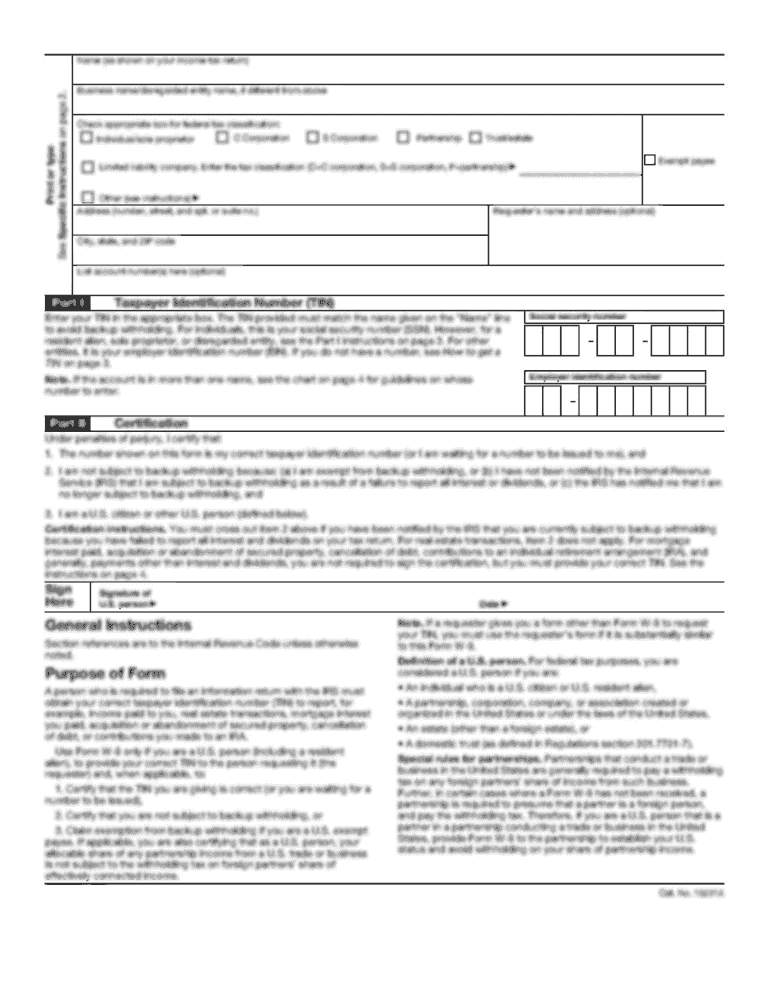

This form is used to report nonprotested sales tax payments in a specified reporting period and is filed in conjunction with the Sales Tax Protest Payment Affidavit.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign nonprotested sales tax payment

Edit your nonprotested sales tax payment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nonprotested sales tax payment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit nonprotested sales tax payment online

Follow the guidelines below to use a professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit nonprotested sales tax payment. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out nonprotested sales tax payment

How to fill out Nonprotested Sales Tax Payment Report

01

Obtain the Nonprotested Sales Tax Payment Report form from your state's tax authority website or office.

02

Fill in your business name, address, and tax identification number at the top of the form.

03

Enter the reporting period for which you are submitting the tax payment.

04

Calculate your total taxable sales for the reporting period.

05

Determine the total amount of sales tax collected during this period.

06

Report any deductions or exemptions applicable to your sales.

07

Subtract the deductions from the total sales tax collected to determine the amount due.

08

Review the completed form for accuracy and sign it.

09

Submit the form by the deadline specified by your state tax authority, along with any payment due.

Who needs Nonprotested Sales Tax Payment Report?

01

Businesses that collect sales tax from customers are required to file a Nonprotested Sales Tax Payment Report.

02

Anyone who has made sales subject to sales tax and is not disputing their tax payment obligations.

03

Companies that operate within a jurisdiction that mandates the reporting of sales tax must complete this report.

Fill

form

: Try Risk Free

People Also Ask about

How to record sales tax payment?

How do you record sales tax payable? To record sales tax payable, debit cash or accounts receivable accounts for the total amount of the sale, including the tax, and credit a sales revenue account for the sale amount, excluding the tax.

What are the IRS payment apps reporting rules?

Now anyone with $5,000 or more in income from selling goods and services via payment apps and online marketplaces will be known to the IRS. For the 2025 tax year, the threshold for issuing the form is slated to drop to $2,500, and then again to $600 for 2026, where it will stay unless new tax legislation is enacted.

Is the IRS changing its rules to include PayPal and other apps in its reporting?

In 2024, the IRS announced that it will be rolling out new reporting requirements for applications, like Venmo or PayPal, where people may send and receive payments. The law was most recently changed by the American Rescue Plan Act of 2021 (ARP) which modified the minimum reporting amount for organizations like Venmo.

What are reportable payment transactions?

Reportable payments are payments to or on behalf of an individual that must be “reported” to the government as income received.

What is the $600 reporting rule?

How does the “$600 rule” work? In 2021, Congress lowered the threshold for reporting income on payment apps from $20,000 and 200 transactions annually to $600 for a single transaction. Implementation of the ”$600 rule” is being phased in over the next three years.

How do I find out how much sales tax I paid?

If you aren't sure how much sales tax you actually paid this year, you can use the IRS Sales Tax Deduction Calculator or the State and Local General Sales Tax Deduction Worksheet in the Schedule A instructions, which you can find on the IRS website .

How much money can you make on Cash App before you have to report it?

Key Takeaways. You must report the income to the IRS if you received over $5,000 in payments for goods and services through platforms like Cash App or Venmo. Failing to report this income can result in but isn't limited to accuracy-related penalties, failure-to-pay penalties, and/or interest charges.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Nonprotested Sales Tax Payment Report?

The Nonprotested Sales Tax Payment Report is a document that businesses file to report and pay sales taxes collected from customers, ensuring compliance with tax laws.

Who is required to file Nonprotested Sales Tax Payment Report?

Businesses that collect sales tax from customers are required to file the Nonprotested Sales Tax Payment Report, specifically those who have not contested the tax amount owed.

How to fill out Nonprotested Sales Tax Payment Report?

To fill out the report, businesses must input their total sales subject to tax, the amount of sales tax collected, and any deductions or exemptions, followed by calculating the net tax owed.

What is the purpose of Nonprotested Sales Tax Payment Report?

The purpose of the Nonprotested Sales Tax Payment Report is to ensure that businesses accurately report and remit the sales tax collected, maintaining compliance with state tax regulations.

What information must be reported on Nonprotested Sales Tax Payment Report?

The report must include total sales figures, the amount of taxable sales, sales tax collected, any exemptions claimed, and the total amount due for payment.

Fill out your nonprotested sales tax payment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nonprotested Sales Tax Payment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.