Get the free CONSOLIDATED MONTHLY CIGARETTE TAX REPORT (25s ONLY) - dor mo

Show details

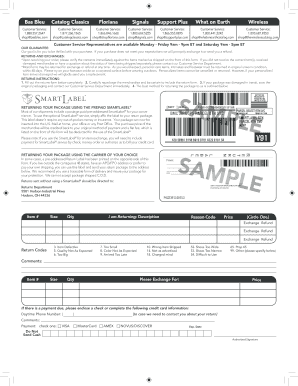

This form is used by wholesalers to report the monthly tax on unstamped and stamped cigarettes, detailing inventory, purchases, and tax calculation as mandated by the Missouri Department of Revenue.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign consolidated monthly cigarette tax

Edit your consolidated monthly cigarette tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your consolidated monthly cigarette tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit consolidated monthly cigarette tax online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit consolidated monthly cigarette tax. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out consolidated monthly cigarette tax

How to fill out CONSOLIDATED MONTHLY CIGARETTE TAX REPORT (25s ONLY)

01

Obtain the CONSOLIDATED MONTHLY CIGARETTE TAX REPORT form from the relevant tax authority's website or office.

02

Fill in the reporting period at the top of the form, indicating the month and year for which the report is being submitted.

03

Record the total number of 25s cigarette packs sold during the reporting period in the designated section.

04

Calculate the tax due based on the specified tax rate for each 25s cigarette pack sold.

05

Enter any credits or adjustments in the appropriate section, if applicable.

06

Sum the total tax due and any credits to determine the net amount owed.

07

Include any necessary signatures and certifications required by the form.

08

Submit the completed report by the specified deadline to the tax authority, ensuring to keep a copy for your records.

Who needs CONSOLIDATED MONTHLY CIGARETTE TAX REPORT (25s ONLY)?

01

Manufacturers or distributors of 25s cigarette packs.

02

Retailers who sell 25s cigarette packs.

03

Businesses engaged in the sale or distribution of tobacco products within jurisdictions that require this report.

Fill

form

: Try Risk Free

People Also Ask about

How much are cigarettes taxed in Nevada?

Tax Rate. Tax Stamp: Nevada uses a tax stamp system where a stamp must be affixed to each pack of cigarettes to indicate that the state tax has been paid. Rate: The rate for cigarettes is the actual tax stamp value. $1.80 for a pack of 20s, $2.25 for a pack of 25s, and Tribal stamped 20s are not taxed.

What is the US cigarette tax rate?

Federal cigarette tax is $1.01 per pack. From the beginning of 1998 through 2023, the major cigarette companies increased the prices they charge by more than $4.00 per pack (but also instituted aggressive retail-level discounting for competitive purposes and to reduce related consumption declines).

Will cigarette taxes have the desired effect of reducing the demand for cigarettes?

Evidence from countries at all income levels shows that price increases on cigarettes are highly effective in reducing demand. Higher taxes induce some smokers to quit and deter others from starting. They also reduce the number of ex-smokers who return to cigarettes and reduce consumption among continuing smokers.

Which state has the highest tax on cigarettes?

Cigarette Prices by State 2024 StateCigarette Prices (per pack)Tax New Mexico $8.47 $2.00 Utah $8.33 $1.70 Michigan $8.27 $2.00 Nevada $8.27 $1.8047 more rows

How much is a pack of cigarettes including taxes?

The federal cigarette tax is $1.01 per pack. The states' average is $1.93 per pack which includes DC, but not Puerto Rico, other U.S. territories, or local cigarette taxes. State also has special taxes or fees on brands of manufacturers not participating in the state tobacco lawsuit settlements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CONSOLIDATED MONTHLY CIGARETTE TAX REPORT (25s ONLY)?

The CONSOLIDATED MONTHLY CIGARETTE TAX REPORT (25s ONLY) is a tax report required by certain jurisdictions that details the quantity and tax liability of cigarette sales specifically for packs containing 25 cigarettes.

Who is required to file CONSOLIDATED MONTHLY CIGARETTE TAX REPORT (25s ONLY)?

Retailers, wholesalers, or distributors of cigarettes who sell or distribute 25-pack cigarettes are required to file the CONSOLIDATED MONTHLY CIGARETTE TAX REPORT.

How to fill out CONSOLIDATED MONTHLY CIGARETTE TAX REPORT (25s ONLY)?

To fill out the report, entities must accurately report the number of 25-pack cigarettes sold, calculate the total tax due based on applicable rates, and provide any additional required information as specified by the local tax authority.

What is the purpose of CONSOLIDATED MONTHLY CIGARETTE TAX REPORT (25s ONLY)?

The purpose of the CONSOLIDATED MONTHLY CIGARETTE TAX REPORT is to ensure compliance with cigarette tax regulations, track sales for tax collection, and prevent tax evasion within the cigarette industry.

What information must be reported on CONSOLIDATED MONTHLY CIGARETTE TAX REPORT (25s ONLY)?

The report must include the total number of 25-pack cigarettes sold, tax rate applied, total tax calculated, and any relevant business identification information, such as permit numbers.

Fill out your consolidated monthly cigarette tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Consolidated Monthly Cigarette Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.