Get the free Fuel Tax Registration Change Request - dor mo

Show details

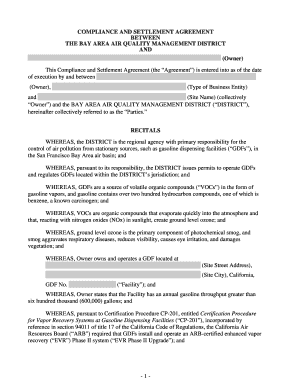

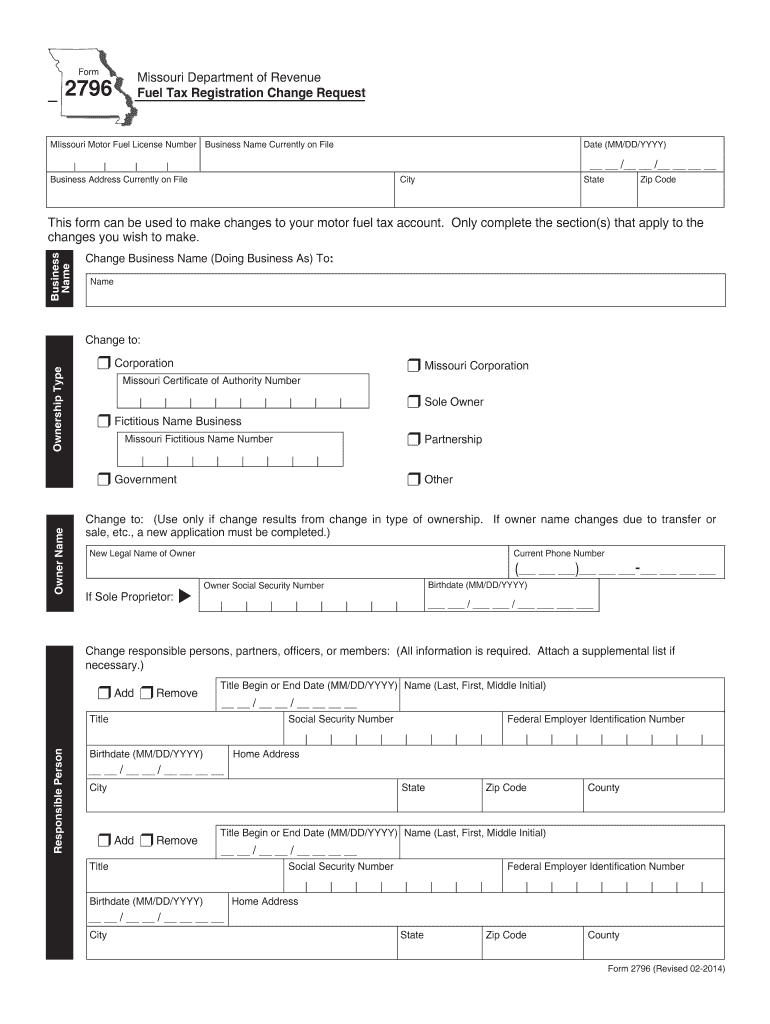

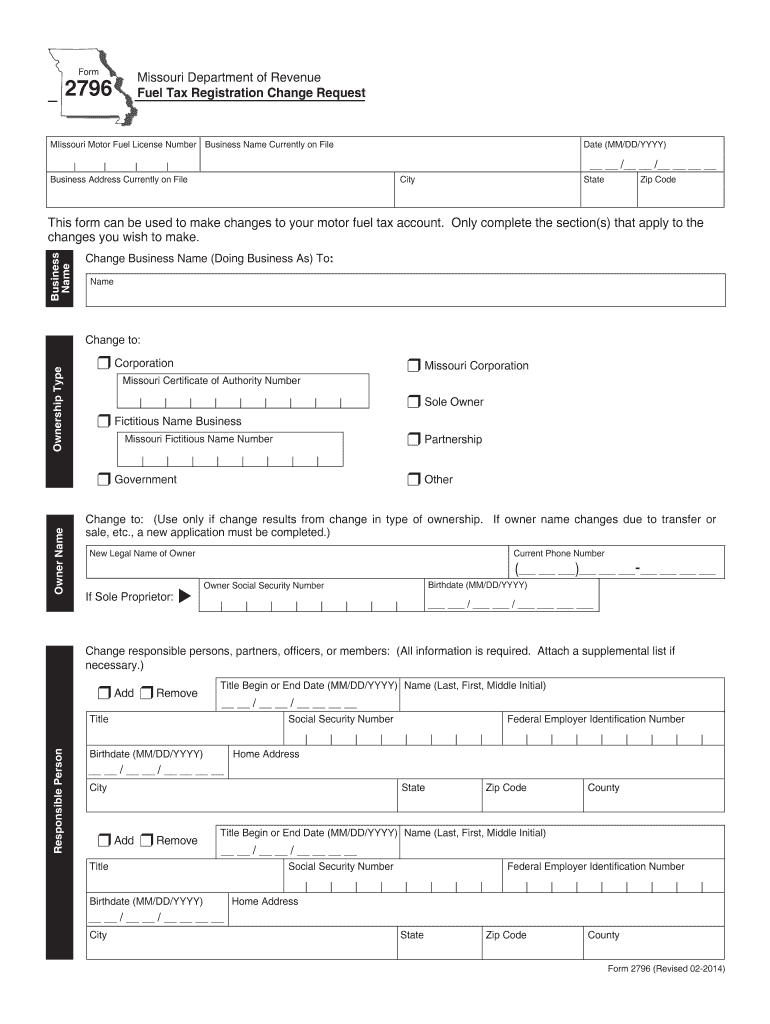

This form is used to make changes to the motor fuel tax account for businesses in Missouri, including changes to business name, ownership type, responsible persons, and contact information.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fuel tax registration change

