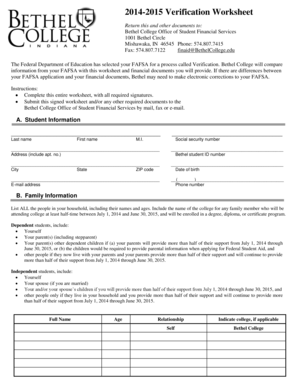

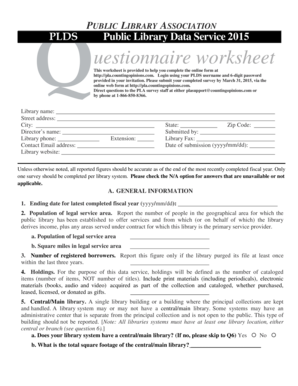

Get the free 2007 INDIVIDUAL CONSUMER’S USE TAX RETURN - dor mo

Show details

This form is used by individuals in Missouri to declare and pay consumer's use tax on out-of-state purchases made during the tax period.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2007 individual consumers use

Edit your 2007 individual consumers use form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2007 individual consumers use form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2007 individual consumers use online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit 2007 individual consumers use. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2007 individual consumers use

How to fill out 2007 INDIVIDUAL CONSUMER’S USE TAX RETURN

01

Obtain the 2007 INDIVIDUAL CONSUMER’S USE TAX RETURN form from the appropriate tax agency.

02

Read the instructions provided with the form carefully to understand what information is needed.

03

Fill in your personal information at the top of the form, including your name, address, and Social Security number.

04

List all items purchased for use in your state that were not taxed at the time of purchase.

05

Calculate the total cost of these items as directed on the form.

06

Determine the applicable tax rate for your items and compute the use tax owed based on the total cost.

07

Complete any additional sections of the form that may pertain to exemptions or special circumstances.

08

Review the completed form for accuracy before signing and dating it.

09

Submit the form by the due date, along with any payment if tax is owed.

Who needs 2007 INDIVIDUAL CONSUMER’S USE TAX RETURN?

01

Individuals who purchased tangible personal property for use in their state without paying sales tax.

02

Residents who engaged in out-of-state purchases where sales tax was not collected.

03

Consumers who utilized online shopping or catalog purchases that do not charge sales tax.

Fill

form

: Try Risk Free

People Also Ask about

Who pays NJ use tax?

Use Tax is owed by New Jersey residents and businesses that buy products out of state, online, or via the mail, and then bring the products to New Jersey or have them shipped here for their use.

Who has to pay CA use tax?

The use tax generally applies to the storage, use, or other consumption in California of goods purchased from retailers in transactions not subject to the sales tax. Use tax may also apply to purchases shipped to a California consumer from another state, including purchases made by mail order, telephone, or Internet.

Who pays NJ transfer tax, buyer or seller?

Realty Transfer Fee: Sellers pay a 1% Realty Transfer Fee on all home sales. The buyer is not responsible for this fee. However, buyers may pay an additional 1% fee on all home sales of $1 million or more.

What is NC use tax?

What is use tax? Use tax is a tax due on purchases, leases, and rentals of tangible personal property and certain digital property purchased, leased or rented inside or outside this state for storage, use, or consumption in North Carolina. Use tax is also due on taxable services sourced to North Carolina.

Is sales and use tax the same as property tax?

Property tax is a direct tax, for which the owner of the property is obligated to pay the taxes. Sales tax is an indirect tax, for which a company collects tax from a customer on behalf of the government. Property owners are responsible for paying taxes on their property every year.

How can I avoid paying NJ exit tax?

Exemptions to avoid the New Jersey exit tax Those who continue to reside in New Jersey after selling a home are required to submit a GIT/REP-3 form at closing, exempting them from paying estimated taxes on the sale; instead, any taxes on capital gains are reported on their New Jersey Gross Income Tax return.

What items are exempt from sales and use tax in New Jersey?

Some goods are exempt from sales tax under New Jersey law. Examples include clothing and footwear, most non-prepared food items, food stamps, and medical supplies. New Jersey also offers a partial exemption for certain products, such as boats.

What is a consumer use tax return?

Consumer Use Tax is a tax on the purchaser and is self-assessed by the purchaser on taxable items purchased where the vendor did not collect either a sales or vendor use tax. The purchaser remits this tax directly to the taxing jurisdiction.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2007 INDIVIDUAL CONSUMER’S USE TAX RETURN?

The 2007 Individual Consumer’s Use Tax Return is a tax document that allows individuals to report and pay use tax on taxable purchases that were not subjected to sales tax at the time of purchase.

Who is required to file 2007 INDIVIDUAL CONSUMER’S USE TAX RETURN?

Individuals who made purchases of taxable goods or services from out-of-state vendors and did not pay sales tax at the time of purchase are required to file the 2007 Individual Consumer’s Use Tax Return.

How to fill out 2007 INDIVIDUAL CONSUMER’S USE TAX RETURN?

To fill out the 2007 Individual Consumer’s Use Tax Return, you need to report the total purchase amount of taxable goods, calculate the use tax owed based on applicable rates, provide your personal information, and submit the return along with payment if necessary.

What is the purpose of 2007 INDIVIDUAL CONSUMER’S USE TAX RETURN?

The purpose of the 2007 Individual Consumer’s Use Tax Return is to ensure compliance with state taxation laws by requiring individuals to report and pay use tax on items purchased without sales tax to fund state and local services.

What information must be reported on 2007 INDIVIDUAL CONSUMER’S USE TAX RETURN?

The information that must be reported includes the total amount of taxable purchases, the use tax rate, total use tax owed, your personal identification details, and any supporting documentation for purchases.

Fill out your 2007 individual consumers use online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2007 Individual Consumers Use is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.