Edit your fuel tax registration change form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fuel tax registration change form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fuel tax registration change online

Follow the steps below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit fuel tax registration change. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fuel tax registration change

How to fill out Fuel Tax Registration Change Request

01

Obtain the Fuel Tax Registration Change Request form from the relevant authority or website.

02

Fill in the date of application.

03

Provide your existing account number or registration number.

04

Complete the sections regarding the changes you wish to make (e.g., address, business name).

05

Include any supporting documentation that may be required.

06

Review the form for accuracy and completeness.

07

Sign and date the form.

08

Submit the form according to the provided instructions, either online or via mail.

Who needs Fuel Tax Registration Change Request?

01

Businesses that have changed their address or name.

02

Companies that need to update their business structure or ownership.

03

Individuals involved in transporting goods who need to amend their registration details.

04

Organizations registering for fuel tax exemptions or changes in fuel use.

Fill

form

: Try Risk Free

People Also Ask about

Who can claim gas on taxes?

Yes, if you're self-employed or a small business owner, you can write off gas used for business purposes on your tax return. You can deduct gas in one of two ways: Actual expenses. Keep your receipts and detailed records of your gas purchases.

What do I need to get an IFTA sticker?

How to apply for IFTA. Applications may vary by state or province, but typically require a mailing address, registered business name, federal business number, and USDOT number. Contact the relevant transportation department in your base state for an IFTA application.

Who qualifies for the fuel tax credit form 4136?

Many farmers can claim the Credit for Federal Tax Paid on Fuels each year by filing Form 4136 with their individual tax return. This refundable credit is based on the gallons of fuel used in an off-highway business use or on a farm for farming purposes.

How do I get my IFTA stickers in PA?

You will need to complete a Pennsylvania application form and submit by mail or in person to the Department of Revenue. There is a $5 fee for each set of decals. You will need one set per qualified vehicle. You should receive your decals within 3 weeks.

Who qualifies for the fuel tax credit form 4136 turbotax?

Many farmers can claim the Credit for Federal Tax Paid on Fuels each year by filing Form 4136 with their individual tax return. This refundable credit is based on the gallons of fuel used in an off-highway business use or on a farm for farming purposes.

How much is the IFTA sticker in PA?

The cost is $12 per vehicle per calendar year. The decals must be displayed on both sides of each qualified vehicle operated in Pennsylvania: A carrier operating inside and outside PA that selects PA as its base jurisdiction must purchase and display PA IFTA decals.

Who is exempt from motor fuel tax in Pennsylvania?

Overview. Exempt from the tax are fuels sold and delivered to the U.S. government; the commonwealth and any of its political subdivisions; volunteer fire companies; volunteer ambulance services and volunteer rescue squads; second class county port authorities; and nonpublic, nonprofit schools (K-12).

How to get an IFTA sticker in PA?

You will need to complete a Pennsylvania application form and submit by mail or in person to the Department of Revenue. There is a $5 fee for each set of decals. You will need one set per qualified vehicle. You should receive your decals within 3 weeks.

Who qualifies for fuel tax credit?

The credit is available only for nontaxable uses of gasoline, aviation gasoline, undyed diesel and undyed kerosene. Nontaxable uses are purposes where fuel isn't used for regular driving purposes, such as: On a farm for farming purposes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Fuel Tax Registration Change Request?

A Fuel Tax Registration Change Request is a formal request filed by businesses or individuals to update their fuel tax registration information with the relevant tax authorities.

Who is required to file Fuel Tax Registration Change Request?

Businesses or individuals who have changes in their fuel tax registration details, such as business name, address, or ownership structure, are required to file a Fuel Tax Registration Change Request.

How to fill out Fuel Tax Registration Change Request?

To fill out a Fuel Tax Registration Change Request, provide accurate information regarding the existing registration and specify the changes being made. Include relevant documentation if required, and submit it to the appropriate tax authority.

What is the purpose of Fuel Tax Registration Change Request?

The purpose of the Fuel Tax Registration Change Request is to ensure that the tax authorities have up-to-date information about registrants, which helps in the proper administration and enforcement of fuel tax regulations.

What information must be reported on Fuel Tax Registration Change Request?

The information that must be reported includes the registrant's identification details, any changes to the registrant's business name, address, contact information, and the specific changes being requested.

Fill out your fuel tax registration change online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fuel Tax Registration Change is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.